Finance Equation Sheet - Identify assets and liabilities that “spontaneously” increase or decrease with sales. Amortization refers to the method of repaying both the principal and the interest by a series of equal payments made at equal intervals of time. Prepare a forecast balance sheet. From college students who are studying finance and business to the professionals entrenched in the field of corporate finance,.

Prepare a forecast balance sheet. Amortization refers to the method of repaying both the principal and the interest by a series of equal payments made at equal intervals of time. From college students who are studying finance and business to the professionals entrenched in the field of corporate finance,. Identify assets and liabilities that “spontaneously” increase or decrease with sales.

Identify assets and liabilities that “spontaneously” increase or decrease with sales. Amortization refers to the method of repaying both the principal and the interest by a series of equal payments made at equal intervals of time. From college students who are studying finance and business to the professionals entrenched in the field of corporate finance,. Prepare a forecast balance sheet.

Balance Sheet Accounts, Examples, and Equation Financial

From college students who are studying finance and business to the professionals entrenched in the field of corporate finance,. Identify assets and liabilities that “spontaneously” increase or decrease with sales. Amortization refers to the method of repaying both the principal and the interest by a series of equal payments made at equal intervals of time. Prepare a forecast balance sheet.

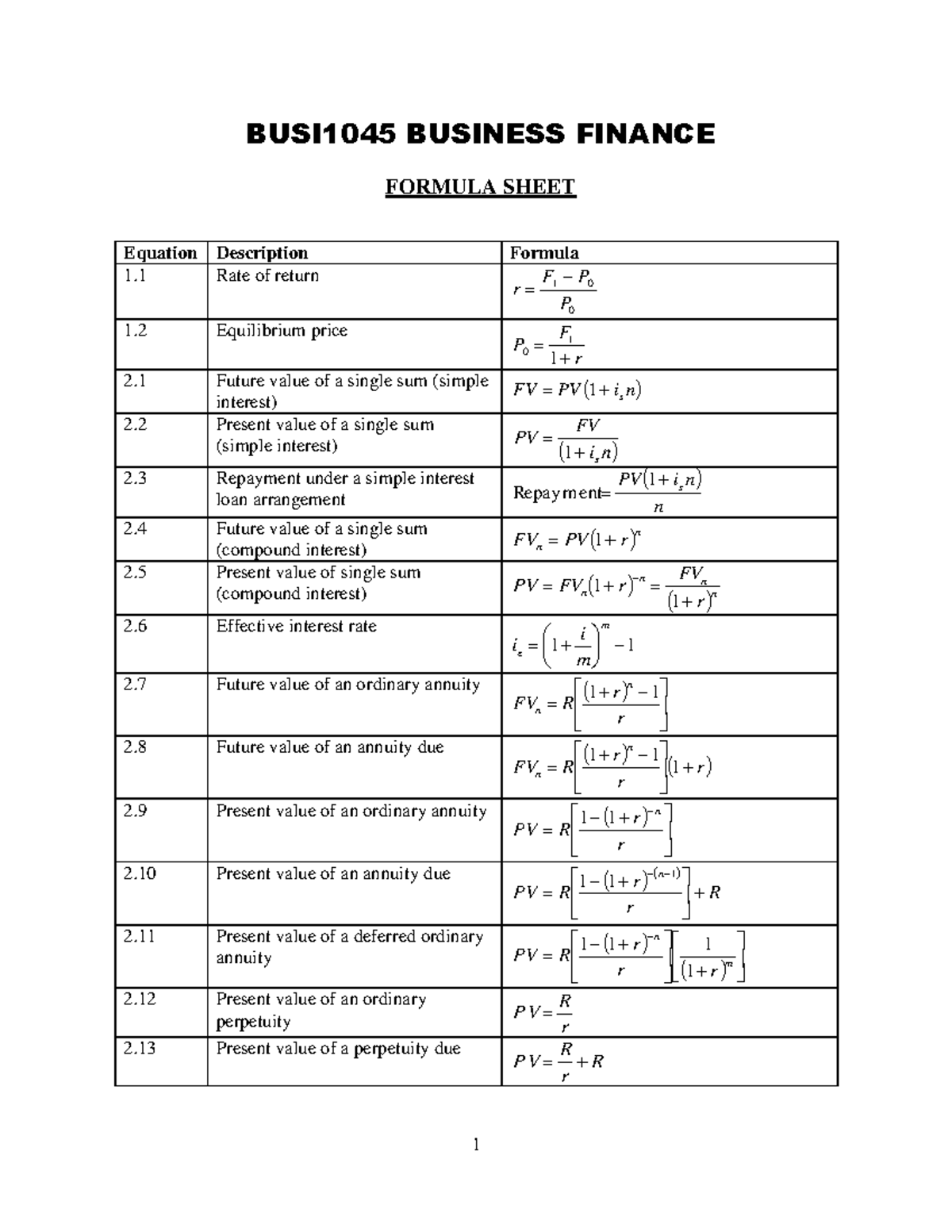

Business Finance Session 2 Formula Sheet BUSI1045 BUSI1045 BUSINESS

Identify assets and liabilities that “spontaneously” increase or decrease with sales. Amortization refers to the method of repaying both the principal and the interest by a series of equal payments made at equal intervals of time. Prepare a forecast balance sheet. From college students who are studying finance and business to the professionals entrenched in the field of corporate finance,.

