Gain To Ppe On Balance Sheet - Learn about ppe accounting, understand the importance of ppe costs for investments, discover how to calculate the net. Where an asset’s carrying amount is increased as a result of a revaluation (ie a revaluation gain), this gain is normally recognised in other. The formula to calculate the ending pp&e balance consists of adding capex to the beginning pp&e balance and then subtracting. After the company record the item of ppe in the accounting record, it will need to be depreciated as the time passed (e.g.

The formula to calculate the ending pp&e balance consists of adding capex to the beginning pp&e balance and then subtracting. After the company record the item of ppe in the accounting record, it will need to be depreciated as the time passed (e.g. Where an asset’s carrying amount is increased as a result of a revaluation (ie a revaluation gain), this gain is normally recognised in other. Learn about ppe accounting, understand the importance of ppe costs for investments, discover how to calculate the net.

Where an asset’s carrying amount is increased as a result of a revaluation (ie a revaluation gain), this gain is normally recognised in other. After the company record the item of ppe in the accounting record, it will need to be depreciated as the time passed (e.g. Learn about ppe accounting, understand the importance of ppe costs for investments, discover how to calculate the net. The formula to calculate the ending pp&e balance consists of adding capex to the beginning pp&e balance and then subtracting.

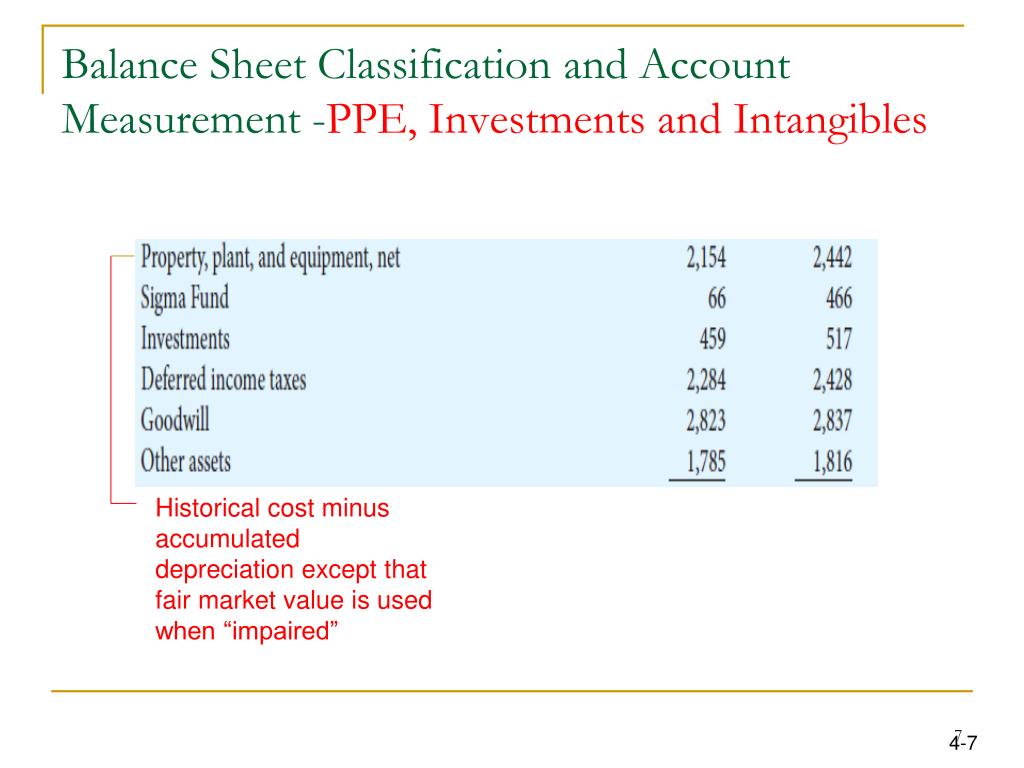

PPT Gap Inc. PowerPoint Presentation, free download ID1851791

Where an asset’s carrying amount is increased as a result of a revaluation (ie a revaluation gain), this gain is normally recognised in other. After the company record the item of ppe in the accounting record, it will need to be depreciated as the time passed (e.g. The formula to calculate the ending pp&e balance consists of adding capex to.

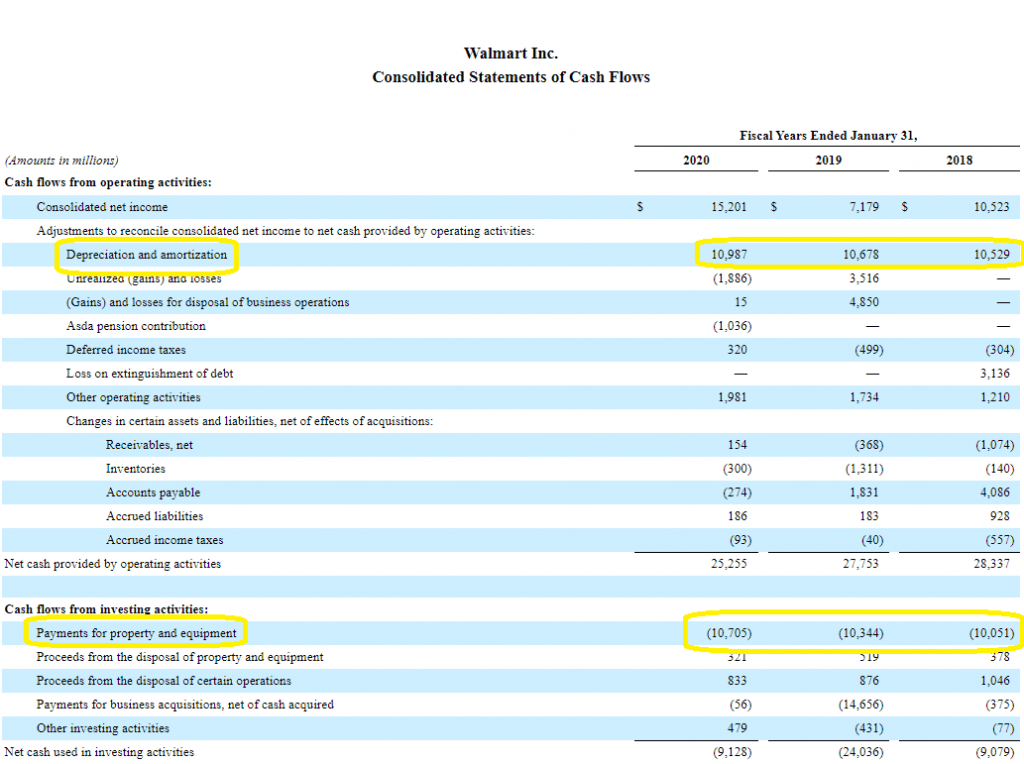

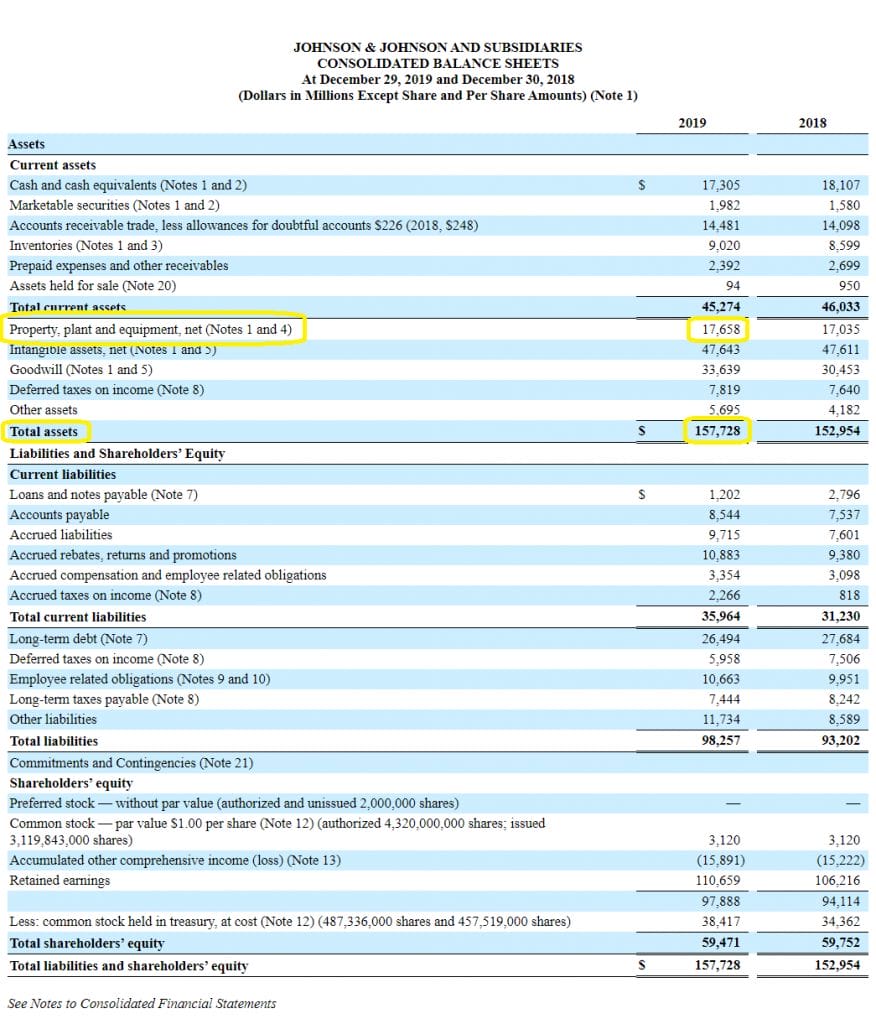

Property, Plant, and Equipment (PP&E) Definition

The formula to calculate the ending pp&e balance consists of adding capex to the beginning pp&e balance and then subtracting. Learn about ppe accounting, understand the importance of ppe costs for investments, discover how to calculate the net. Where an asset’s carrying amount is increased as a result of a revaluation (ie a revaluation gain), this gain is normally recognised.

