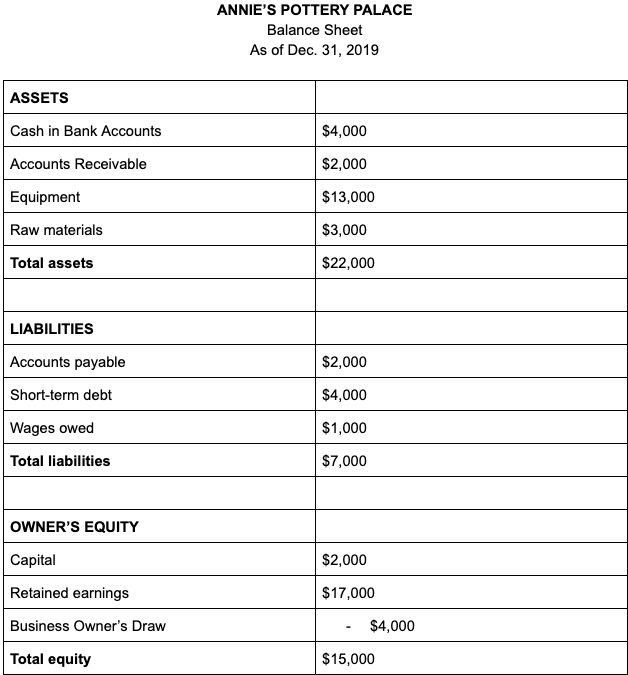

Drawings On A Balance Sheet - Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s. In accounting, assets such as cash or goods which are withdrawn from a business by the owner(s) for their personal.

Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s. In accounting, assets such as cash or goods which are withdrawn from a business by the owner(s) for their personal.

Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s. In accounting, assets such as cash or goods which are withdrawn from a business by the owner(s) for their personal.

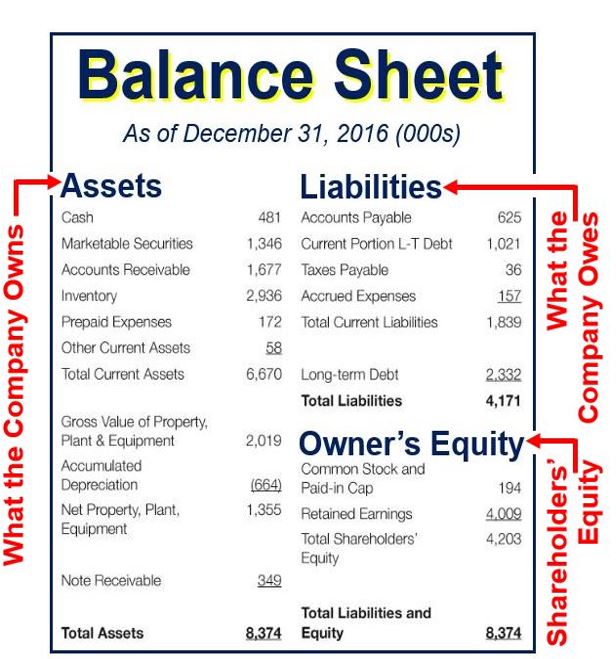

Expert Advice on How to Make a Balance Sheet for Accounting

Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s. In accounting, assets such as cash or goods which are withdrawn from a business by the owner(s) for their personal.

