Is Depreciation Expense On The Balance Sheet - On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. Depreciation expense itself does not appear as a separate line item on the. Placement of depreciation expense on the balance sheet.

Placement of depreciation expense on the balance sheet. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its. Depreciation expense itself does not appear as a separate line item on the.

Placement of depreciation expense on the balance sheet. Depreciation expense itself does not appear as a separate line item on the. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its.

How do you account for depreciation on a balance sheet? Leia aqui Is

On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its. Depreciation expense itself does not appear as a separate line item on the. Placement of depreciation expense on the balance sheet. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where.

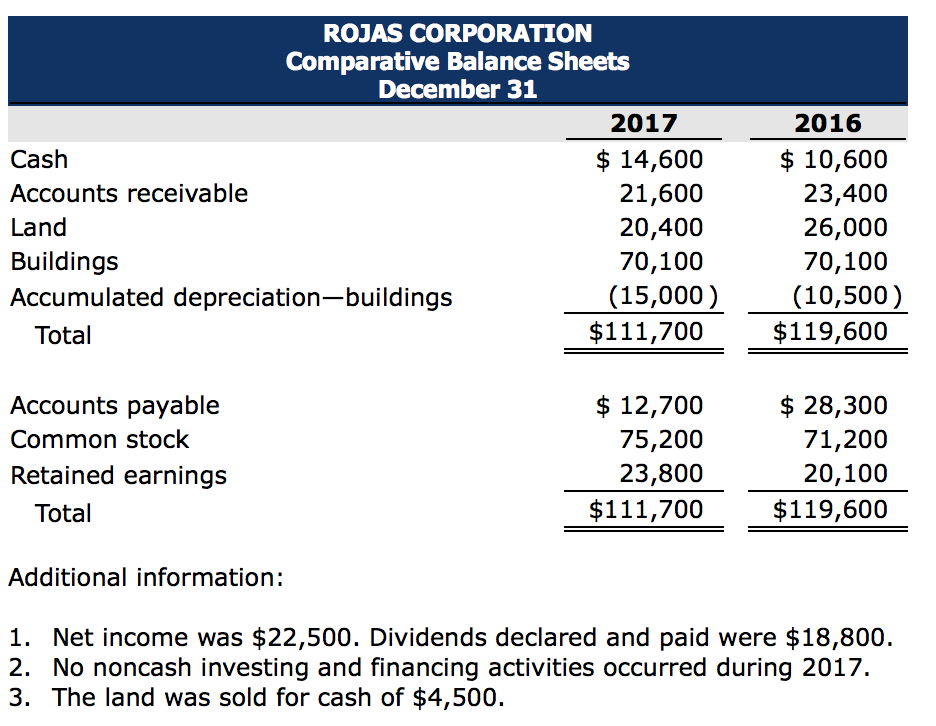

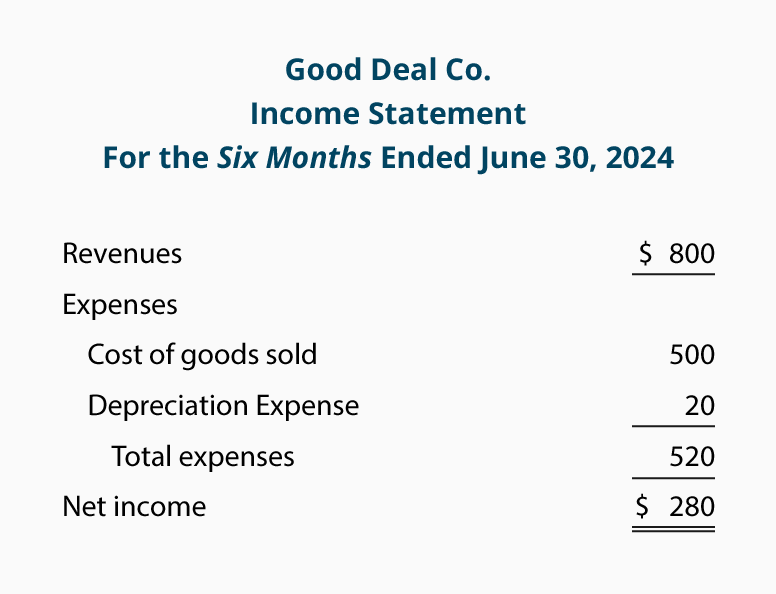

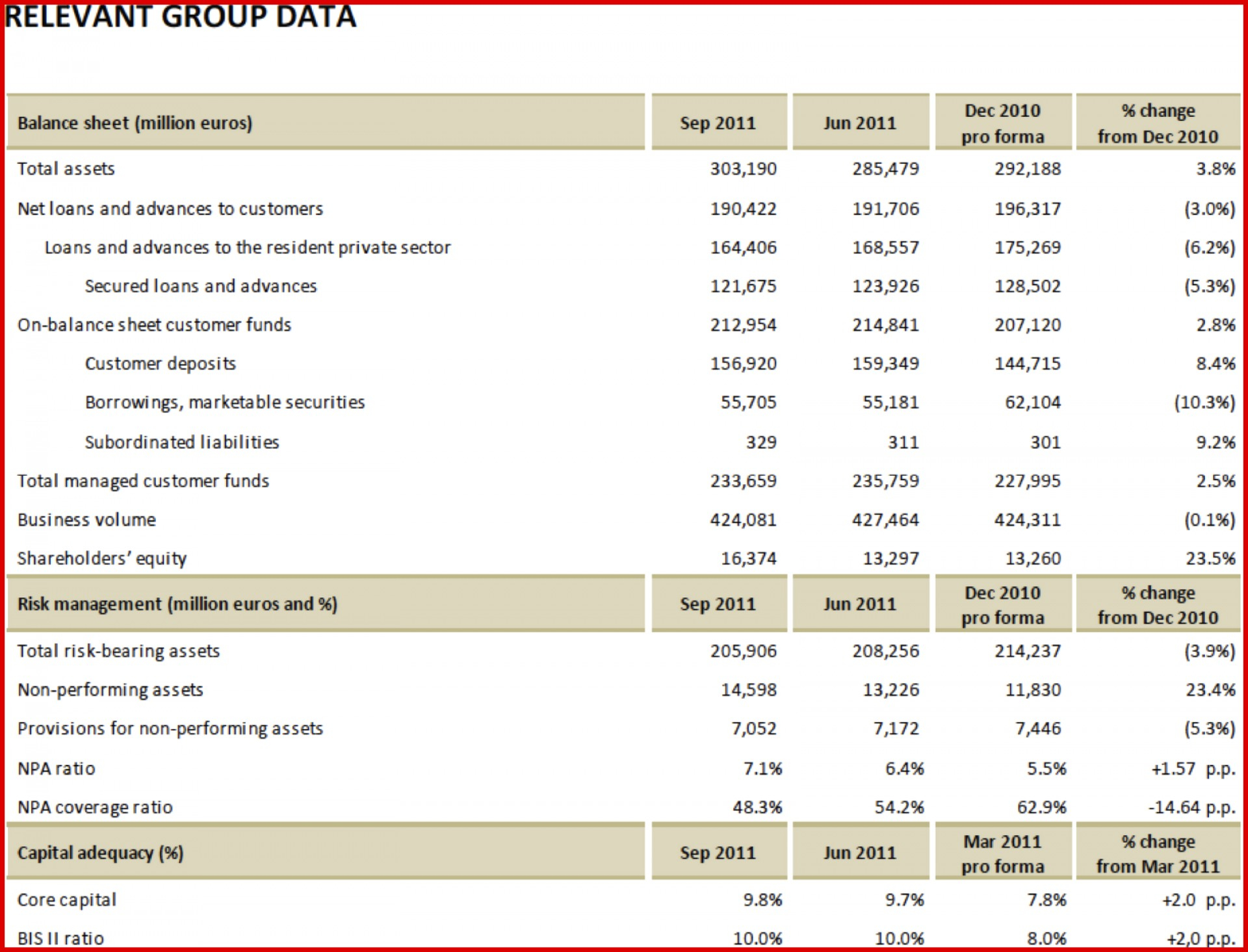

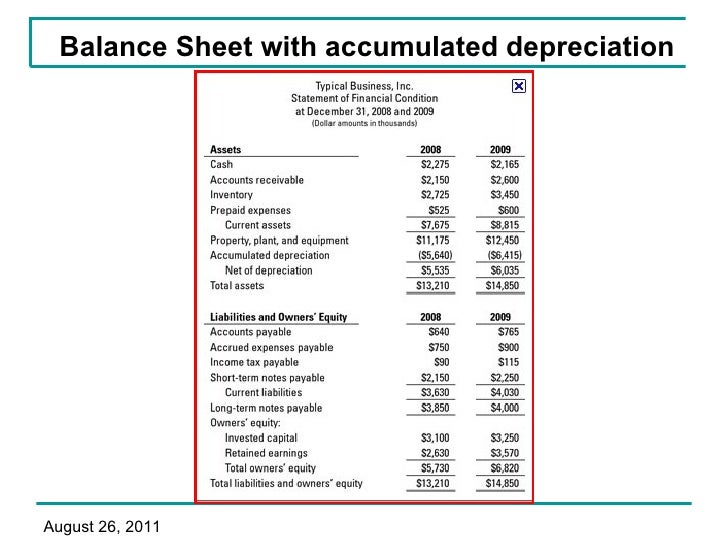

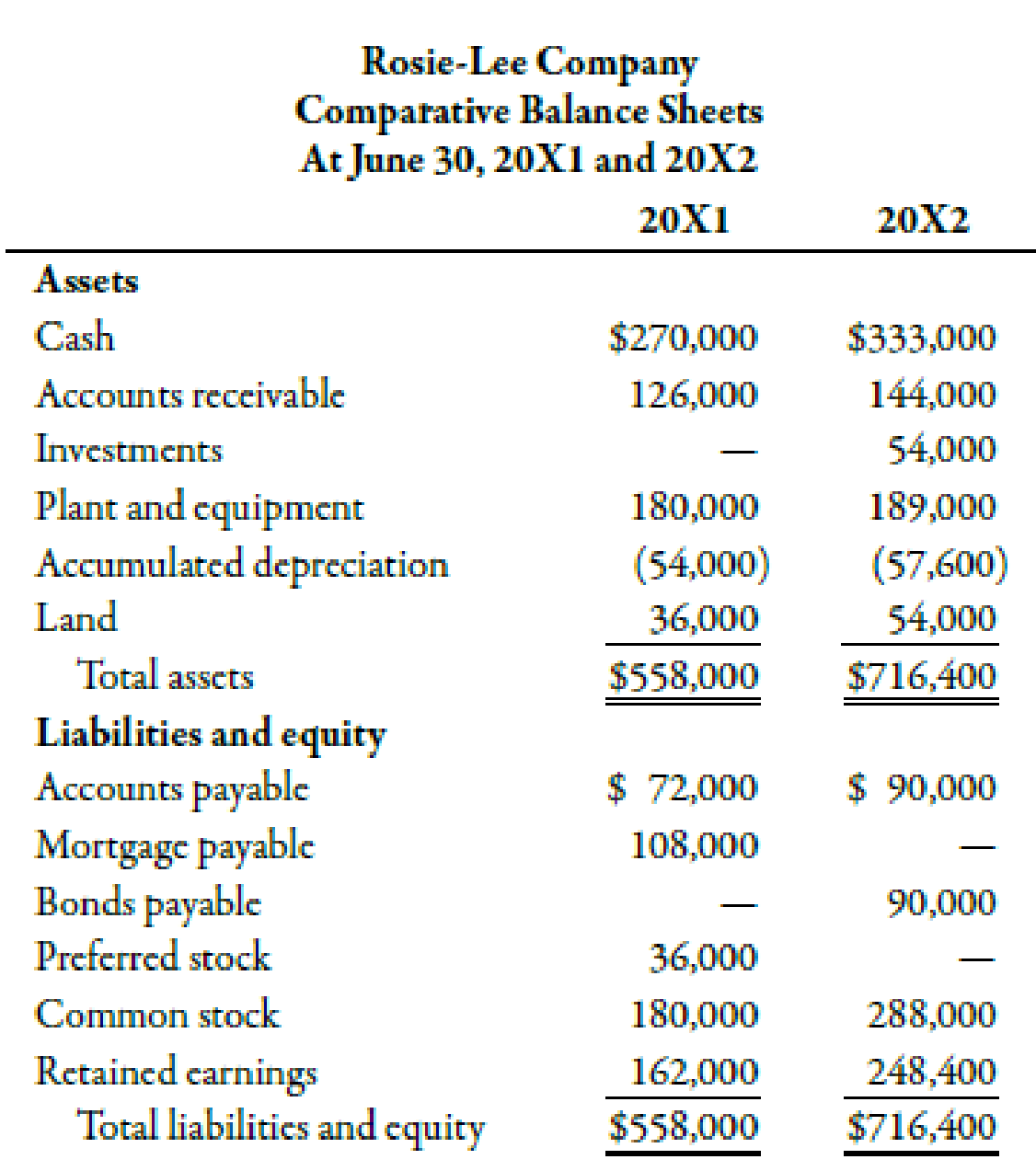

Balance Sheet Example With Depreciation