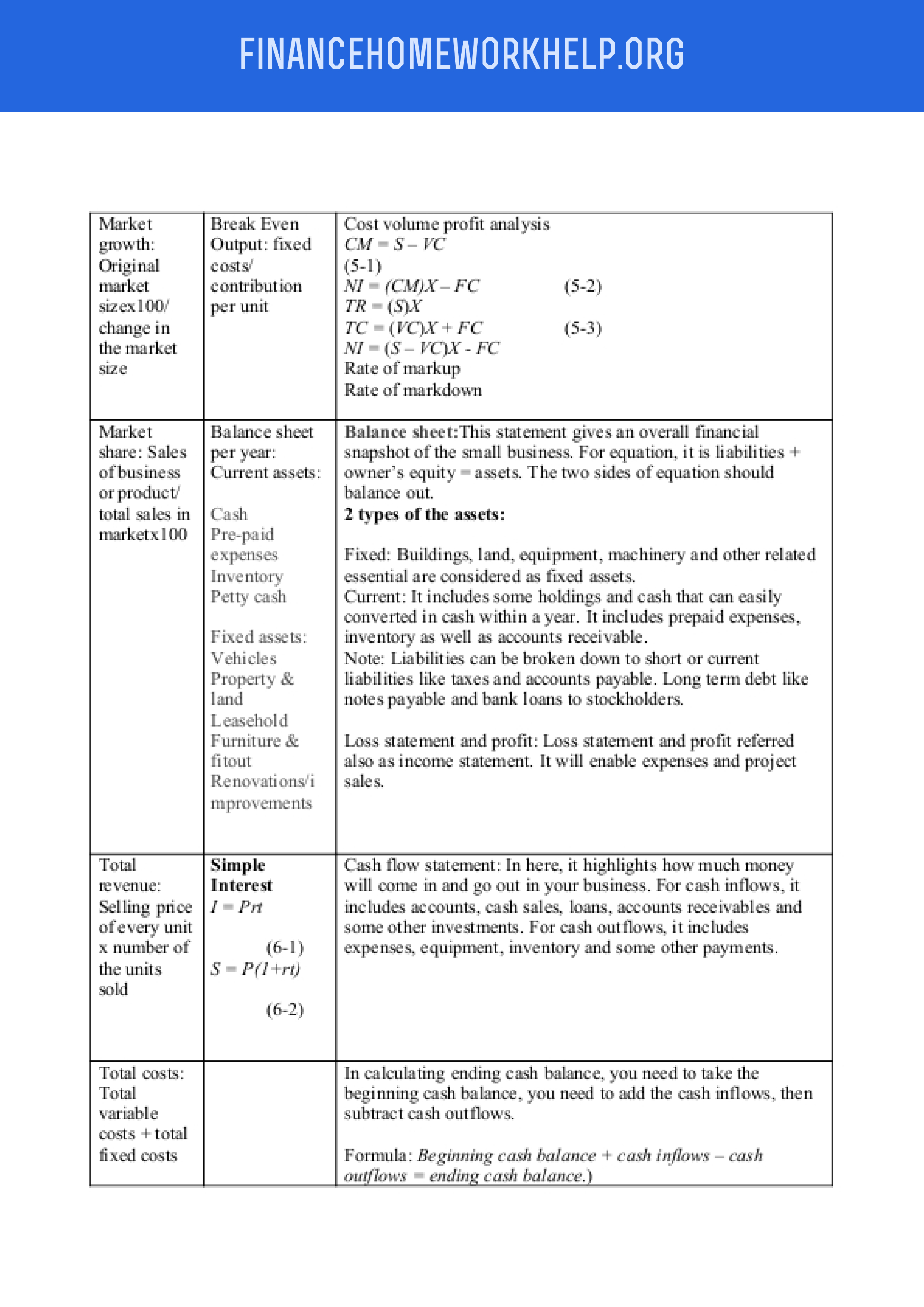

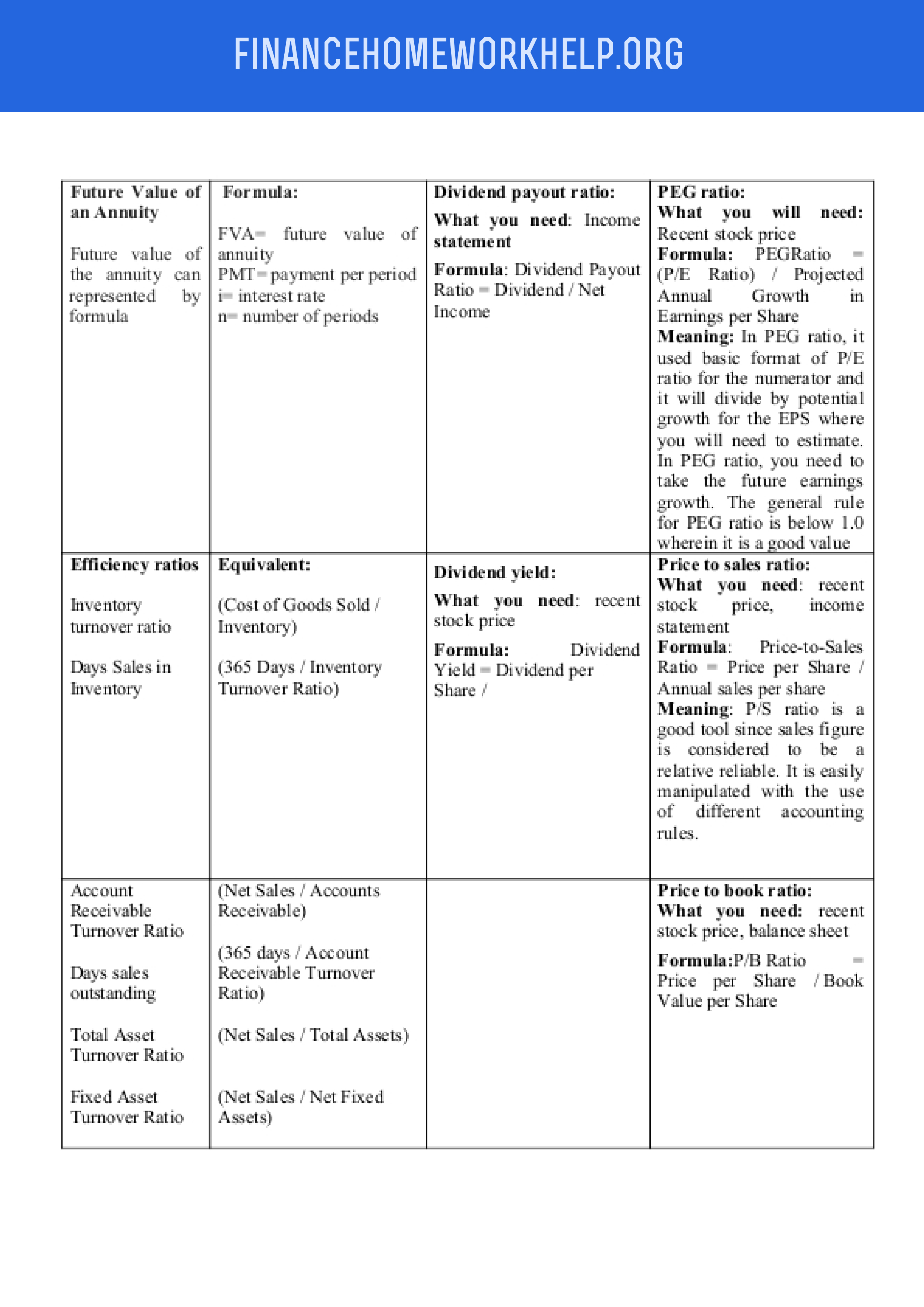

Our Handy Finance Formula Sheet Finance Homework Help

Prepare a forecast balance sheet. From college students who are studying finance and business to the professionals entrenched in the field of corporate finance,. Amortization refers to the method of repaying both the principal and the interest by a series of equal payments made at equal intervals of time. Identify assets and liabilities that “spontaneously” increase or decrease with sales.

MN20502 Corporate Finance Equation Sheet MN20502 Corporate Finance

Identify assets and liabilities that “spontaneously” increase or decrease with sales. From college students who are studying finance and business to the professionals entrenched in the field of corporate finance,. Prepare a forecast balance sheet. Amortization refers to the method of repaying both the principal and the interest by a series of equal payments made at equal intervals of time.

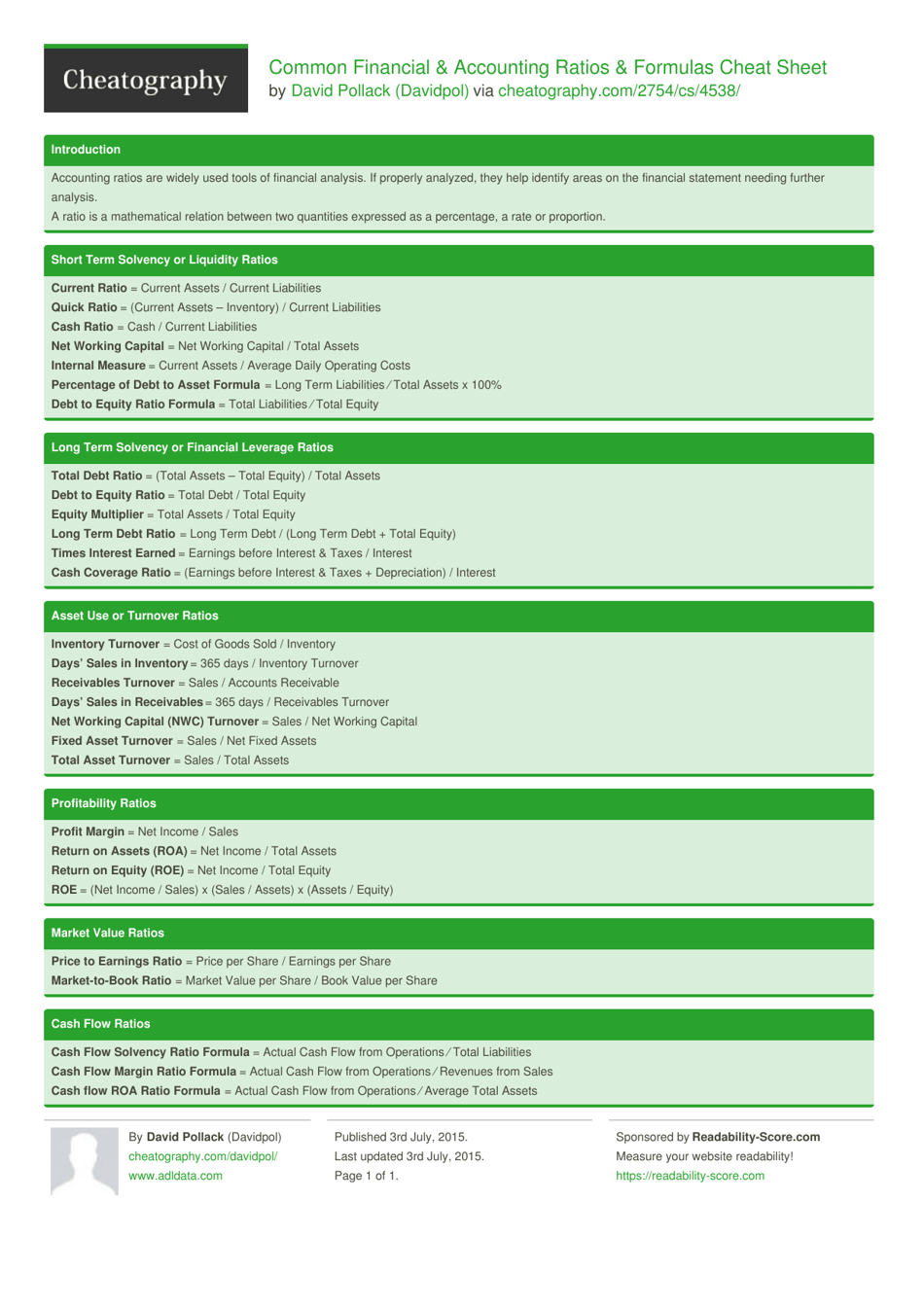

Common Financial & Accounting Ratios & Formulas Cheat Sheet Download

Prepare a forecast balance sheet. From college students who are studying finance and business to the professionals entrenched in the field of corporate finance,. Amortization refers to the method of repaying both the principal and the interest by a series of equal payments made at equal intervals of time. Identify assets and liabilities that “spontaneously” increase or decrease with sales.

Printable Finance Formulas Cheatsheet Etsy

Prepare a forecast balance sheet. Identify assets and liabilities that “spontaneously” increase or decrease with sales. Amortization refers to the method of repaying both the principal and the interest by a series of equal payments made at equal intervals of time. From college students who are studying finance and business to the professionals entrenched in the field of corporate finance,.

BTEC Business Level 3, Unit 3 Personal and Business Finance Formulas

From college students who are studying finance and business to the professionals entrenched in the field of corporate finance,. Prepare a forecast balance sheet. Amortization refers to the method of repaying both the principal and the interest by a series of equal payments made at equal intervals of time. Identify assets and liabilities that “spontaneously” increase or decrease with sales.

Accounting Equation Cheat Sheet

Prepare a forecast balance sheet. From college students who are studying finance and business to the professionals entrenched in the field of corporate finance,. Amortization refers to the method of repaying both the principal and the interest by a series of equal payments made at equal intervals of time. Identify assets and liabilities that “spontaneously” increase or decrease with sales.

Financial Management Cheat Sheet of Finance Formulas and Concepts RM

From college students who are studying finance and business to the professionals entrenched in the field of corporate finance,. Identify assets and liabilities that “spontaneously” increase or decrease with sales. Amortization refers to the method of repaying both the principal and the interest by a series of equal payments made at equal intervals of time. Prepare a forecast balance sheet.

Financial Formula Sheet Complete with ease airSlate SignNow

Prepare a forecast balance sheet. Amortization refers to the method of repaying both the principal and the interest by a series of equal payments made at equal intervals of time. Identify assets and liabilities that “spontaneously” increase or decrease with sales. From college students who are studying finance and business to the professionals entrenched in the field of corporate finance,.

From College Students Who Are Studying Finance And Business To The Professionals Entrenched In The Field Of Corporate Finance,.

Amortization refers to the method of repaying both the principal and the interest by a series of equal payments made at equal intervals of time. Identify assets and liabilities that “spontaneously” increase or decrease with sales. Prepare a forecast balance sheet.