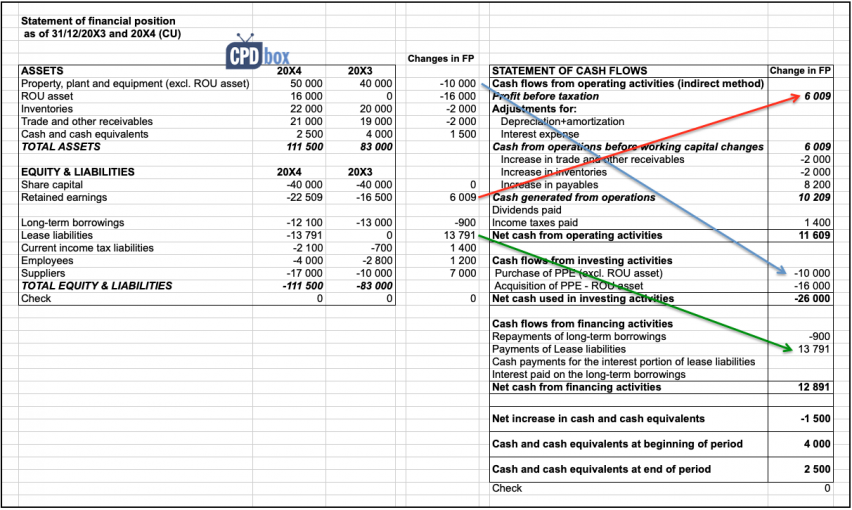

How to present leases under IFRS 16 in the statement of cash flows (IAS

The formula to calculate the ending pp&e balance consists of adding capex to the beginning pp&e balance and then subtracting. Where an asset’s carrying amount is increased as a result of a revaluation (ie a revaluation gain), this gain is normally recognised in other. After the company record the item of ppe in the accounting record, it will need to.

What is PPE in Accounting? Investing for Beginners 101

Learn about ppe accounting, understand the importance of ppe costs for investments, discover how to calculate the net. Where an asset’s carrying amount is increased as a result of a revaluation (ie a revaluation gain), this gain is normally recognised in other. The formula to calculate the ending pp&e balance consists of adding capex to the beginning pp&e balance and.

PPT The Balance Sheet Statement PowerPoint Presentation, free

After the company record the item of ppe in the accounting record, it will need to be depreciated as the time passed (e.g. Where an asset’s carrying amount is increased as a result of a revaluation (ie a revaluation gain), this gain is normally recognised in other. Learn about ppe accounting, understand the importance of ppe costs for investments, discover.

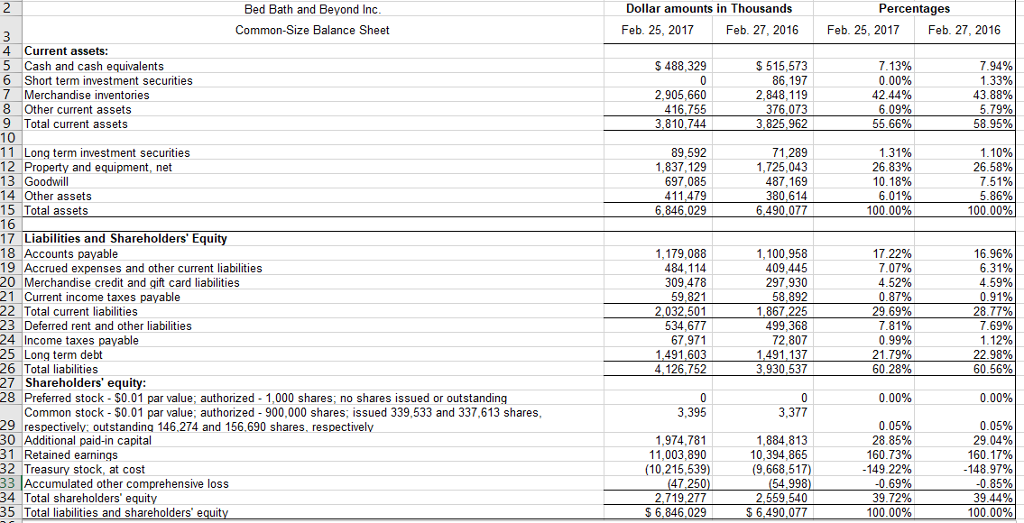

Solved Dollar amounts in Thousands Bed Bath and Beyond Inc

Learn about ppe accounting, understand the importance of ppe costs for investments, discover how to calculate the net. Where an asset’s carrying amount is increased as a result of a revaluation (ie a revaluation gain), this gain is normally recognised in other. After the company record the item of ppe in the accounting record, it will need to be depreciated.

What is PPE in Accounting? Investing for Beginners 101

The formula to calculate the ending pp&e balance consists of adding capex to the beginning pp&e balance and then subtracting. Where an asset’s carrying amount is increased as a result of a revaluation (ie a revaluation gain), this gain is normally recognised in other. After the company record the item of ppe in the accounting record, it will need to.

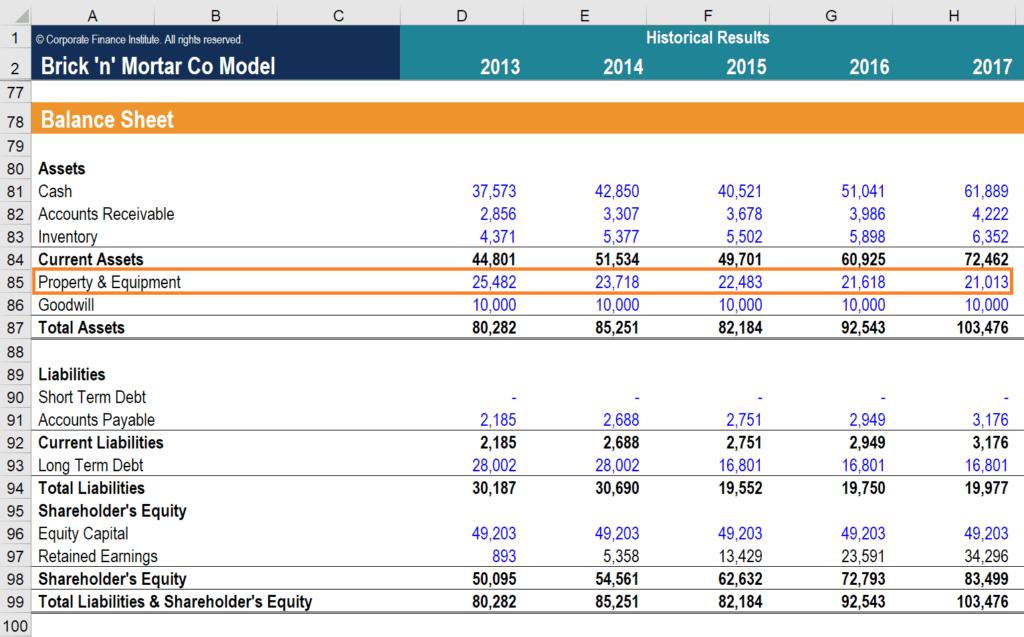

PP&E (Property, Plant & Equipment) Overview, Formula, Examples

Learn about ppe accounting, understand the importance of ppe costs for investments, discover how to calculate the net. Where an asset’s carrying amount is increased as a result of a revaluation (ie a revaluation gain), this gain is normally recognised in other. The formula to calculate the ending pp&e balance consists of adding capex to the beginning pp&e balance and.

Revaluing Property, Plant, and Equipment (PPE) Assets Using the

The formula to calculate the ending pp&e balance consists of adding capex to the beginning pp&e balance and then subtracting. Where an asset’s carrying amount is increased as a result of a revaluation (ie a revaluation gain), this gain is normally recognised in other. After the company record the item of ppe in the accounting record, it will need to.

Property, Plant, and Equipment PP&E Definition

Learn about ppe accounting, understand the importance of ppe costs for investments, discover how to calculate the net. The formula to calculate the ending pp&e balance consists of adding capex to the beginning pp&e balance and then subtracting. After the company record the item of ppe in the accounting record, it will need to be depreciated as the time passed.

The Formula To Calculate The Ending Pp&E Balance Consists Of Adding Capex To The Beginning Pp&E Balance And Then Subtracting.

Where an asset’s carrying amount is increased as a result of a revaluation (ie a revaluation gain), this gain is normally recognised in other. Learn about ppe accounting, understand the importance of ppe costs for investments, discover how to calculate the net. After the company record the item of ppe in the accounting record, it will need to be depreciated as the time passed (e.g.

:max_bytes(150000):strip_icc()/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg)

:max_bytes(150000):strip_icc()/Exxonbalancesheet10Q09302018-5c53bbe546e0fb000152e504.jpg)