On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its. Placement of depreciation expense on the balance sheet. Depreciation expense itself does not appear as a separate line item on the. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where.

Balance Sheet Example With Depreciation

On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. Depreciation expense itself does not appear as a separate line item on the. Placement of depreciation expense on the balance sheet.

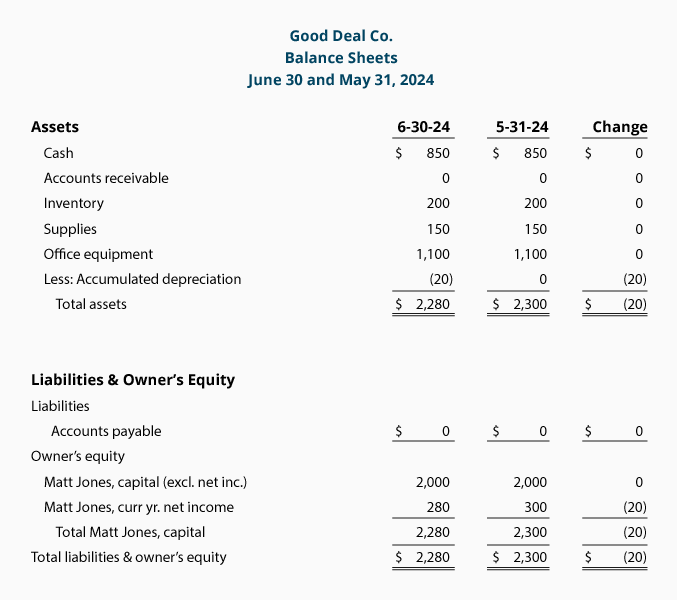

Fixed Asset Depreciation Excel Spreadsheet for 013 Accounting Balance

On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its. Depreciation expense itself does not appear as a separate line item on the. Placement of depreciation expense on the balance sheet. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where.

Depreciation

Placement of depreciation expense on the balance sheet. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. Depreciation expense itself does not appear as a separate line item on the.

Where Is Accumulated Depreciation on the Balance Sheet?

Depreciation expense itself does not appear as a separate line item on the. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its. Placement of depreciation expense on the balance sheet. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where.

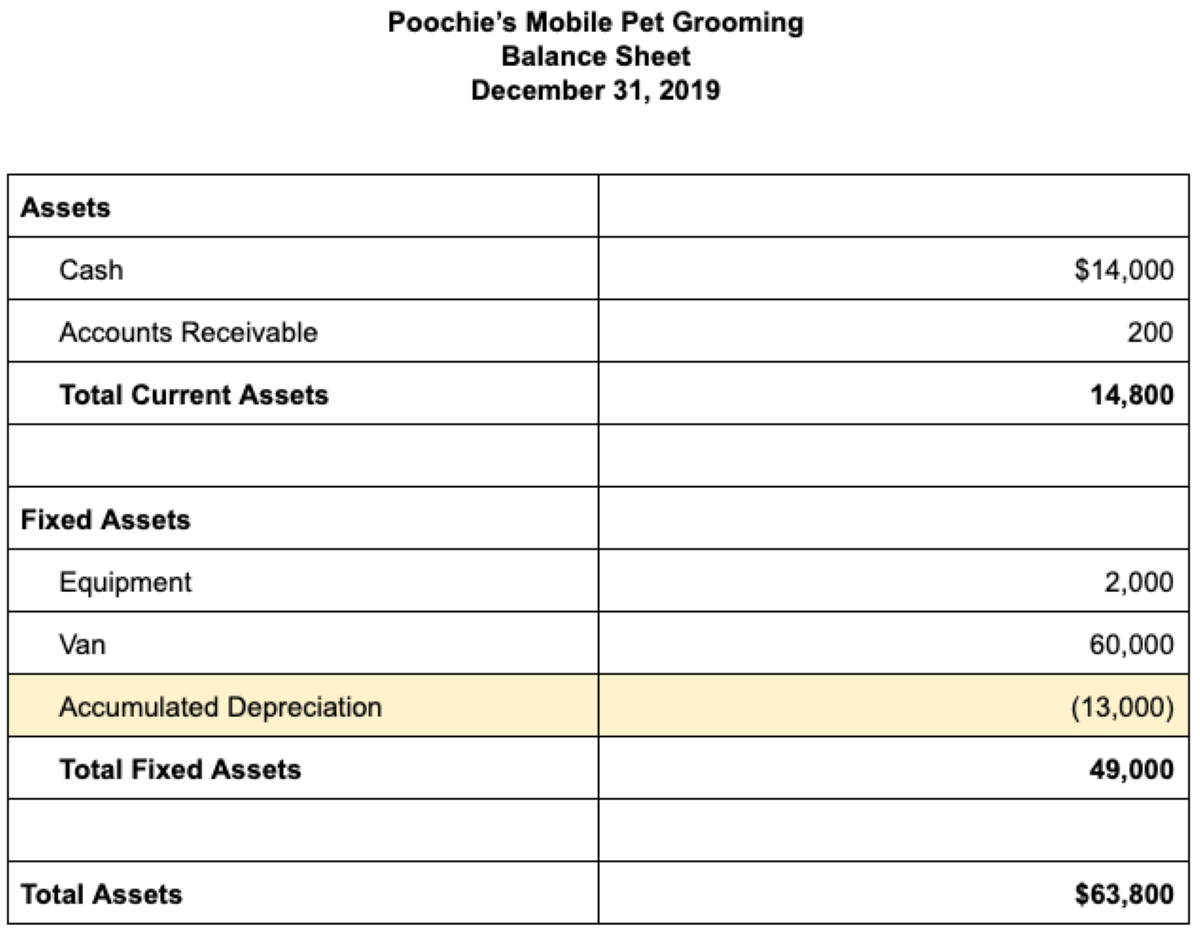

Balance Sheet Example With Depreciation

On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its. Placement of depreciation expense on the balance sheet. Depreciation expense itself does not appear as a separate line item on the. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where.

Balance Sheet Example With Depreciation

Placement of depreciation expense on the balance sheet. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its. Depreciation expense itself does not appear as a separate line item on the. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where.

Where Does Depreciation Expense Go On A Balance Sheet LiveWell

Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. Depreciation expense itself does not appear as a separate line item on the. Placement of depreciation expense on the balance sheet. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its.

Cash Flow Statement Depreciation Expense AccountingCoach

On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (pp&e) over its. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. Depreciation expense itself does not appear as a separate line item on the. Placement of depreciation expense on the balance sheet.

On The Balance Sheet, Depreciation Expense Reduces The Book Value Of A Company’s Property, Plant And Equipment (Pp&E) Over Its.

Placement of depreciation expense on the balance sheet. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. Depreciation expense itself does not appear as a separate line item on the.