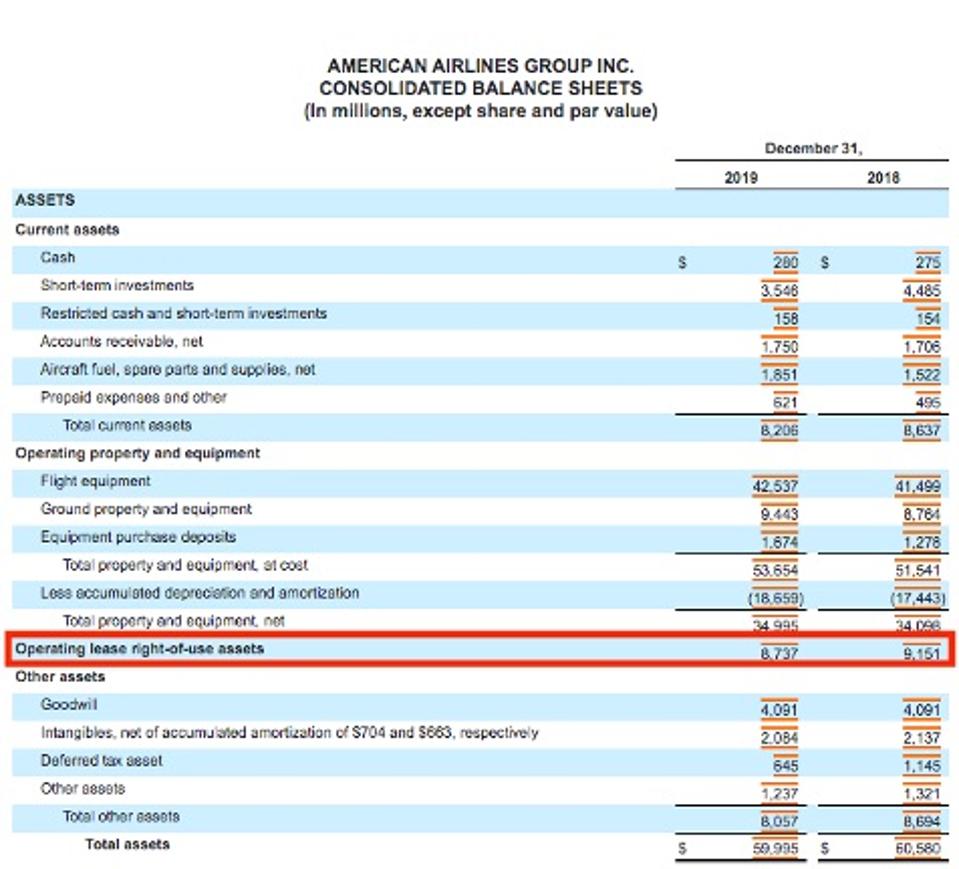

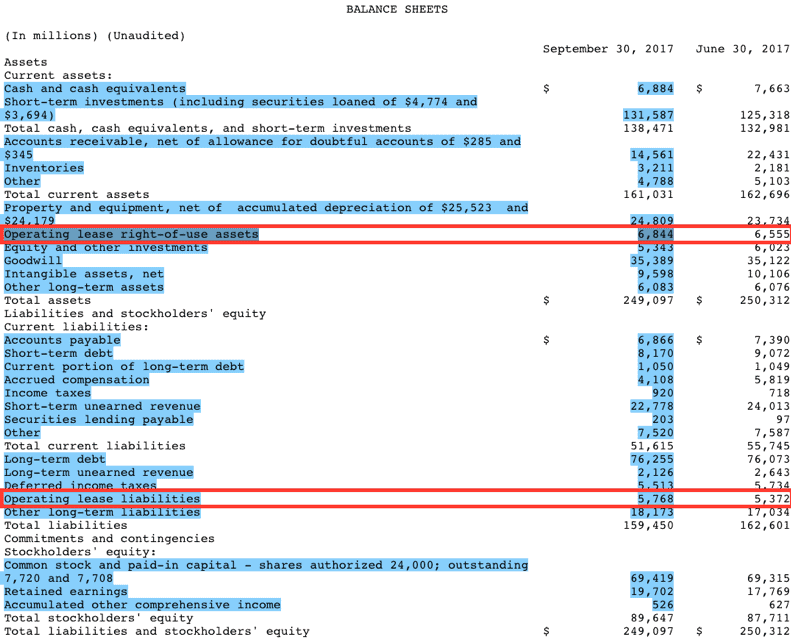

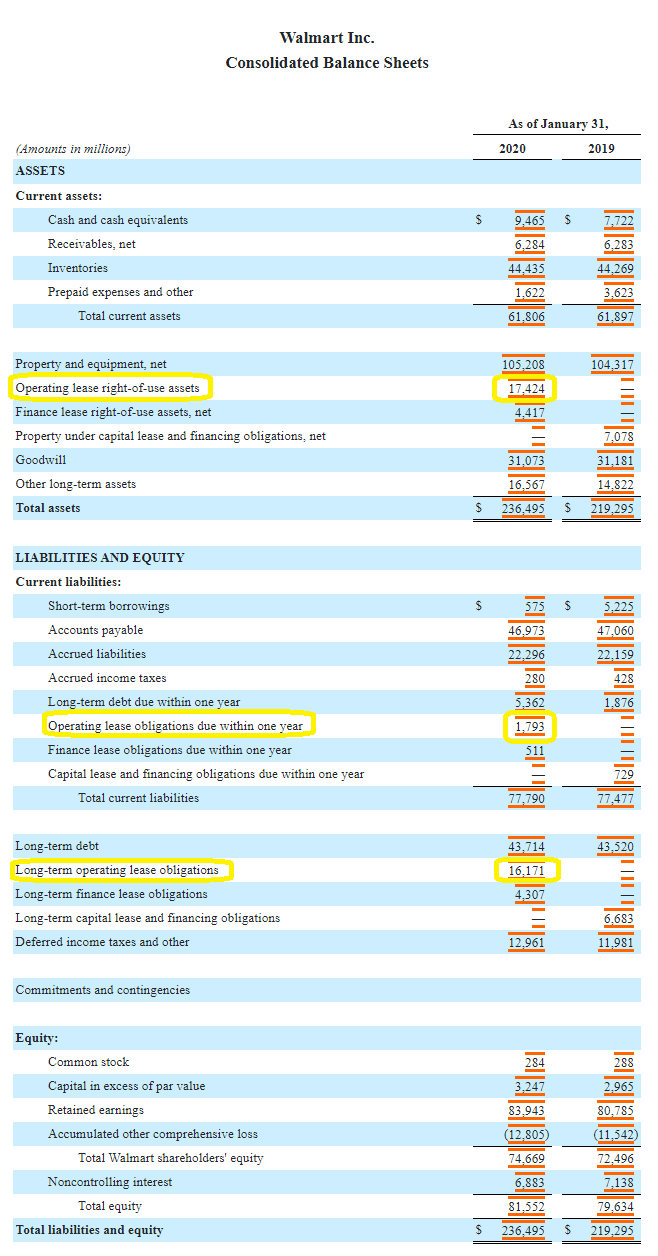

