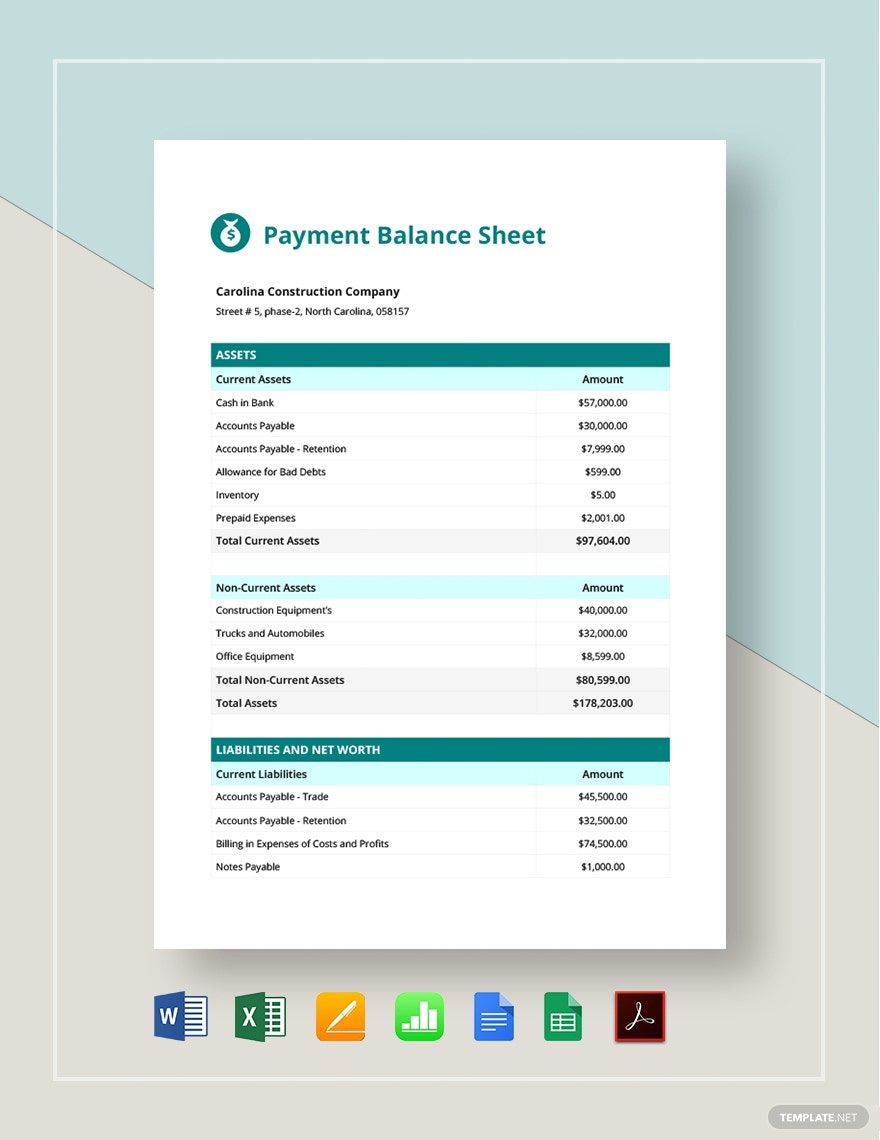

Interest Payment Balance Sheet - You would include the interest for december 29, 30, and. When you make that loan payment, you pay interest up to december 28. Generate regular reports on loan balances, payment status, and overdue accounts, and review them for anomalies or patterns that. Interest expense is an expense, and so appears on the income statement, while interest payable is a liability, and so appears on. Add “interest payable,” which is the amount of interest the company owes (not yet paid), under “current liabilities” on the balance.

When you make that loan payment, you pay interest up to december 28. Interest expense is an expense, and so appears on the income statement, while interest payable is a liability, and so appears on. Add “interest payable,” which is the amount of interest the company owes (not yet paid), under “current liabilities” on the balance. You would include the interest for december 29, 30, and. Generate regular reports on loan balances, payment status, and overdue accounts, and review them for anomalies or patterns that.

Add “interest payable,” which is the amount of interest the company owes (not yet paid), under “current liabilities” on the balance. Generate regular reports on loan balances, payment status, and overdue accounts, and review them for anomalies or patterns that. When you make that loan payment, you pay interest up to december 28. Interest expense is an expense, and so appears on the income statement, while interest payable is a liability, and so appears on. You would include the interest for december 29, 30, and.

Noncontrolling Interests The Full Consolidation Accounting Tutorial

Add “interest payable,” which is the amount of interest the company owes (not yet paid), under “current liabilities” on the balance. You would include the interest for december 29, 30, and. Generate regular reports on loan balances, payment status, and overdue accounts, and review them for anomalies or patterns that. When you make that loan payment, you pay interest up.