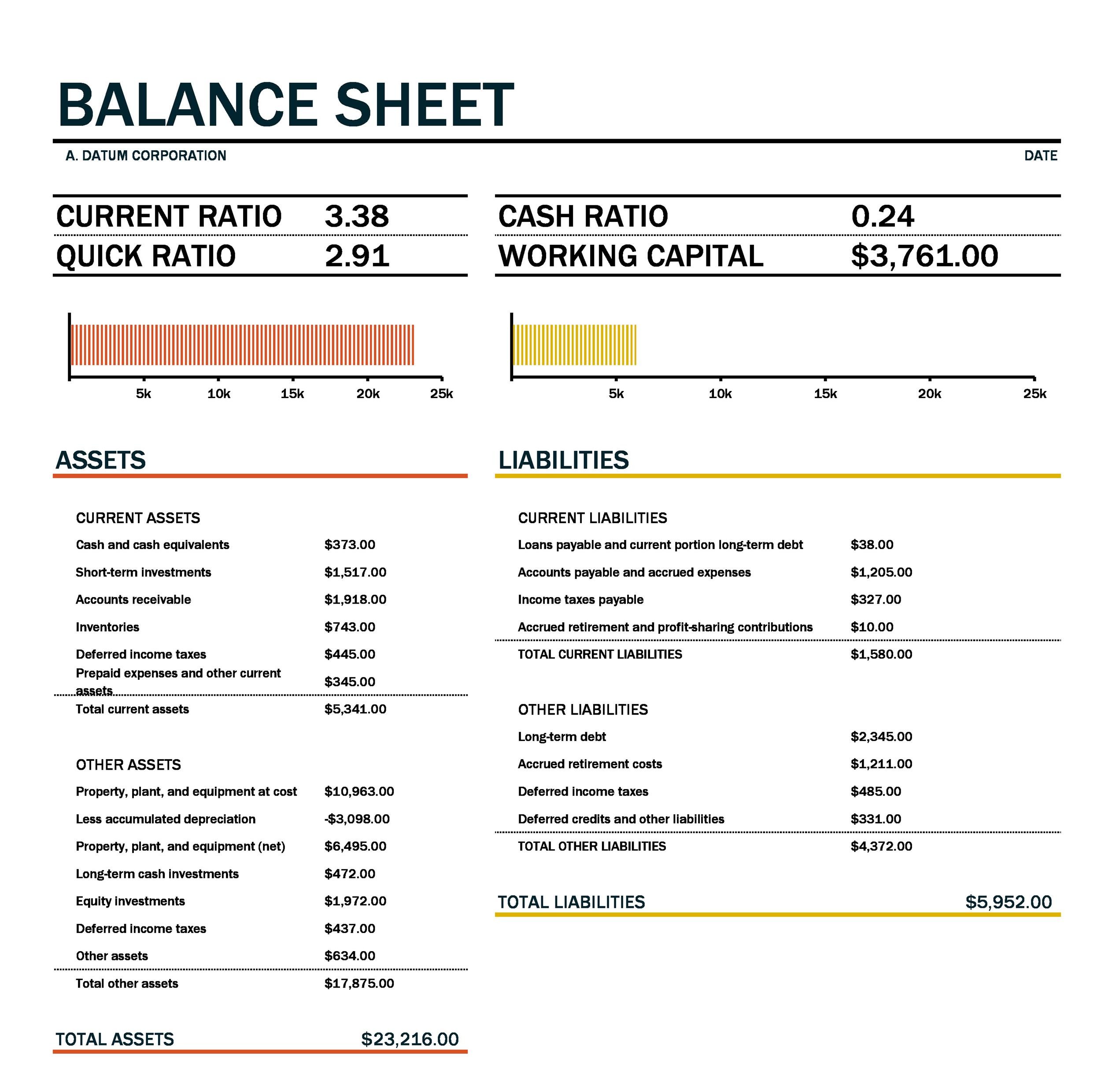

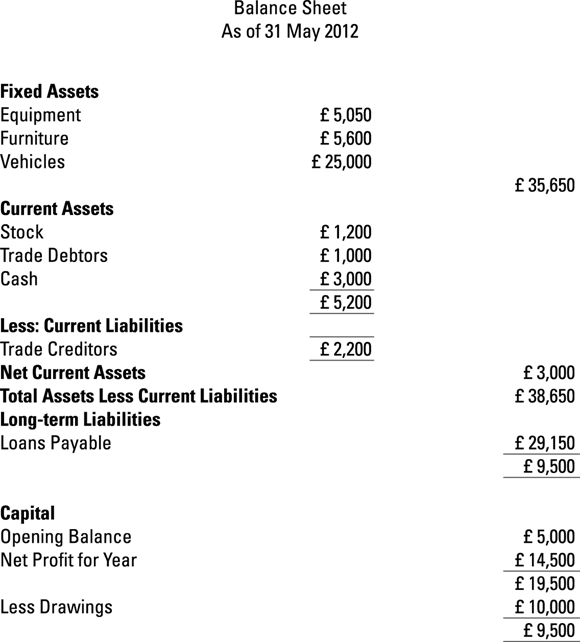

Balance Sheet Example For Students at Lori Bell blog

In accounting, assets such as cash or goods which are withdrawn from a business by the owner(s) for their personal. Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s.

