What Is A Calendar Spread - In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias.

A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the.

A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures.

Calendar Spreads in Futures and Options Trading Explained

A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. A calendar spread, also known as a time spread, is an options trading strategy that involves.

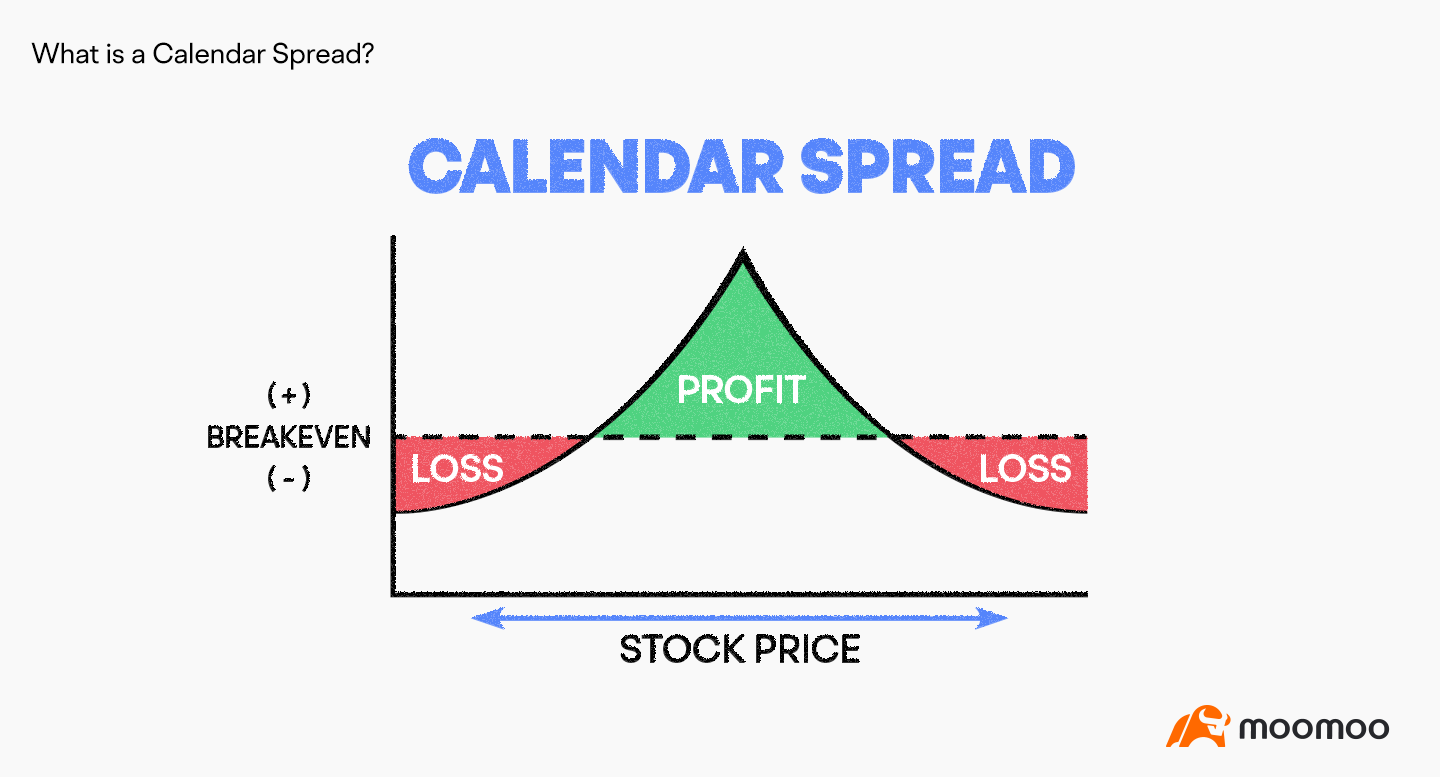

What is a Calendar Spread?

In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. A calendar spread, also known as a time spread, is an options trading strategy that involves.

What Is A Calendar Spread Option Strategy Mab Millicent

A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread.

Everything You Need to Know about Calendar Spreads

In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. A calendar spread allows option traders to take advantage of elevated premium in near.

Calendar Spread Options Examples Mavra Sibella

A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread.

Calendar Spread Options Trading Strategy In Python

In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. A calendar spread, also known as a time spread, is an options trading strategy that involves.

What is Calendar Spread Options Strategy ? Different types of Calendar

A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. A calendar spread, also known as a time spread, is an options trading strategy that involves.

How to Trade Options Calendar Spreads (Visuals and Examples)

A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. A calendar spread, also known as a time spread, is an options trading strategy that involves.

Calendar Call Spread Option Strategy Heida Kristan

In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. A calendar spread allows option traders to take advantage of elevated premium in near.

How Long Calendar Spreads Work (w/ Examples) Options Trading

A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread.

A Calendar Spread, Also Known As A Time Spread, Is An Options Trading Strategy That Involves Buying And Selling Two Options Of The.

In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias.

:max_bytes(150000):strip_icc()/calendarspread.asp_final-6628bf3928bd4717bde925a70b28ac8c.png)