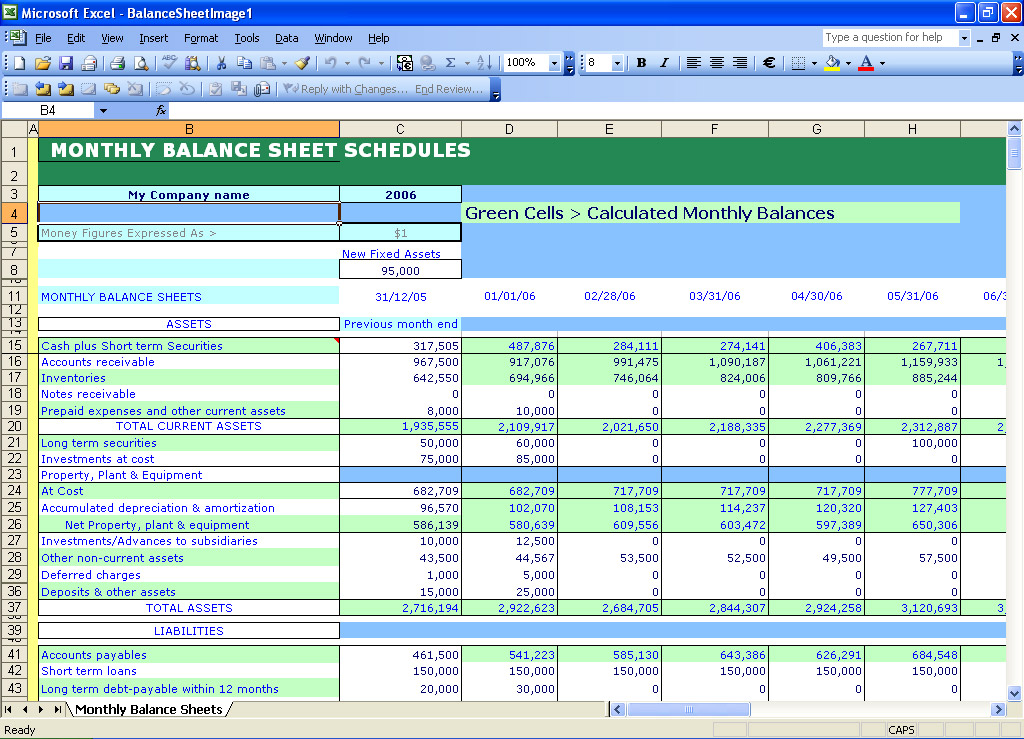

Account Balance Spreadsheet Template with 38 Free Balance Sheet

Interest expense is an expense, and so appears on the income statement, while interest payable is a liability, and so appears on. Generate regular reports on loan balances, payment status, and overdue accounts, and review them for anomalies or patterns that. When you make that loan payment, you pay interest up to december 28. You would include the interest for.

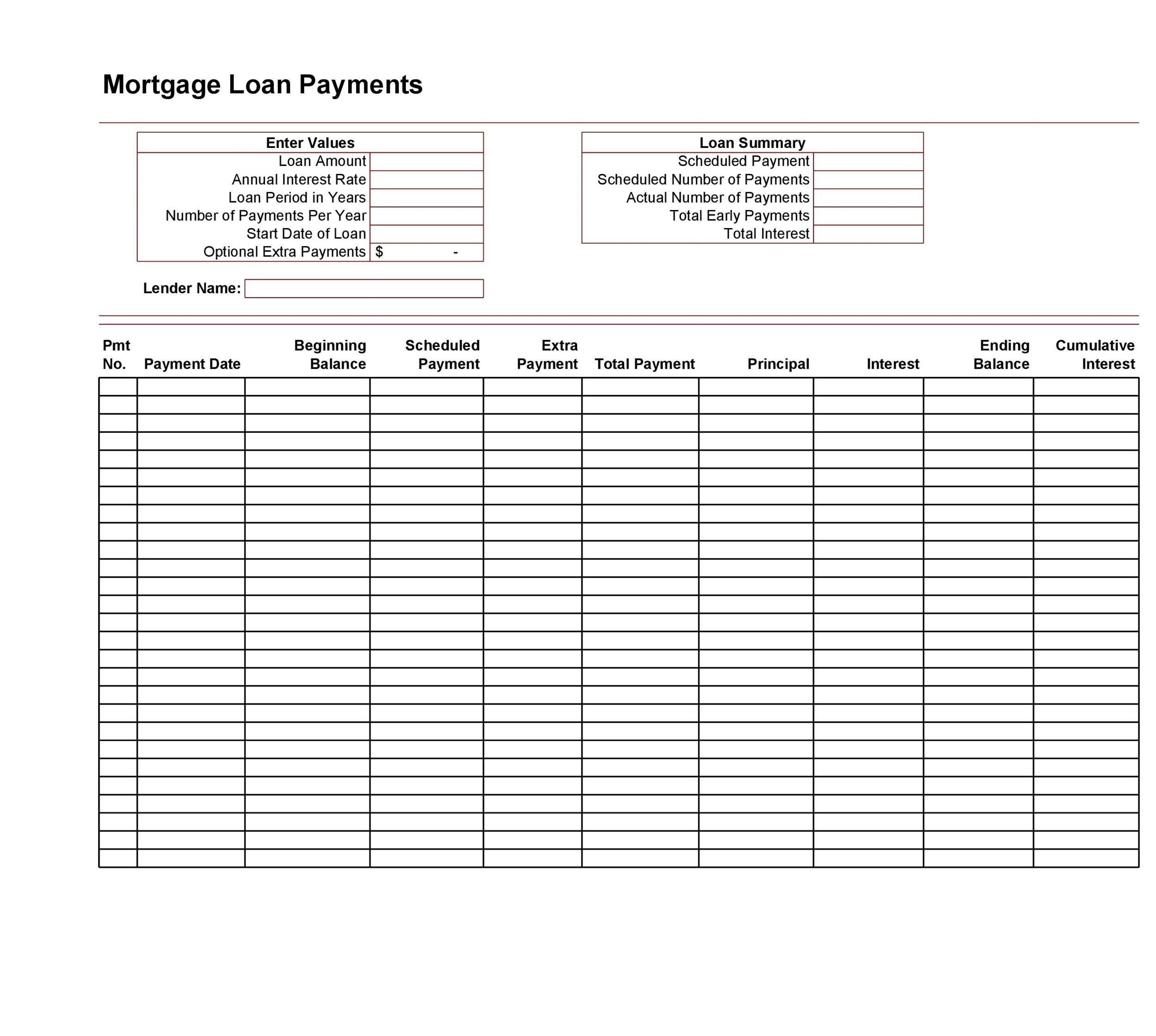

Biweekly mortgage calculator with extra payments [Free Excel Template

You would include the interest for december 29, 30, and. When you make that loan payment, you pay interest up to december 28. Interest expense is an expense, and so appears on the income statement, while interest payable is a liability, and so appears on. Generate regular reports on loan balances, payment status, and overdue accounts, and review them for.

Payment Log Sheet Template in Excel, Google Sheets Download

Generate regular reports on loan balances, payment status, and overdue accounts, and review them for anomalies or patterns that. When you make that loan payment, you pay interest up to december 28. You would include the interest for december 29, 30, and. Add “interest payable,” which is the amount of interest the company owes (not yet paid), under “current liabilities”.

28 Tables to Calculate Loan Amortization Schedule (Excel) ᐅ TemplateLab

Add “interest payable,” which is the amount of interest the company owes (not yet paid), under “current liabilities” on the balance. When you make that loan payment, you pay interest up to december 28. Generate regular reports on loan balances, payment status, and overdue accounts, and review them for anomalies or patterns that. Interest expense is an expense, and so.

excel ledger template with debits and credits Balance sheet template

You would include the interest for december 29, 30, and. Interest expense is an expense, and so appears on the income statement, while interest payable is a liability, and so appears on. When you make that loan payment, you pay interest up to december 28. Add “interest payable,” which is the amount of interest the company owes (not yet paid),.

balance sheet template excel mac —

Interest expense is an expense, and so appears on the income statement, while interest payable is a liability, and so appears on. You would include the interest for december 29, 30, and. Generate regular reports on loan balances, payment status, and overdue accounts, and review them for anomalies or patterns that. Add “interest payable,” which is the amount of interest.

EXCEL of Monthly Balance Sheet.xlsx WPS Free Templates

You would include the interest for december 29, 30, and. Generate regular reports on loan balances, payment status, and overdue accounts, and review them for anomalies or patterns that. Interest expense is an expense, and so appears on the income statement, while interest payable is a liability, and so appears on. Add “interest payable,” which is the amount of interest.

Business Interests Understanding Receivables and Inventory

You would include the interest for december 29, 30, and. When you make that loan payment, you pay interest up to december 28. Interest expense is an expense, and so appears on the income statement, while interest payable is a liability, and so appears on. Generate regular reports on loan balances, payment status, and overdue accounts, and review them for.

How To Calculate Credit Card Interest Excel

You would include the interest for december 29, 30, and. Add “interest payable,” which is the amount of interest the company owes (not yet paid), under “current liabilities” on the balance. Generate regular reports on loan balances, payment status, and overdue accounts, and review them for anomalies or patterns that. Interest expense is an expense, and so appears on the.

Add “Interest Payable,” Which Is The Amount Of Interest The Company Owes (Not Yet Paid), Under “Current Liabilities” On The Balance.

Interest expense is an expense, and so appears on the income statement, while interest payable is a liability, and so appears on. When you make that loan payment, you pay interest up to december 28. You would include the interest for december 29, 30, and. Generate regular reports on loan balances, payment status, and overdue accounts, and review them for anomalies or patterns that.