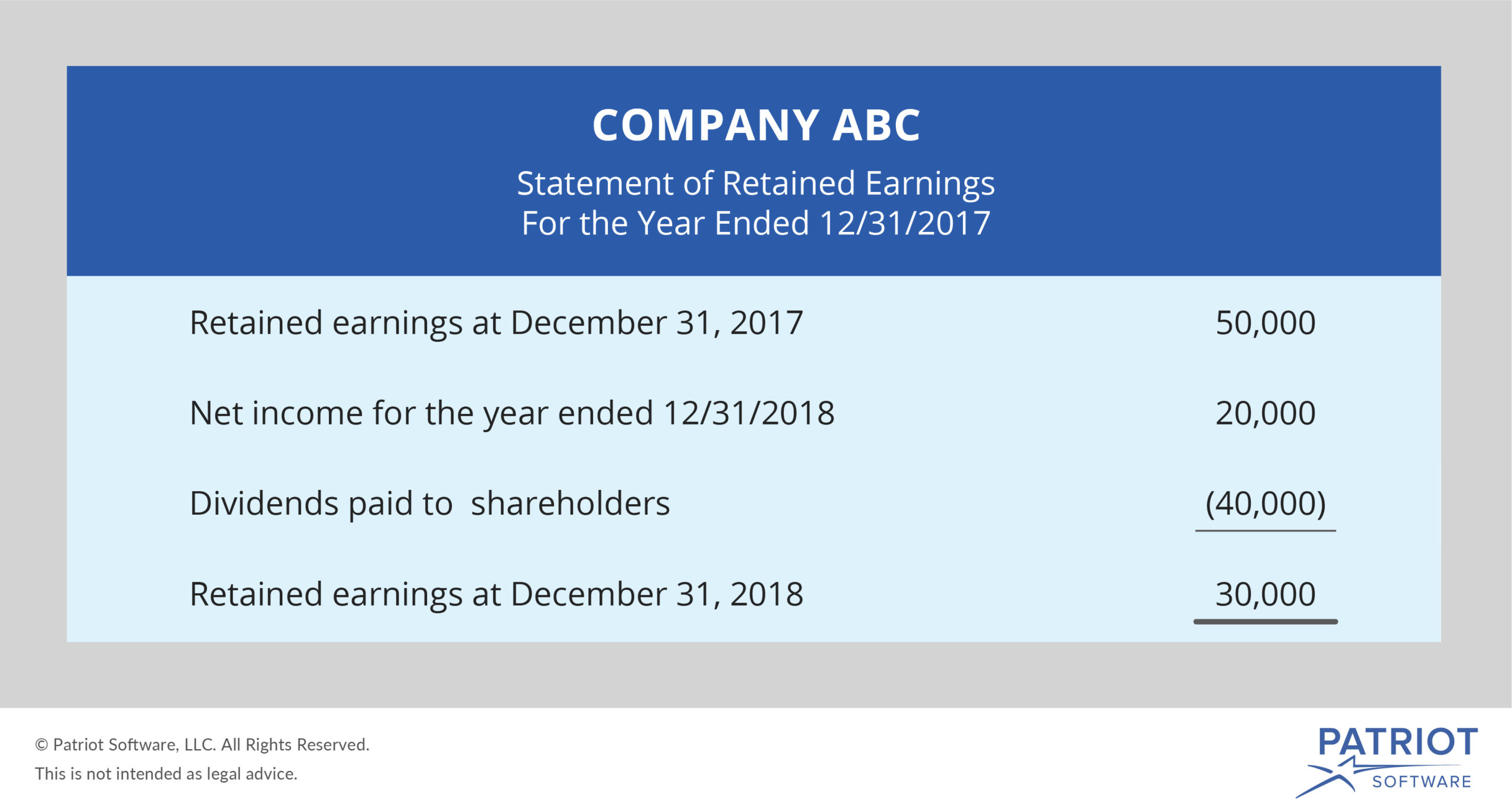

What Are Retained Earnings In A Balance Sheet - Retained earnings are calculated by adding the current period’s net income to the previous period’s balance and subtracting. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings can be defined as, accumulation of a company’s historical revenues for reinvestment, loan.

The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings can be defined as, accumulation of a company’s historical revenues for reinvestment, loan. Retained earnings are calculated by adding the current period’s net income to the previous period’s balance and subtracting.