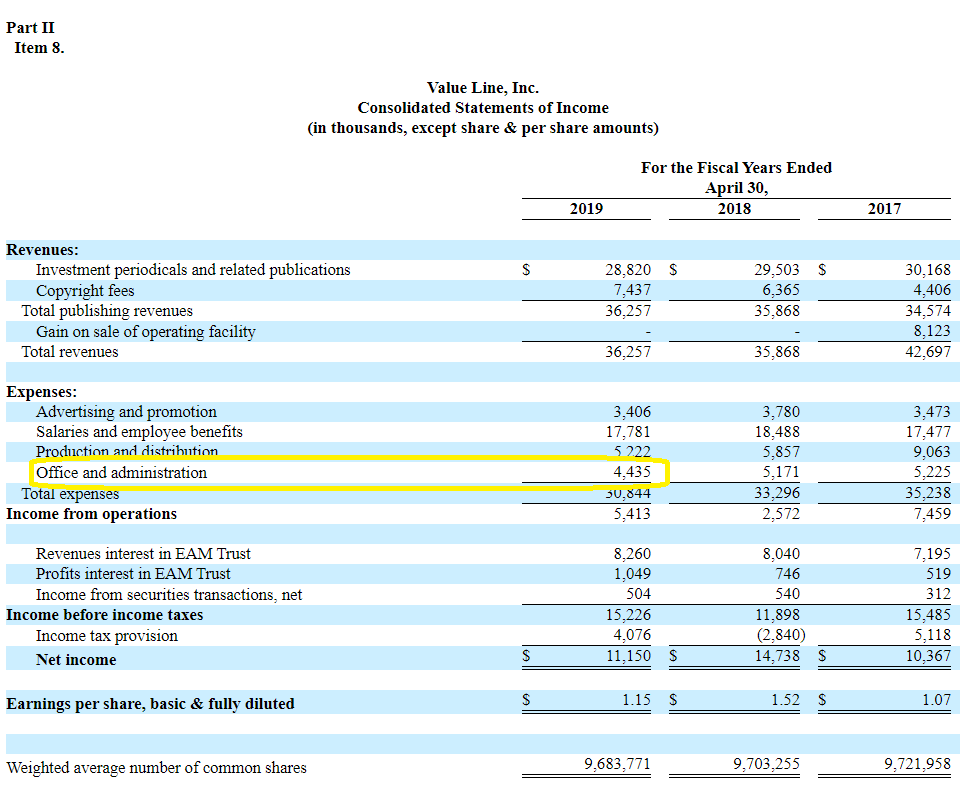

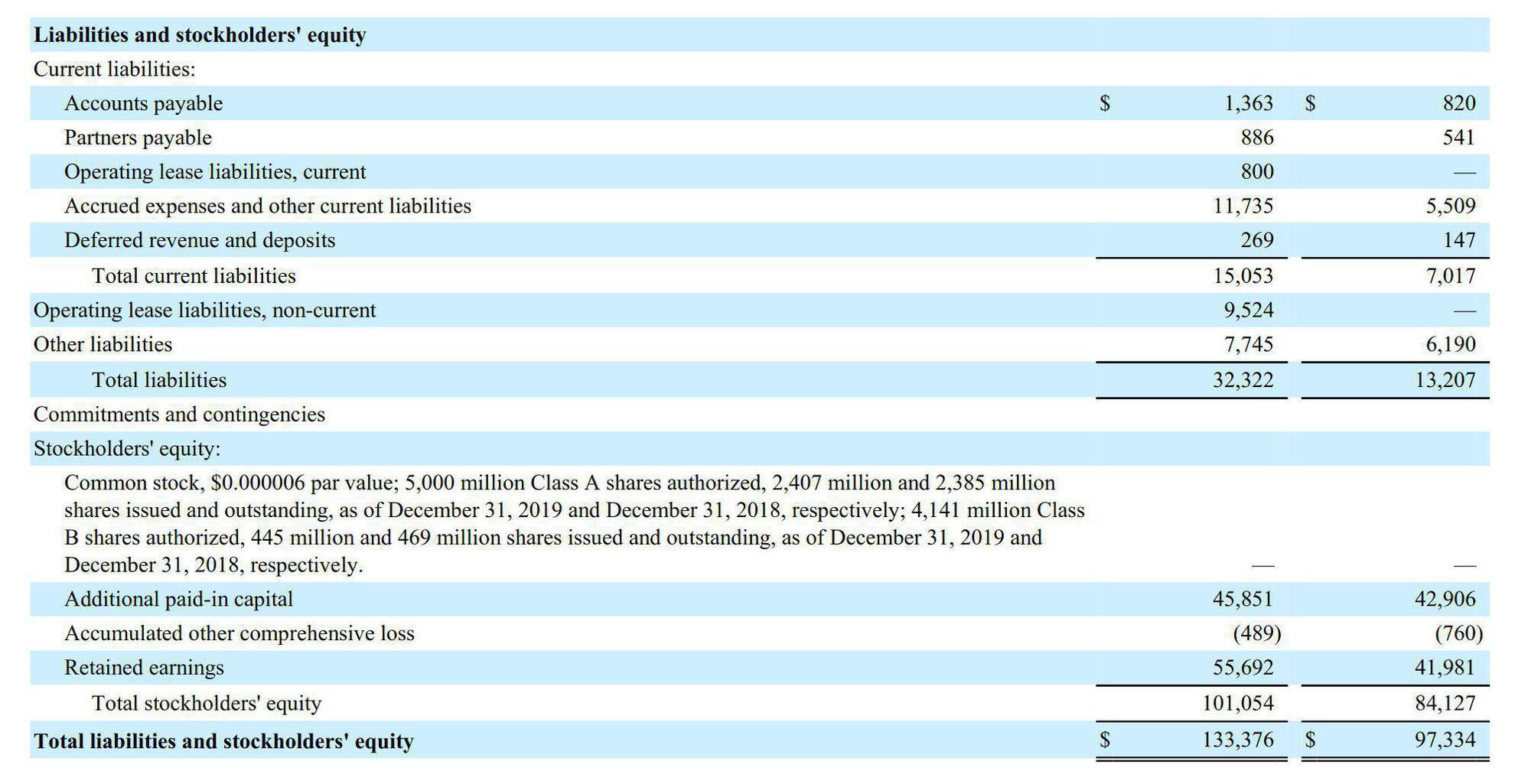

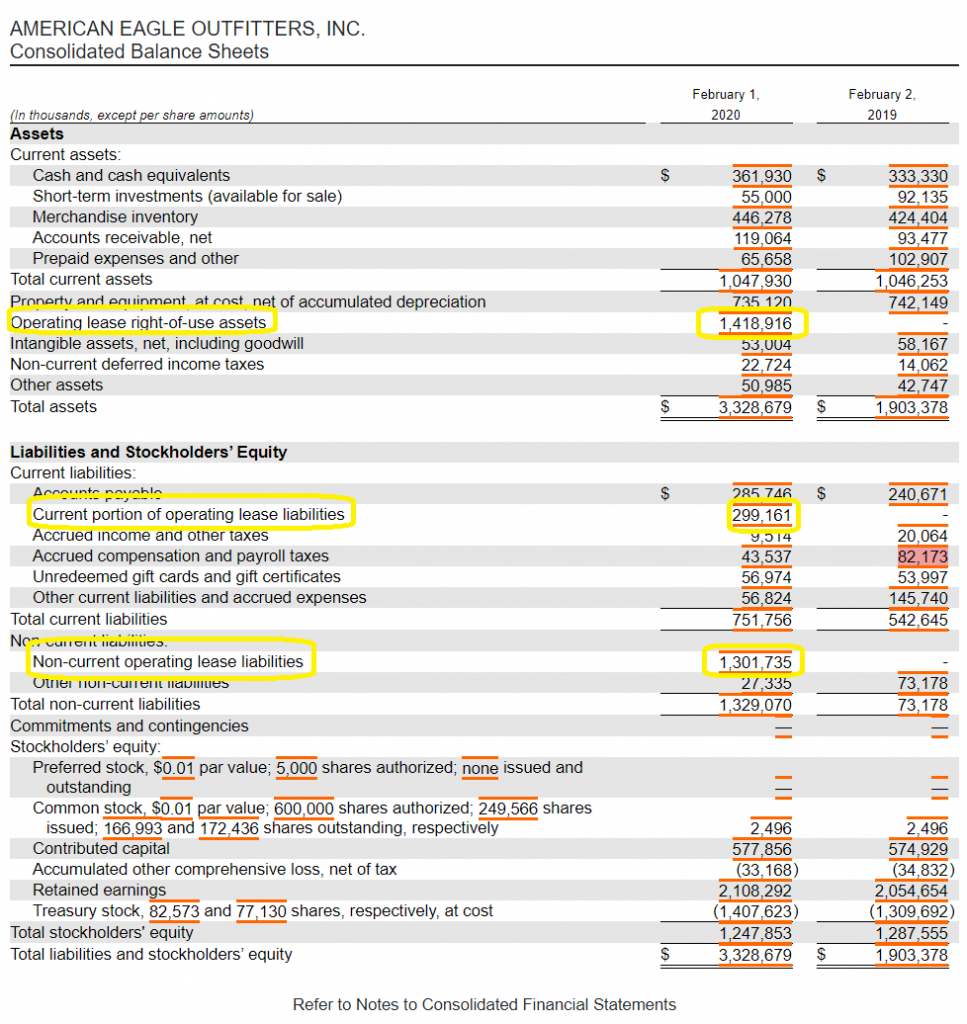

Operating Lease On Balance Sheet - Under the latest accounting standards, companies must classify any asset that they lease for less than 12 months as operating leases. Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet.

Under the latest accounting standards, companies must classify any asset that they lease for less than 12 months as operating leases. Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet.

Under the latest accounting standards, companies must classify any asset that they lease for less than 12 months as operating leases. Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet.

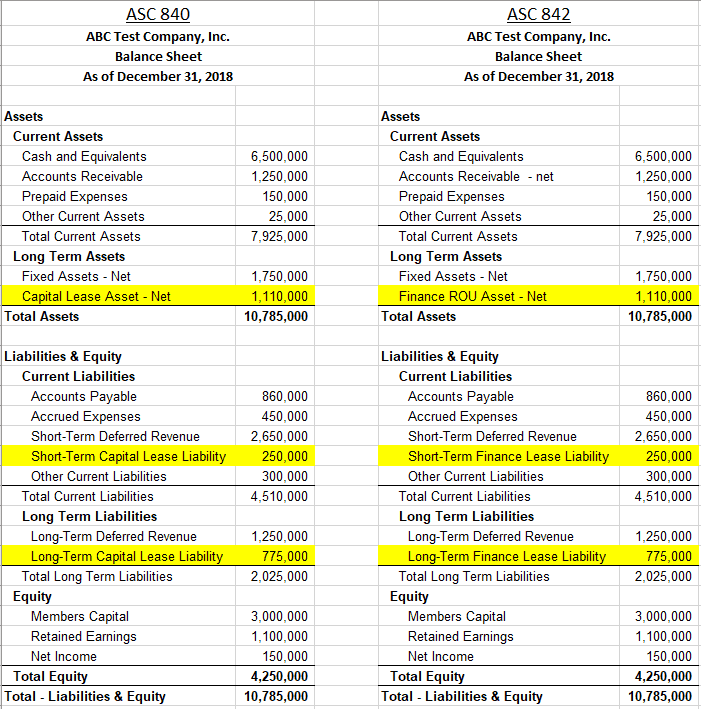

ASC 842 Balance Sheet Guide with Examples Visual Lease

Under the latest accounting standards, companies must classify any asset that they lease for less than 12 months as operating leases. Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet.

Operating Leases Now in the Balance Sheet GAAP Accounting Made Simple

Under the latest accounting standards, companies must classify any asset that they lease for less than 12 months as operating leases. Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet.

Do Operating Leases Go On The Balance Sheet at Laura Strong blog

Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet. Under the latest accounting standards, companies must classify any asset that they lease for less than 12 months as operating leases.

New Operating Lease Disclosures The Good, The Bad & The

Under the latest accounting standards, companies must classify any asset that they lease for less than 12 months as operating leases. Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet.

The Impacts of Operating Leases Moving to the Balance Sheet

Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet. Under the latest accounting standards, companies must classify any asset that they lease for less than 12 months as operating leases.

The Potential Impact of Lease Accounting on Equity Valuation The CPA

Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet. Under the latest accounting standards, companies must classify any asset that they lease for less than 12 months as operating leases.

Accounting for Operating Leases in the Balance Sheet Simply Explained

Under the latest accounting standards, companies must classify any asset that they lease for less than 12 months as operating leases. Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet.

Operating Leases Now in the Balance Sheet GAAP Accounting Made Simple

Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet. Under the latest accounting standards, companies must classify any asset that they lease for less than 12 months as operating leases.

Financing and Operating Leases in Valuation Analyzing Alpha

Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet. Under the latest accounting standards, companies must classify any asset that they lease for less than 12 months as operating leases.

Operating Leases Now in the Balance Sheet GAAP Accounting Made Simple

Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet. Under the latest accounting standards, companies must classify any asset that they lease for less than 12 months as operating leases.

Under The Latest Accounting Standards, Companies Must Classify Any Asset That They Lease For Less Than 12 Months As Operating Leases.

Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet.