Russell 2000 Index Fact Sheet - Representative sampling is an indexing strategy that involves investing in a representative sample of. It includes approximately 2,000 of the smallest securities based on a. Use to diversify a u.s. The russell 2000 index is a subset of. Segment of the us equity universe. The index was launched in 1984 by the frank russell company and is now managed by ftse. Asubset of the russell 3000 index, it includes approximately 2,000 of the. The ishares russell 2000 etf seeks to track the investment results of an index. Btc uses a representative sampling indexing strategy to manage the fund. 98% of the investable us equity market.

Asubset of the russell 3000 index, it includes approximately 2,000 of the. 98% of the investable us equity market. It includes approximately 2,000 of the smallest securities based on a. The index was launched in 1984 by the frank russell company and is now managed by ftse. Use to diversify a u.s. Btc uses a representative sampling indexing strategy to manage the fund. The ishares russell 2000 etf seeks to track the investment results of an index. Segment of the us equity universe. The russell 2000 index is a subset of. Representative sampling is an indexing strategy that involves investing in a representative sample of.

The ishares russell 2000 etf seeks to track the investment results of an index. The russell 2000 index is a subset of. Representative sampling is an indexing strategy that involves investing in a representative sample of. Use to diversify a u.s. Btc uses a representative sampling indexing strategy to manage the fund. Asubset of the russell 3000 index, it includes approximately 2,000 of the. 98% of the investable us equity market. Segment of the us equity universe. The index was launched in 1984 by the frank russell company and is now managed by ftse. It includes approximately 2,000 of the smallest securities based on a.

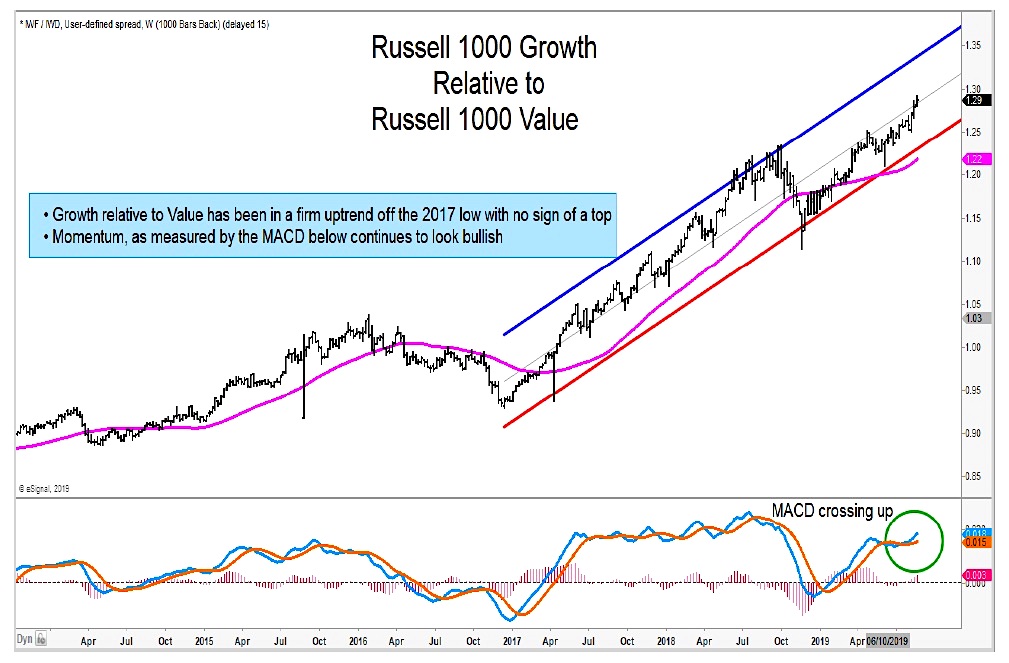

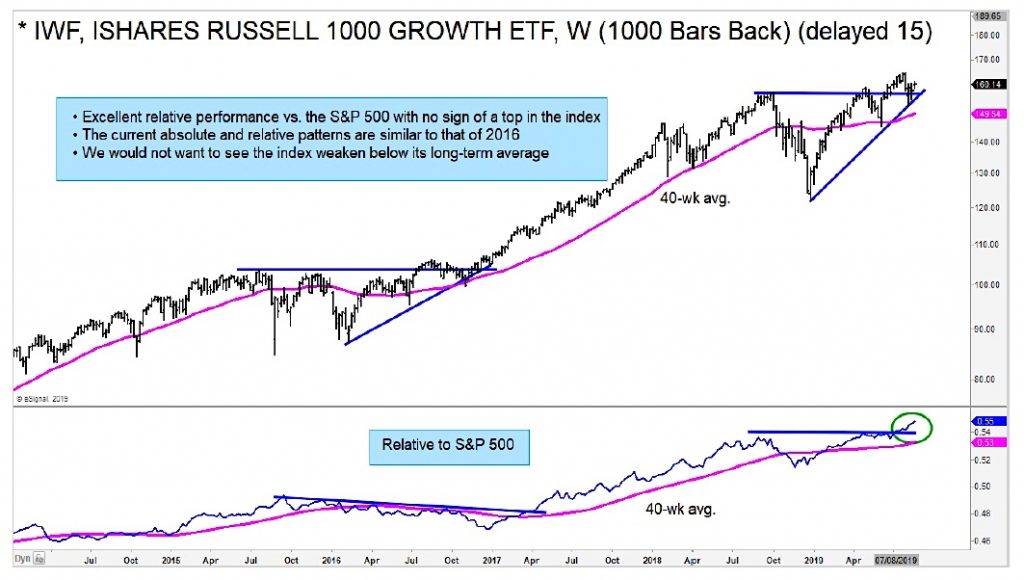

Growth Stocks Are Outperforming Value Here's 4 We Like See It Market

The index was launched in 1984 by the frank russell company and is now managed by ftse. The russell 2000 index is a subset of. Btc uses a representative sampling indexing strategy to manage the fund. Representative sampling is an indexing strategy that involves investing in a representative sample of. It includes approximately 2,000 of the smallest securities based on.

What Companies Are in the Russell 2000 Index Quant RL

Btc uses a representative sampling indexing strategy to manage the fund. The ishares russell 2000 etf seeks to track the investment results of an index. It includes approximately 2,000 of the smallest securities based on a. The index was launched in 1984 by the frank russell company and is now managed by ftse. The russell 2000 index is a subset.

Russell 2000 Index Definition, Components, How it Works?

It includes approximately 2,000 of the smallest securities based on a. The ishares russell 2000 etf seeks to track the investment results of an index. Segment of the us equity universe. Use to diversify a u.s. Asubset of the russell 3000 index, it includes approximately 2,000 of the.

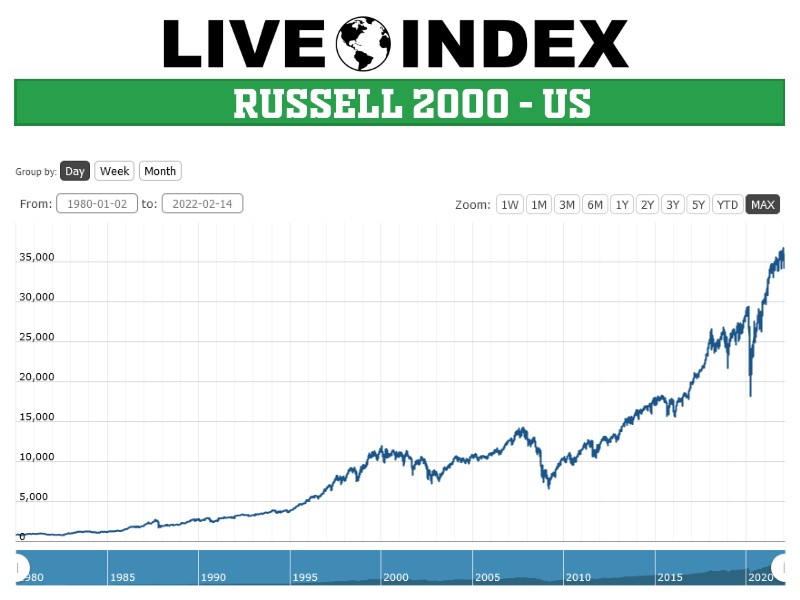

Russell 2000 ® Index daily closing levels*

Use to diversify a u.s. It includes approximately 2,000 of the smallest securities based on a. Representative sampling is an indexing strategy that involves investing in a representative sample of. Btc uses a representative sampling indexing strategy to manage the fund. The russell 2000 index is a subset of.

Russell 2000 Index Definition and Key Metrics

Asubset of the russell 3000 index, it includes approximately 2,000 of the. Representative sampling is an indexing strategy that involves investing in a representative sample of. Btc uses a representative sampling indexing strategy to manage the fund. It includes approximately 2,000 of the smallest securities based on a. Segment of the us equity universe.

e67724russell2000.jpg

It includes approximately 2,000 of the smallest securities based on a. 98% of the investable us equity market. The ishares russell 2000 etf seeks to track the investment results of an index. The index was launched in 1984 by the frank russell company and is now managed by ftse. Btc uses a representative sampling indexing strategy to manage the fund.

Russell 2000

The russell 2000 index is a subset of. Use to diversify a u.s. The index was launched in 1984 by the frank russell company and is now managed by ftse. Representative sampling is an indexing strategy that involves investing in a representative sample of. Segment of the us equity universe.

Russell 2000 Index Alchetron, The Free Social Encyclopedia

Representative sampling is an indexing strategy that involves investing in a representative sample of. The index was launched in 1984 by the frank russell company and is now managed by ftse. Asubset of the russell 3000 index, it includes approximately 2,000 of the. The russell 2000 index is a subset of. It includes approximately 2,000 of the smallest securities based.

Introduction to the Russell 2000 Indices OANDA Labs

Asubset of the russell 3000 index, it includes approximately 2,000 of the. The russell 2000 index is a subset of. Use to diversify a u.s. It includes approximately 2,000 of the smallest securities based on a. Segment of the us equity universe.

Growth Stocks Are Outperforming Value Here's 4 We Like See It Market

The ishares russell 2000 etf seeks to track the investment results of an index. The index was launched in 1984 by the frank russell company and is now managed by ftse. Representative sampling is an indexing strategy that involves investing in a representative sample of. Use to diversify a u.s. Segment of the us equity universe.

Btc Uses A Representative Sampling Indexing Strategy To Manage The Fund.

The index was launched in 1984 by the frank russell company and is now managed by ftse. The russell 2000 index is a subset of. Asubset of the russell 3000 index, it includes approximately 2,000 of the. Representative sampling is an indexing strategy that involves investing in a representative sample of.

98% Of The Investable Us Equity Market.

Segment of the us equity universe. The ishares russell 2000 etf seeks to track the investment results of an index. Use to diversify a u.s. It includes approximately 2,000 of the smallest securities based on a.

:max_bytes(150000):strip_icc()/Russel-2000-V3-4f3ef31086cf49058ecf1eadc55677de.jpg)