Retained earnings can be defined as, accumulation of a company’s historical revenues for reinvestment, loan. Retained earnings are calculated by adding the current period’s net income to the previous period’s balance and subtracting. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds.

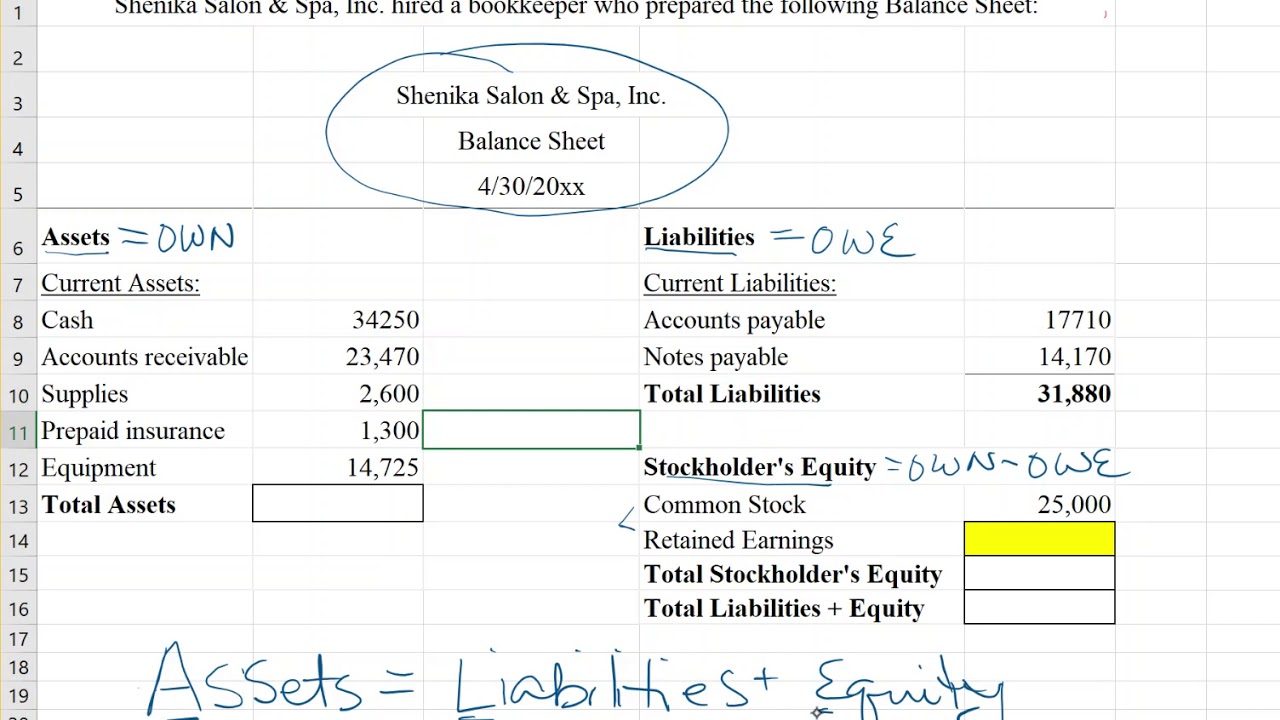

Balance Sheet and Statement of Retained Earnings YouTube

Retained earnings can be defined as, accumulation of a company’s historical revenues for reinvestment, loan. Retained earnings are calculated by adding the current period’s net income to the previous period’s balance and subtracting. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds.

