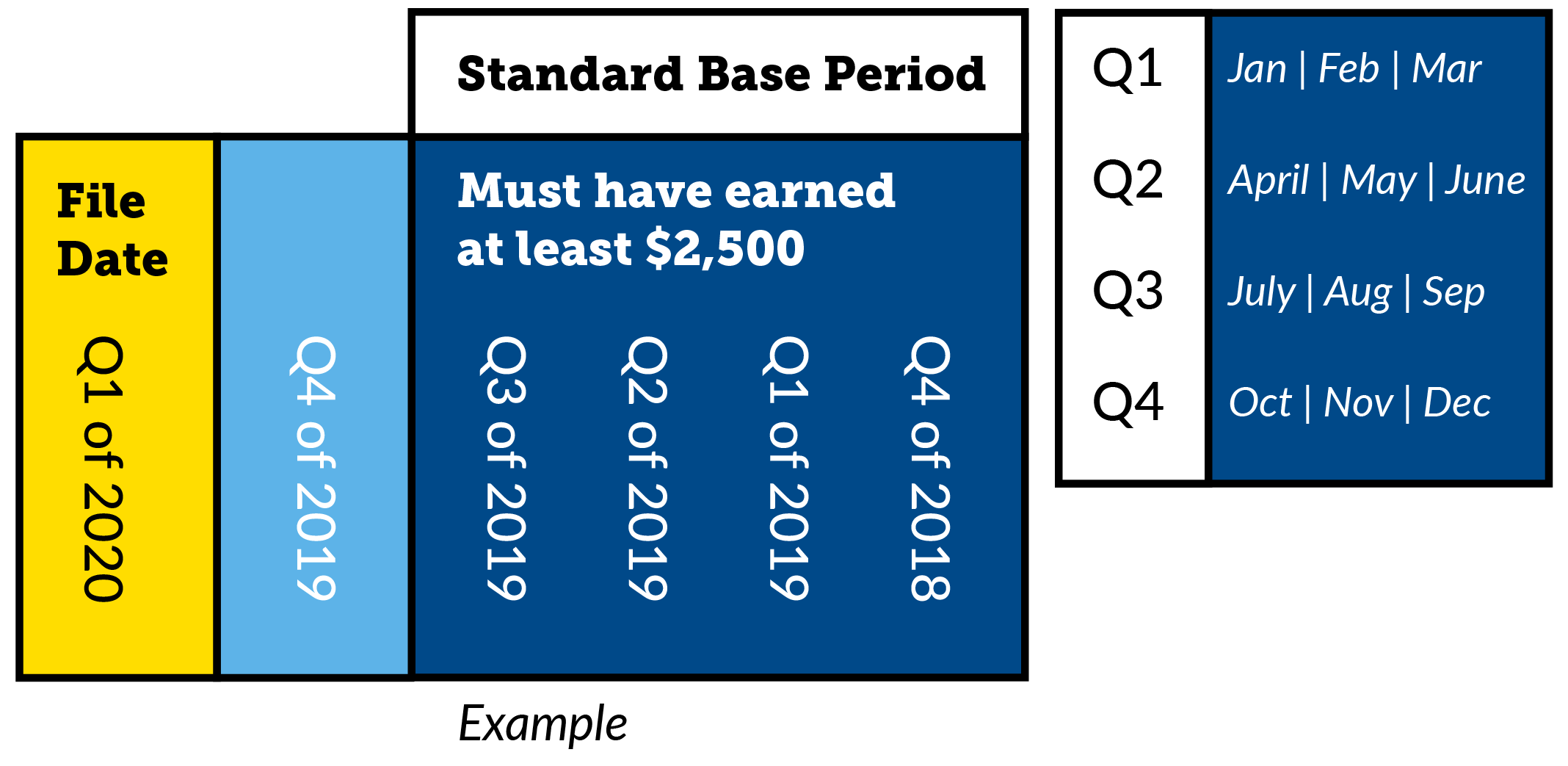

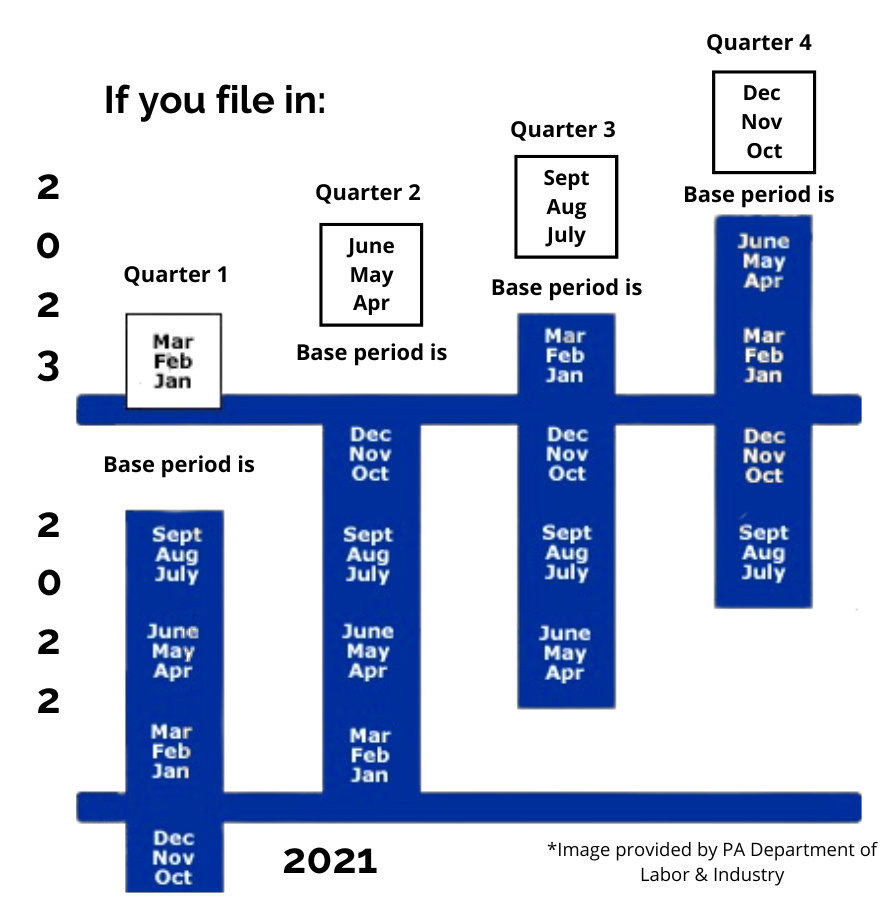

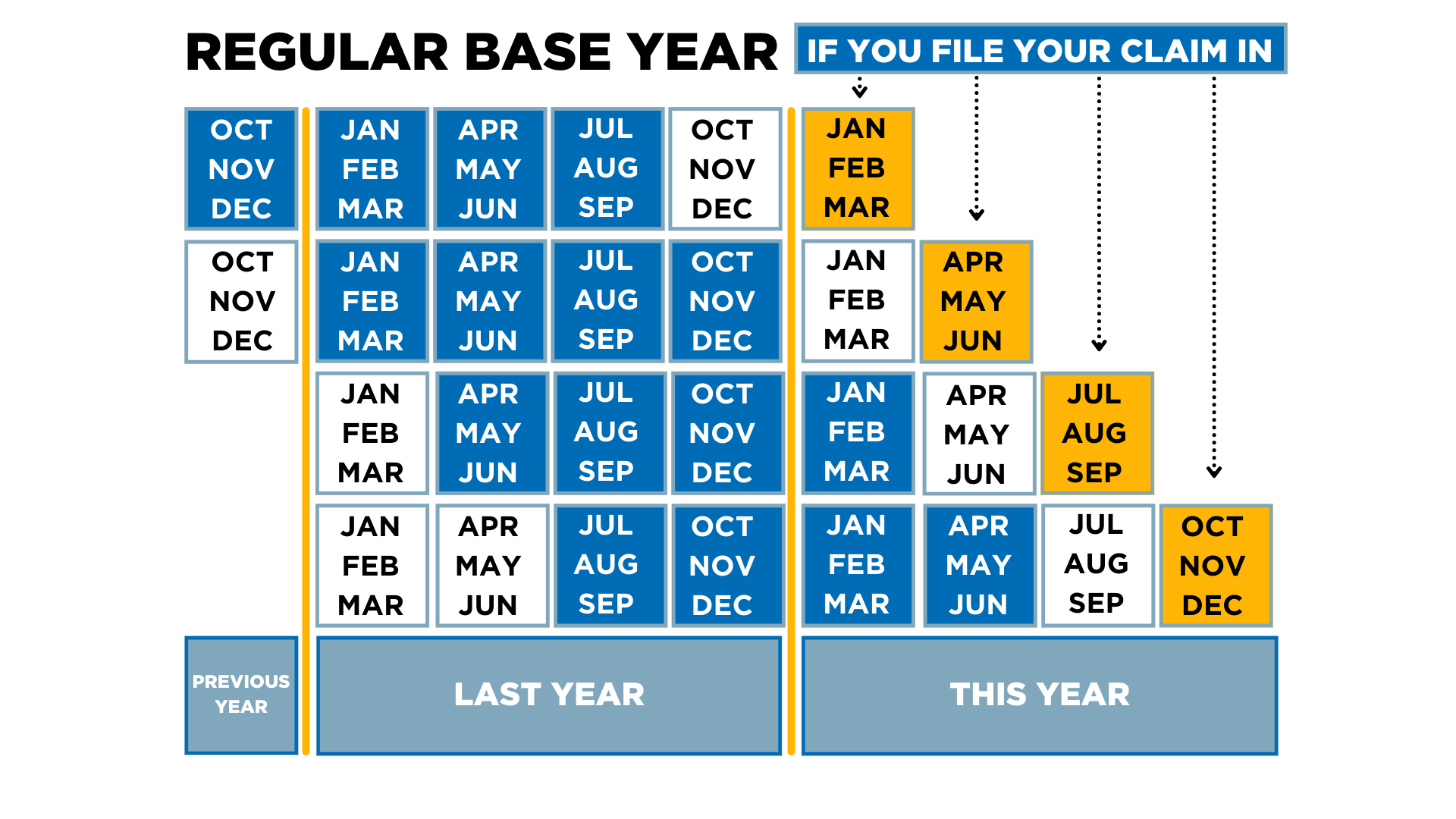

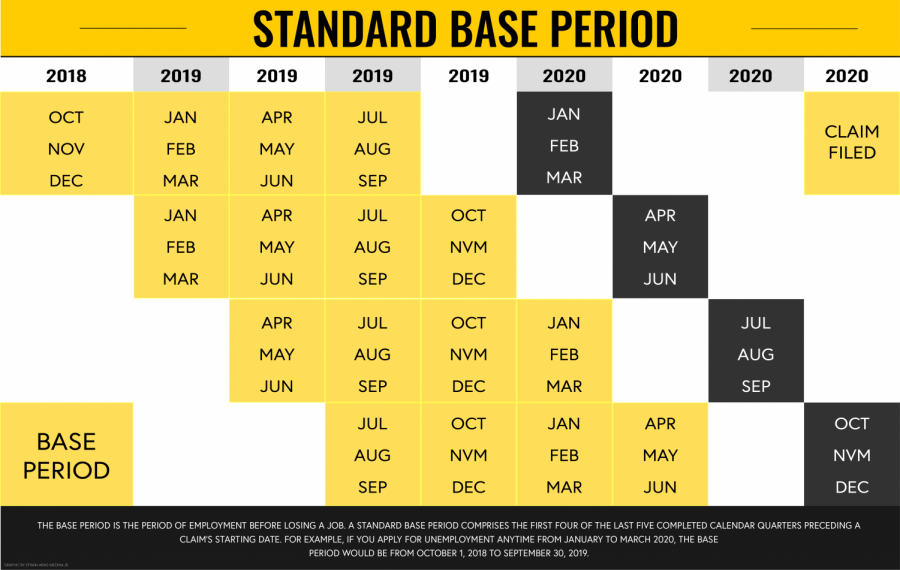

What Is A Calendar Quarter For Unemployment - All states use a base period, or base year, to determine whether laid off workers have earned enough wages to qualify for ui benefits. The most used base period calculation is the first four of the last five completed calendar quarters. January through march, april through june, july through september and october through december represent calendar unemployment quarters. Not enough wages earned in the standard base period is the first four of the last five to file a monetarily valid ui claim, and there are enough.

Not enough wages earned in the standard base period is the first four of the last five to file a monetarily valid ui claim, and there are enough. The most used base period calculation is the first four of the last five completed calendar quarters. January through march, april through june, july through september and october through december represent calendar unemployment quarters. All states use a base period, or base year, to determine whether laid off workers have earned enough wages to qualify for ui benefits.

All states use a base period, or base year, to determine whether laid off workers have earned enough wages to qualify for ui benefits. Not enough wages earned in the standard base period is the first four of the last five to file a monetarily valid ui claim, and there are enough. The most used base period calculation is the first four of the last five completed calendar quarters. January through march, april through june, july through september and october through december represent calendar unemployment quarters.

Qualifying for Benefits Department of Labor & Employment

Not enough wages earned in the standard base period is the first four of the last five to file a monetarily valid ui claim, and there are enough. January through march, april through june, july through september and october through december represent calendar unemployment quarters. The most used base period calculation is the first four of the last five completed.

Regular UC Financial Eligibility

January through march, april through june, july through september and october through december represent calendar unemployment quarters. The most used base period calculation is the first four of the last five completed calendar quarters. Not enough wages earned in the standard base period is the first four of the last five to file a monetarily valid ui claim, and there.

Arts and Business Council of Greater Nashville VLPA Provides

All states use a base period, or base year, to determine whether laid off workers have earned enough wages to qualify for ui benefits. The most used base period calculation is the first four of the last five completed calendar quarters. Not enough wages earned in the standard base period is the first four of the last five to file.

What is a Base Period? Thomas & Company

Not enough wages earned in the standard base period is the first four of the last five to file a monetarily valid ui claim, and there are enough. January through march, april through june, july through september and october through december represent calendar unemployment quarters. All states use a base period, or base year, to determine whether laid off workers.

How to Calculate California Unemployment How Much Will You Get?

The most used base period calculation is the first four of the last five completed calendar quarters. Not enough wages earned in the standard base period is the first four of the last five to file a monetarily valid ui claim, and there are enough. January through march, april through june, july through september and october through december represent calendar.

Texas Unemployment Benefits Eligibility SimplyJobs

Not enough wages earned in the standard base period is the first four of the last five to file a monetarily valid ui claim, and there are enough. January through march, april through june, july through september and october through december represent calendar unemployment quarters. All states use a base period, or base year, to determine whether laid off workers.

Calendars Wisconsin Unemployment Insurance Wisconsin Unemployment

January through march, april through june, july through september and october through december represent calendar unemployment quarters. The most used base period calculation is the first four of the last five completed calendar quarters. All states use a base period, or base year, to determine whether laid off workers have earned enough wages to qualify for ui benefits. Not enough.

INTRODUCTION TO WIOA COMMON MEASURES Measurement and Data Collection

January through march, april through june, july through september and october through december represent calendar unemployment quarters. Not enough wages earned in the standard base period is the first four of the last five to file a monetarily valid ui claim, and there are enough. The most used base period calculation is the first four of the last five completed.

Your guide to unemployment filings amid COVID19 The Appalachian

The most used base period calculation is the first four of the last five completed calendar quarters. January through march, april through june, july through september and october through december represent calendar unemployment quarters. Not enough wages earned in the standard base period is the first four of the last five to file a monetarily valid ui claim, and there.

INTRODUCTION TO WIOA COMMON MEASURES Measurement and Data Collection

The most used base period calculation is the first four of the last five completed calendar quarters. All states use a base period, or base year, to determine whether laid off workers have earned enough wages to qualify for ui benefits. January through march, april through june, july through september and october through december represent calendar unemployment quarters. Not enough.

January Through March, April Through June, July Through September And October Through December Represent Calendar Unemployment Quarters.

All states use a base period, or base year, to determine whether laid off workers have earned enough wages to qualify for ui benefits. Not enough wages earned in the standard base period is the first four of the last five to file a monetarily valid ui claim, and there are enough. The most used base period calculation is the first four of the last five completed calendar quarters.