Balance Sheet Business Literacy Institute Financial Intelligence

Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s. In accounting, assets such as cash or goods which are withdrawn from a business by the owner(s) for their personal.

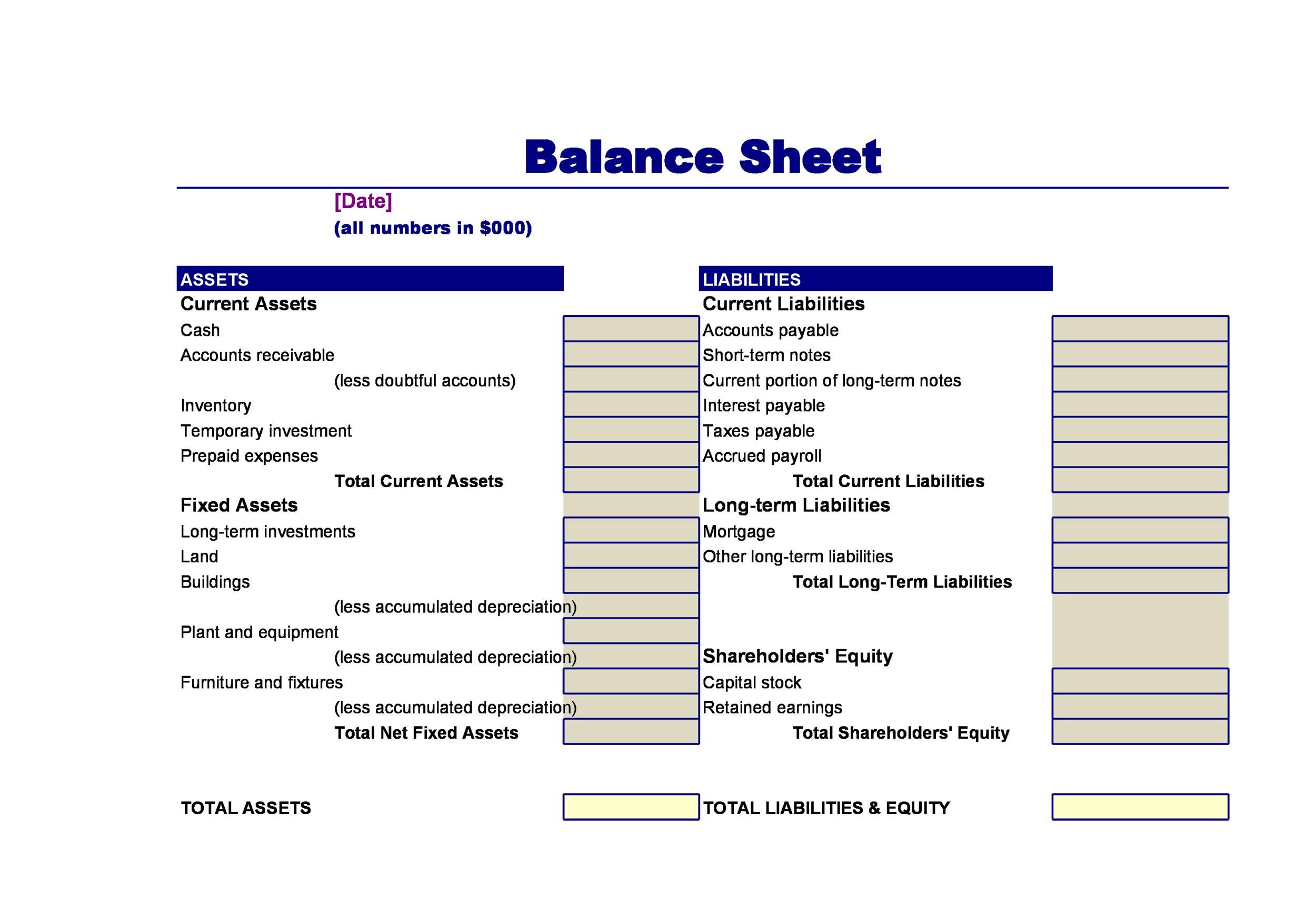

38 Free Balance Sheet Templates & Examples ᐅ TemplateLab

Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s. In accounting, assets such as cash or goods which are withdrawn from a business by the owner(s) for their personal.

How to Read a Balance Sheet Bench Accounting

Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s. In accounting, assets such as cash or goods which are withdrawn from a business by the owner(s) for their personal.

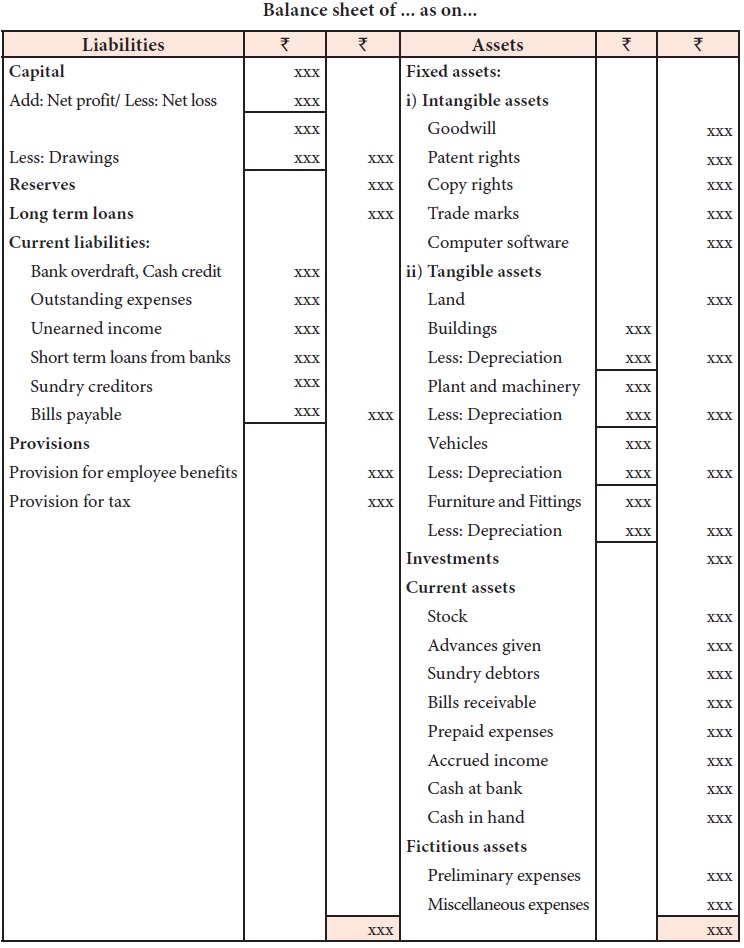

Balance sheet Need for preparing, Methods of drafting, Preparation

In accounting, assets such as cash or goods which are withdrawn from a business by the owner(s) for their personal. Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s.

The taxonomic structure of the balance sheet Download Scientific Diagram

Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s. In accounting, assets such as cash or goods which are withdrawn from a business by the owner(s) for their personal.

image

In accounting, assets such as cash or goods which are withdrawn from a business by the owner(s) for their personal. Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s.

Drawing up P&L and Balance Sheet YouTube

In accounting, assets such as cash or goods which are withdrawn from a business by the owner(s) for their personal. Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s.

38 Free Balance Sheet Templates & Examples Template Lab

Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s. In accounting, assets such as cash or goods which are withdrawn from a business by the owner(s) for their personal.

In Accounting, Assets Such As Cash Or Goods Which Are Withdrawn From A Business By The Owner(S) For Their Personal.

Drawings in accounting are when money is taken out of the business for personal use for a sole trader or partnership withdrawal of owner’s.