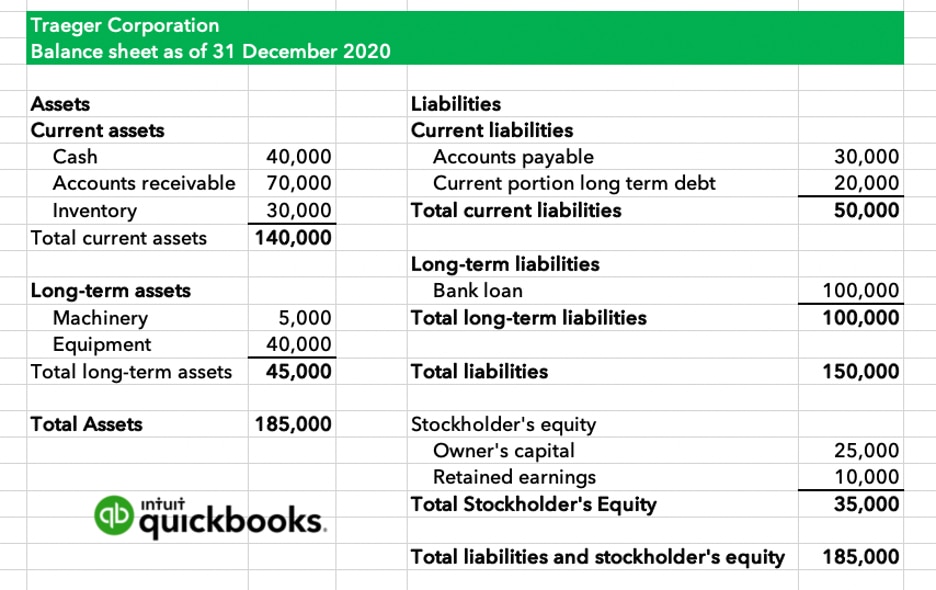

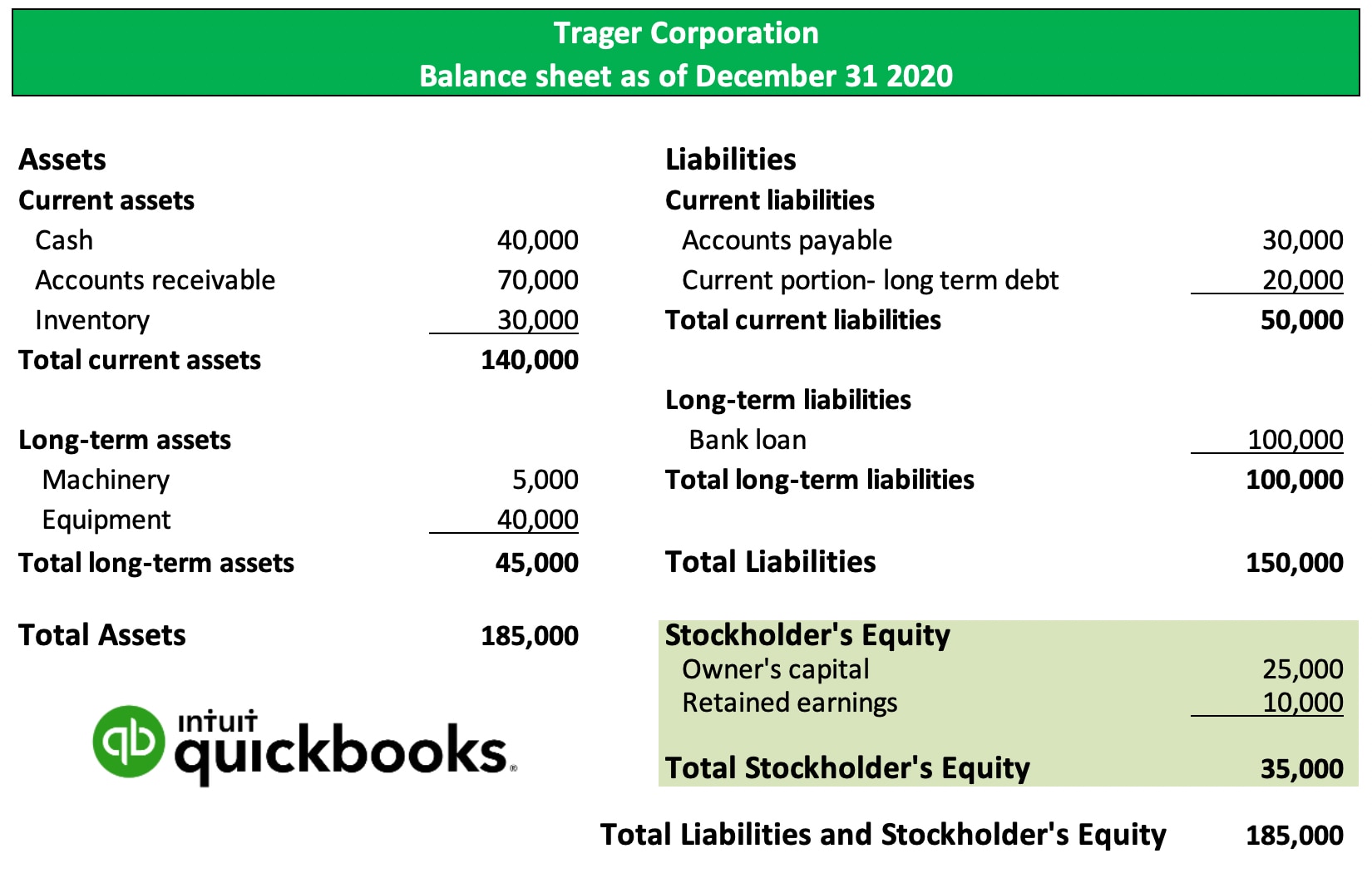

What are retained earnings? QuickBooks Australia

Retained earnings are calculated by adding the current period’s net income to the previous period’s balance and subtracting. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings can be defined as, accumulation of a company’s historical revenues for reinvestment, loan.

