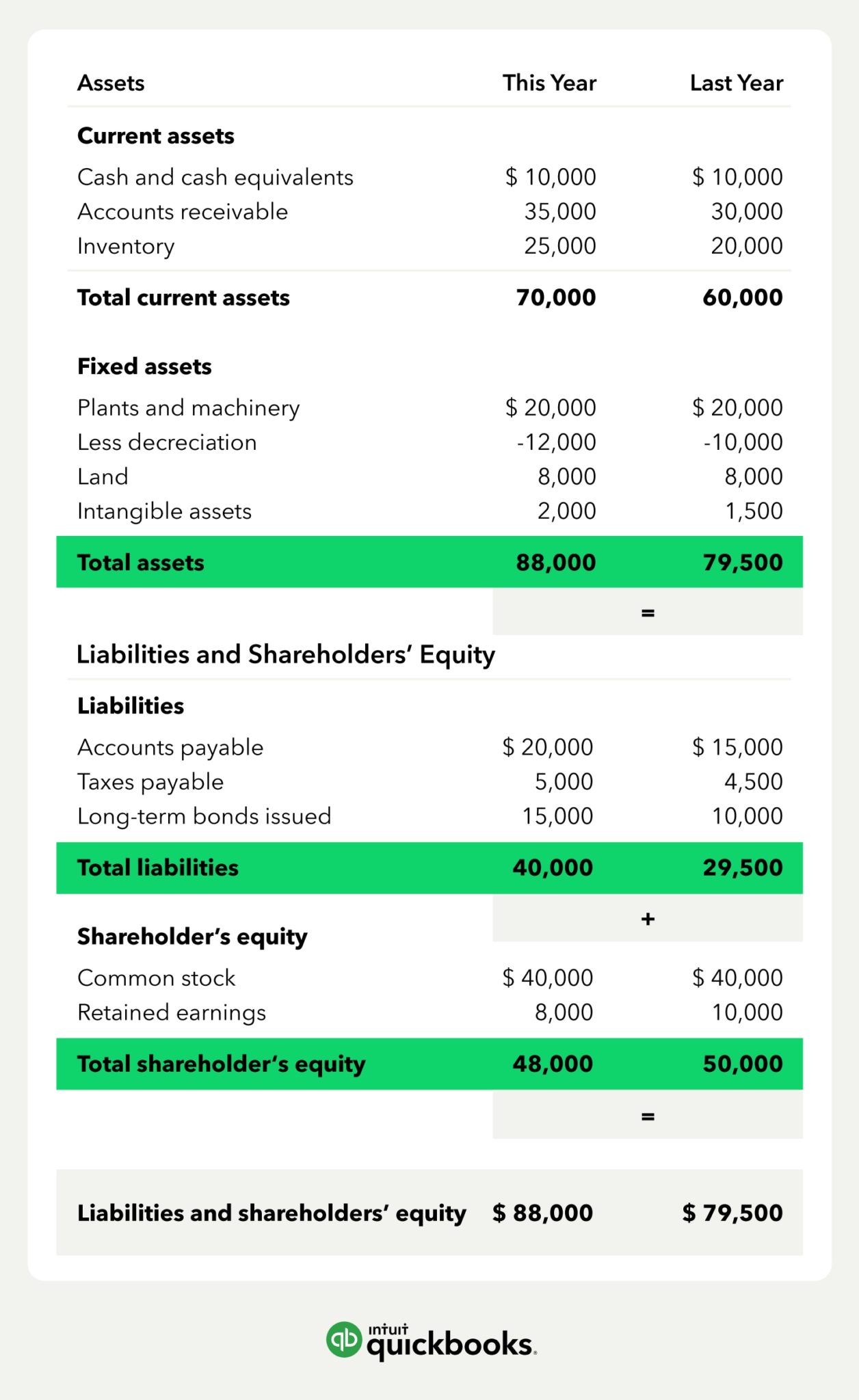

Negative Equity On Balance Sheet - On the balance sheet, it appears as a shareholder equity deficit,. Negative shareholders equity occurs when liabilities exceed assets, leading to a deficit in the equity section of the balance. Learn what negative equity is, how it arises, and what it means for a company's financial health and viability. Negative shareholder equity is when a company owes more money to investors than its assets can cover. Negative equity significantly alters a company’s financial statements.

Negative shareholder equity is when a company owes more money to investors than its assets can cover. Negative equity significantly alters a company’s financial statements. On the balance sheet, it appears as a shareholder equity deficit,. Negative shareholders equity occurs when liabilities exceed assets, leading to a deficit in the equity section of the balance. Learn what negative equity is, how it arises, and what it means for a company's financial health and viability.

Negative shareholders equity occurs when liabilities exceed assets, leading to a deficit in the equity section of the balance. Learn what negative equity is, how it arises, and what it means for a company's financial health and viability. Negative shareholder equity is when a company owes more money to investors than its assets can cover. Negative equity significantly alters a company’s financial statements. On the balance sheet, it appears as a shareholder equity deficit,.

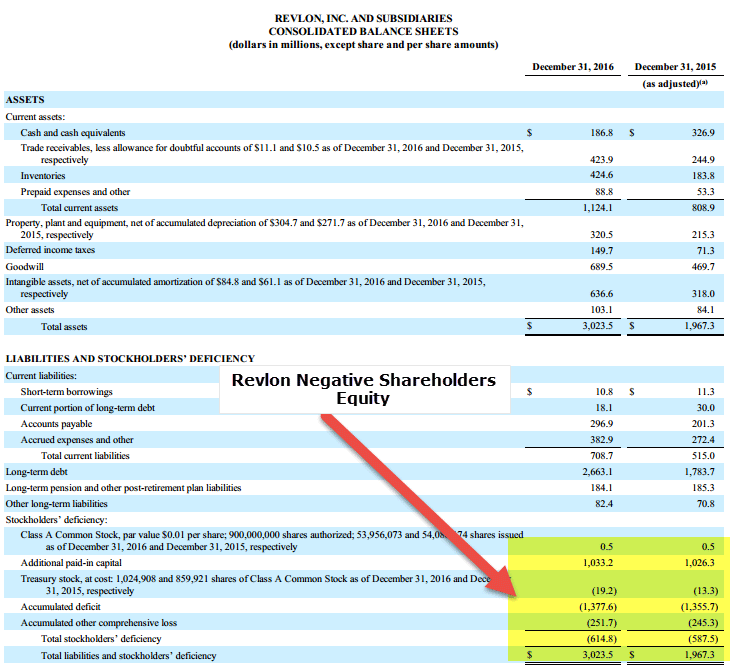

Negative Balance sheet

Negative equity significantly alters a company’s financial statements. Negative shareholder equity is when a company owes more money to investors than its assets can cover. Learn what negative equity is, how it arises, and what it means for a company's financial health and viability. Negative shareholders equity occurs when liabilities exceed assets, leading to a deficit in the equity section.

Negative equity on balance sheet by james water Issuu

Learn what negative equity is, how it arises, and what it means for a company's financial health and viability. Negative shareholders equity occurs when liabilities exceed assets, leading to a deficit in the equity section of the balance. Negative equity significantly alters a company’s financial statements. On the balance sheet, it appears as a shareholder equity deficit,. Negative shareholder equity.

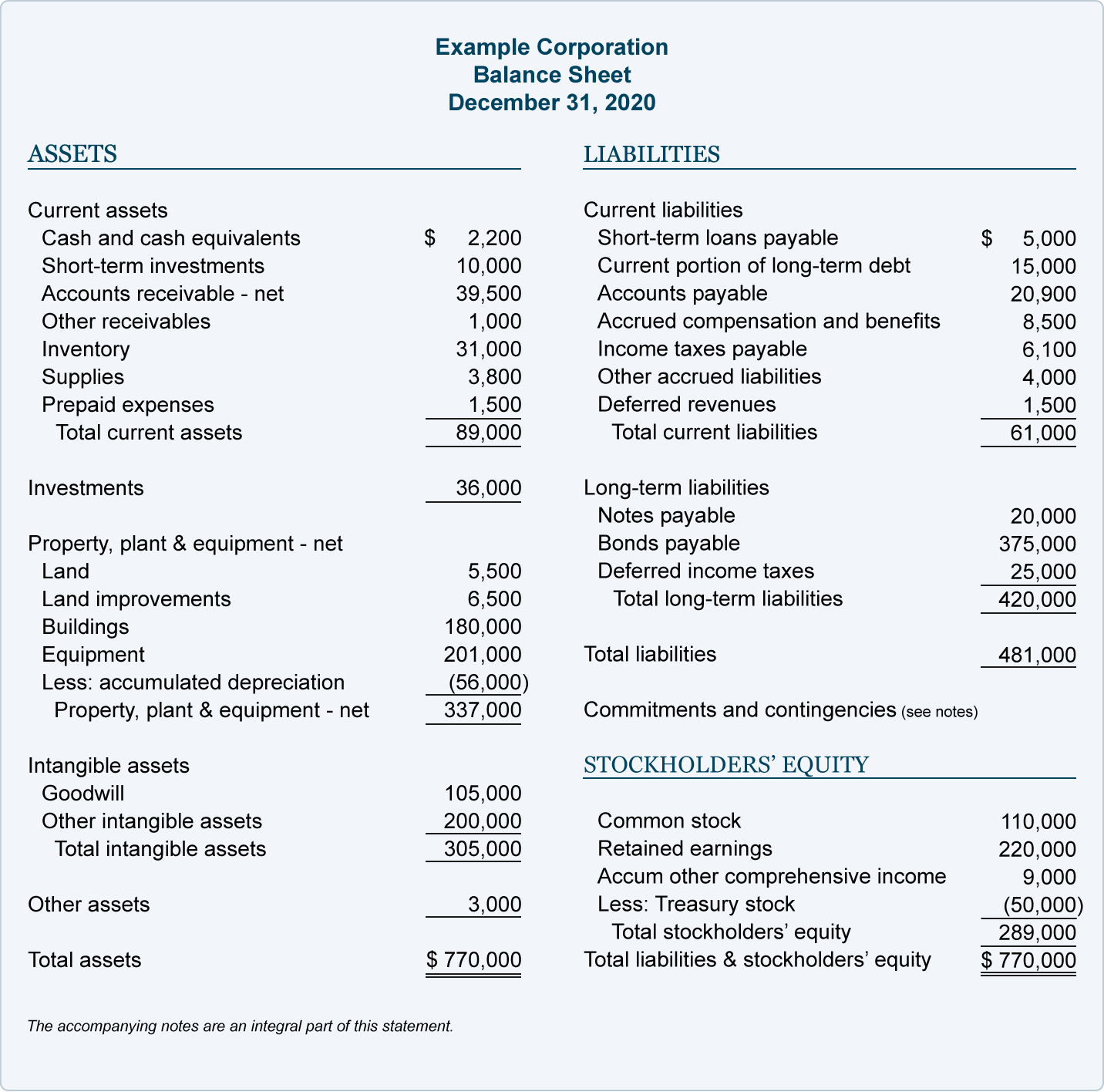

Negative Shareholders Equity Examples Buyback Losses

Negative shareholder equity is when a company owes more money to investors than its assets can cover. Negative shareholders equity occurs when liabilities exceed assets, leading to a deficit in the equity section of the balance. Negative equity significantly alters a company’s financial statements. Learn what negative equity is, how it arises, and what it means for a company's financial.

Negative equity balance sheet

Learn what negative equity is, how it arises, and what it means for a company's financial health and viability. Negative shareholders equity occurs when liabilities exceed assets, leading to a deficit in the equity section of the balance. Negative shareholder equity is when a company owes more money to investors than its assets can cover. On the balance sheet, it.

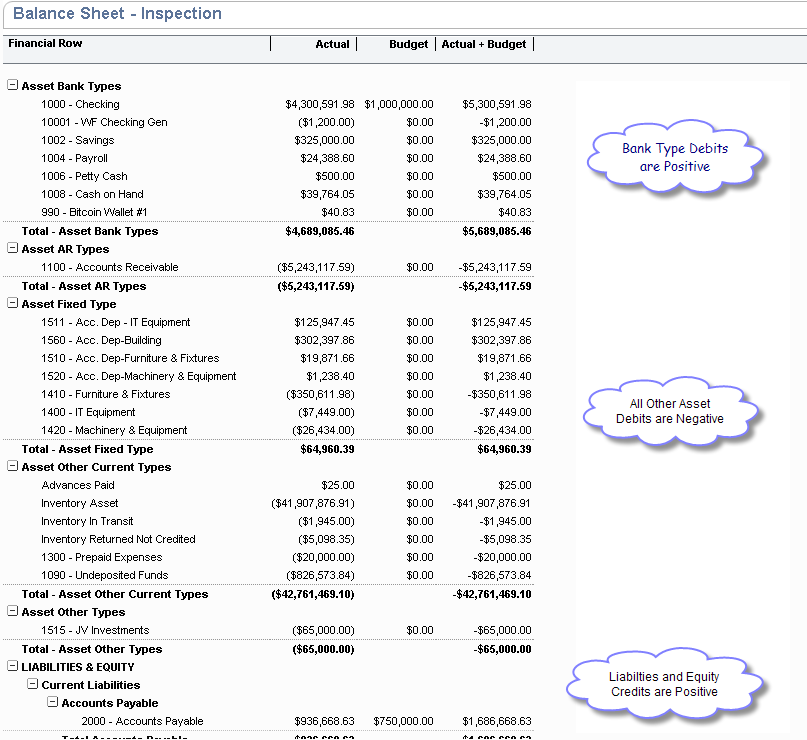

Marty Zigman on "The Pluses and Minuses of NetSuite Financial Statement

Learn what negative equity is, how it arises, and what it means for a company's financial health and viability. On the balance sheet, it appears as a shareholder equity deficit,. Negative shareholders equity occurs when liabilities exceed assets, leading to a deficit in the equity section of the balance. Negative shareholder equity is when a company owes more money to.

How to Find Negative Retained Earnings in a 10k Does it Indicate

Negative shareholders equity occurs when liabilities exceed assets, leading to a deficit in the equity section of the balance. Negative equity significantly alters a company’s financial statements. Negative shareholder equity is when a company owes more money to investors than its assets can cover. On the balance sheet, it appears as a shareholder equity deficit,. Learn what negative equity is,.

Understanding Negative Balances in Your Financial Statements Fortiviti

Negative shareholder equity is when a company owes more money to investors than its assets can cover. Negative equity significantly alters a company’s financial statements. Learn what negative equity is, how it arises, and what it means for a company's financial health and viability. On the balance sheet, it appears as a shareholder equity deficit,. Negative shareholders equity occurs when.

Understanding Your Balance Sheet Financial Accounting Protea

On the balance sheet, it appears as a shareholder equity deficit,. Negative shareholders equity occurs when liabilities exceed assets, leading to a deficit in the equity section of the balance. Learn what negative equity is, how it arises, and what it means for a company's financial health and viability. Negative shareholder equity is when a company owes more money to.

Negative Shareholders Equity Examples Buyback Losses

Negative shareholders equity occurs when liabilities exceed assets, leading to a deficit in the equity section of the balance. Negative equity significantly alters a company’s financial statements. On the balance sheet, it appears as a shareholder equity deficit,. Negative shareholder equity is when a company owes more money to investors than its assets can cover. Learn what negative equity is,.

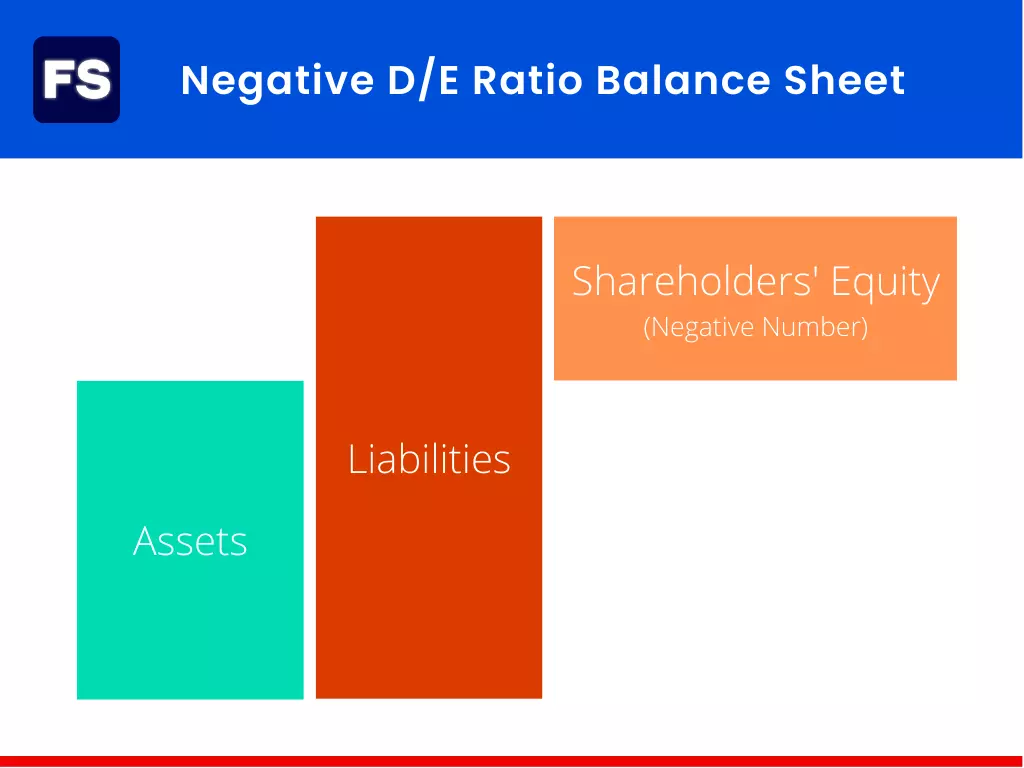

Negative Debt to Equity Ratio Do You Know What It Means?

Negative shareholders equity occurs when liabilities exceed assets, leading to a deficit in the equity section of the balance. Learn what negative equity is, how it arises, and what it means for a company's financial health and viability. Negative shareholder equity is when a company owes more money to investors than its assets can cover. Negative equity significantly alters a.

Learn What Negative Equity Is, How It Arises, And What It Means For A Company's Financial Health And Viability.

Negative shareholders equity occurs when liabilities exceed assets, leading to a deficit in the equity section of the balance. On the balance sheet, it appears as a shareholder equity deficit,. Negative shareholder equity is when a company owes more money to investors than its assets can cover. Negative equity significantly alters a company’s financial statements.