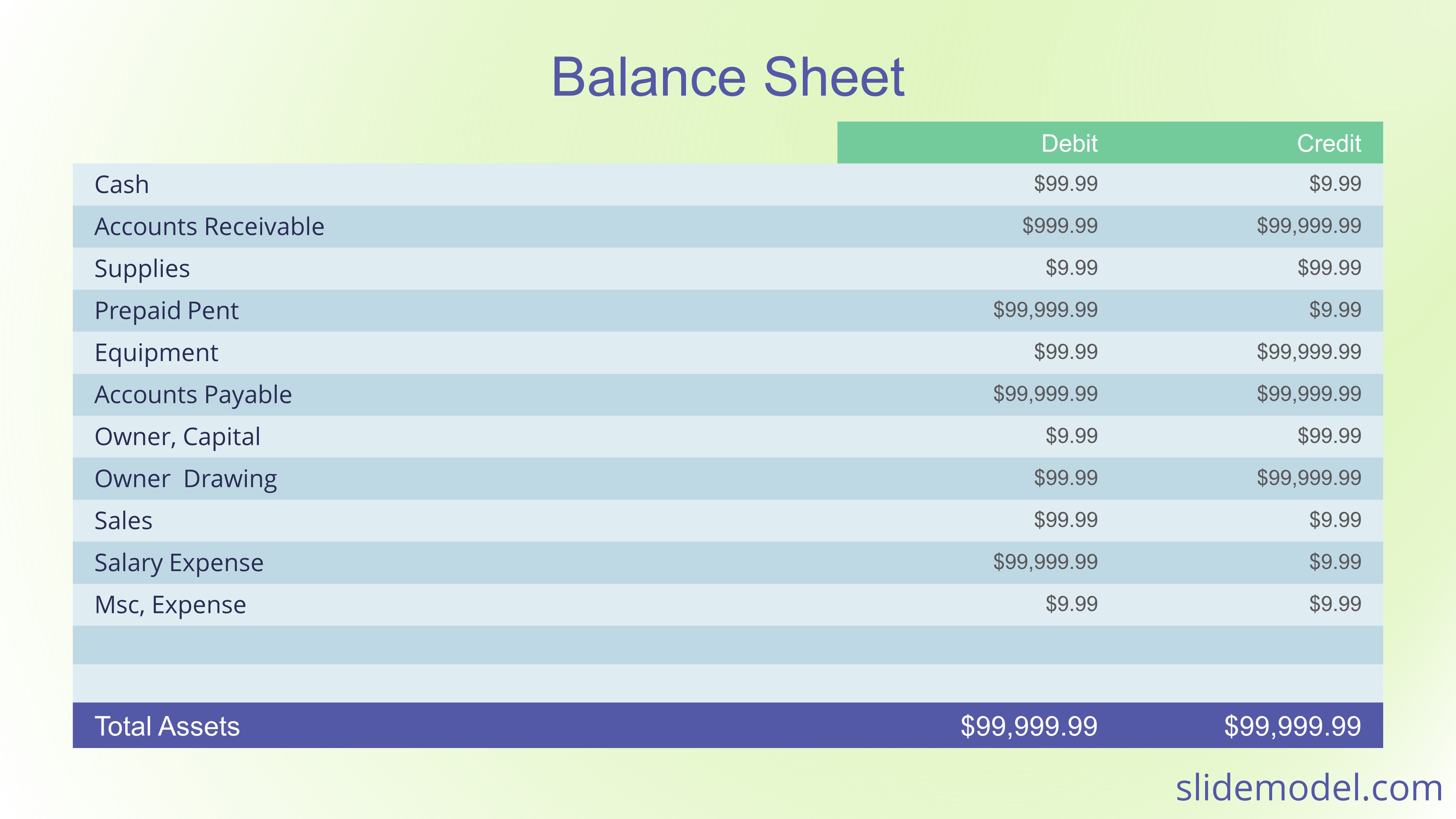

Looking Good Retained Earnings Formula In Balance Sheet Difference

Retained earnings can be defined as, accumulation of a company’s historical revenues for reinvestment, loan. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings are calculated by adding the current period’s net income to the previous period’s balance and subtracting.

Looking Good Retained Earnings Formula In Balance Sheet Difference

Retained earnings can be defined as, accumulation of a company’s historical revenues for reinvestment, loan. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings are calculated by adding the current period’s net income to the previous period’s balance and subtracting.

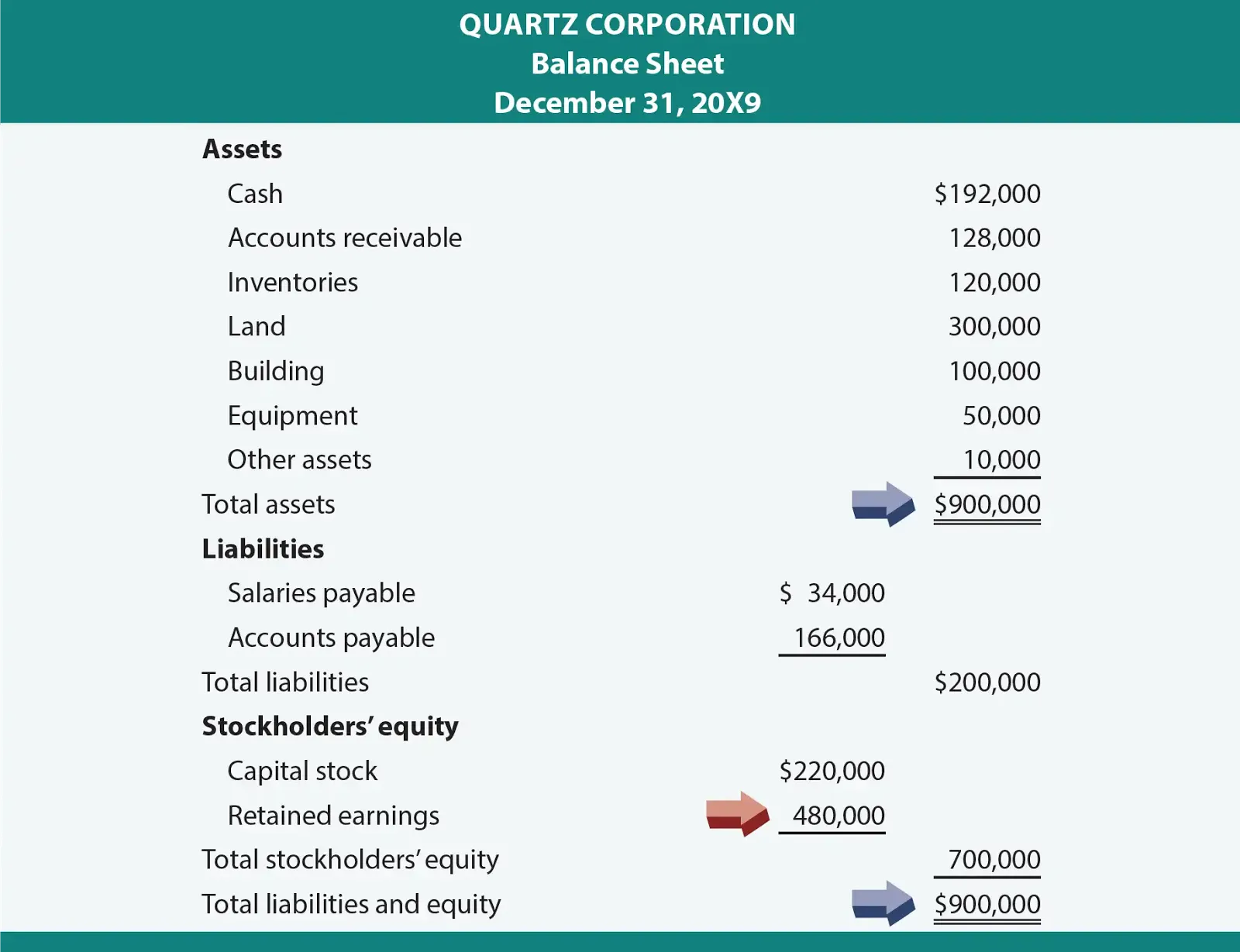

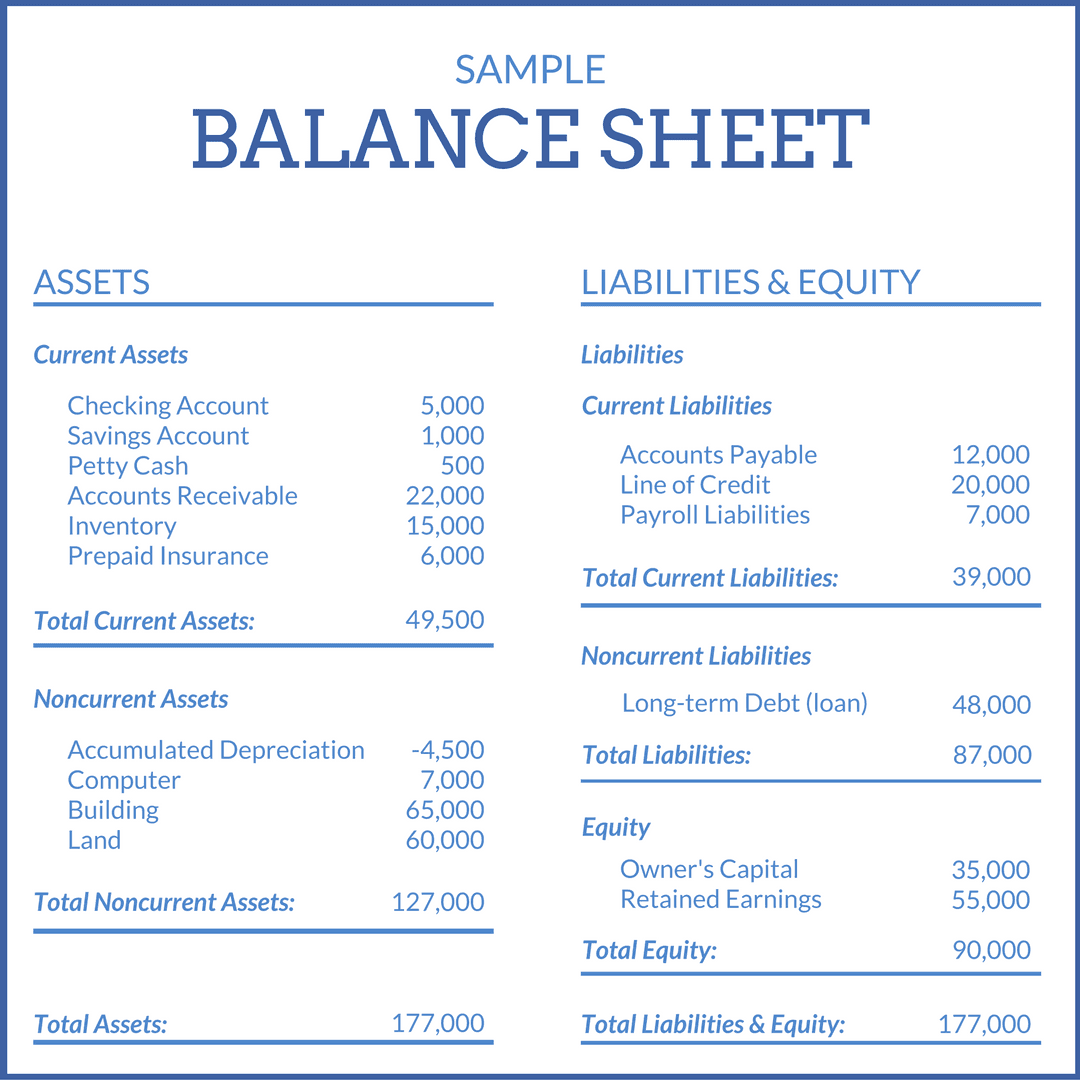

What are Retained Earnings? Guide, Formula, and Examples

The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings are calculated by adding the current period’s net income to the previous period’s balance and subtracting. Retained earnings can be defined as, accumulation of a company’s historical revenues for reinvestment, loan.

Retained Earnings Calculation Balance Sheet at Wayne Owen blog

Retained earnings are calculated by adding the current period’s net income to the previous period’s balance and subtracting. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings can be defined as, accumulation of a company’s historical revenues for reinvestment, loan.

Complete a Balance Sheet by solving for Retained Earnings YouTube

Retained earnings are calculated by adding the current period’s net income to the previous period’s balance and subtracting. Retained earnings can be defined as, accumulation of a company’s historical revenues for reinvestment, loan. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds.

What Is Meant By Retained Earnings in Balance sheet Financial

Retained earnings are calculated by adding the current period’s net income to the previous period’s balance and subtracting. Retained earnings can be defined as, accumulation of a company’s historical revenues for reinvestment, loan. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds.

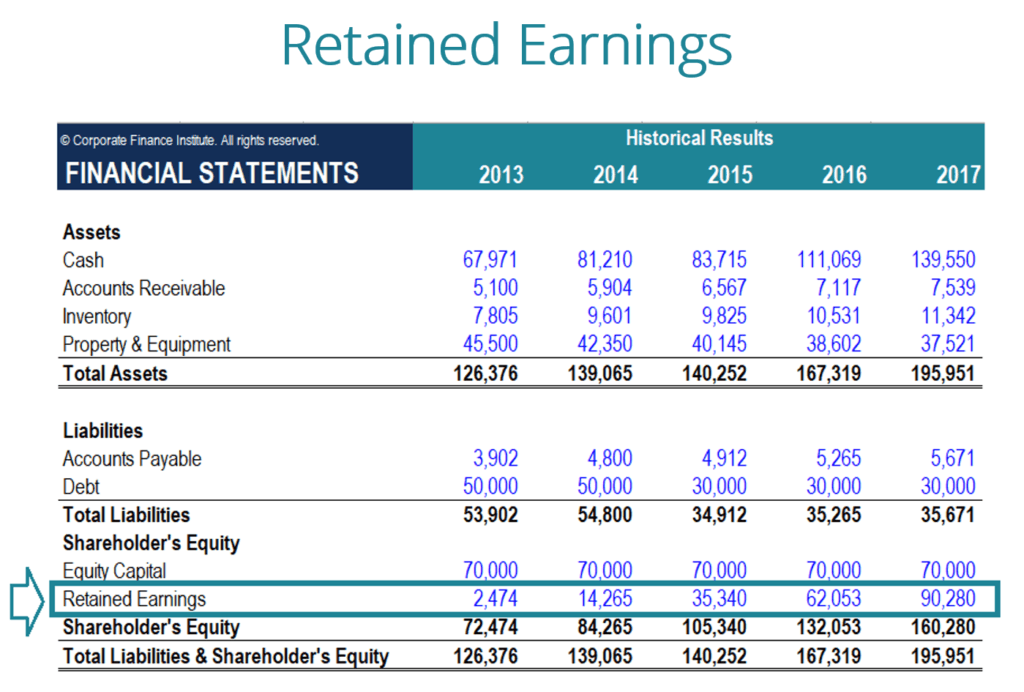

Retained Earnings Definition, Formula, and Example

The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings are calculated by adding the current period’s net income to the previous period’s balance and subtracting. Retained earnings can be defined as, accumulation of a company’s historical revenues for reinvestment, loan.

Retained Earnings What Are They, and How Do You Calculate Them?

The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings can be defined as, accumulation of a company’s historical revenues for reinvestment, loan. Retained earnings are calculated by adding the current period’s net income to the previous period’s balance and subtracting.

Retained Earnings Are Calculated By Adding The Current Period’s Net Income To The Previous Period’s Balance And Subtracting.

Retained earnings can be defined as, accumulation of a company’s historical revenues for reinvestment, loan. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds.