Does Rent Expense Go On The Balance Sheet - In short, organizations will now have to record both an asset and a liability for their operating leases. Under standards like ifrs 16 and asc 842, companies. Rent also impacts the balance sheet in the context of lease accounting. In short, expenses appear directly in the income statement and indirectly in the balance sheet. It is useful to always read both. Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. Rent expense on the balance sheet. It is still only reported on the income statement. Rent expense is not reported on the balance sheet.

In short, organizations will now have to record both an asset and a liability for their operating leases. Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. It is still only reported on the income statement. Under standards like ifrs 16 and asc 842, companies. Rent also impacts the balance sheet in the context of lease accounting. It is useful to always read both. Rent expense is not reported on the balance sheet. In short, expenses appear directly in the income statement and indirectly in the balance sheet. Rent expense on the balance sheet.

Rent also impacts the balance sheet in the context of lease accounting. Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. In short, organizations will now have to record both an asset and a liability for their operating leases. It is still only reported on the income statement. It is useful to always read both. In short, expenses appear directly in the income statement and indirectly in the balance sheet. Under standards like ifrs 16 and asc 842, companies. Rent expense on the balance sheet. Rent expense is not reported on the balance sheet.

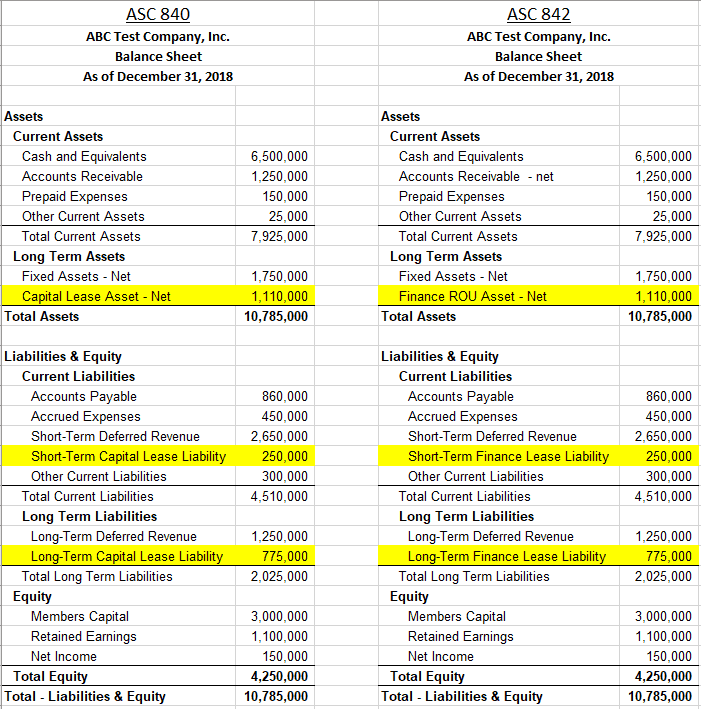

Putting rented assets on a company's balance sheet is long overdue

It is useful to always read both. Rent expense on the balance sheet. Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. Under standards like ifrs 16 and asc 842, companies. Rent also impacts the balance sheet in the context of lease accounting.

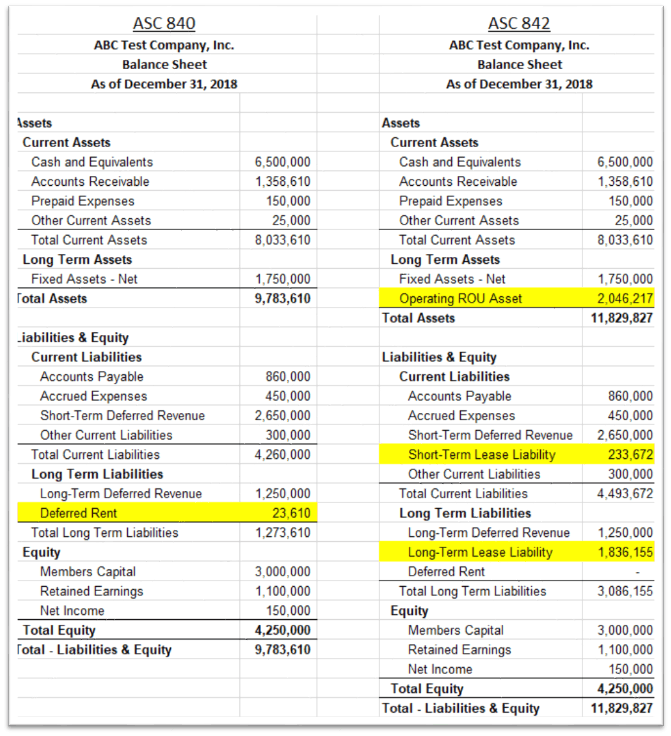

ASC 842 Balance Sheet Guide with Examples Visual Lease

Under standards like ifrs 16 and asc 842, companies. Rent expense on the balance sheet. It is useful to always read both. Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. It is still only reported on the income statement.

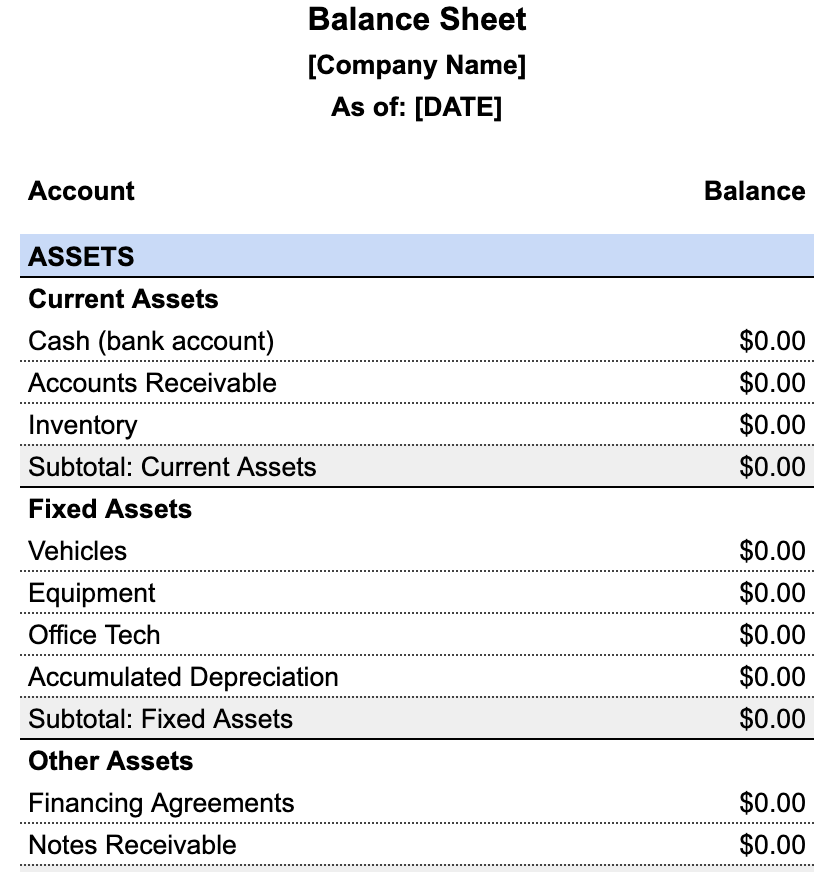

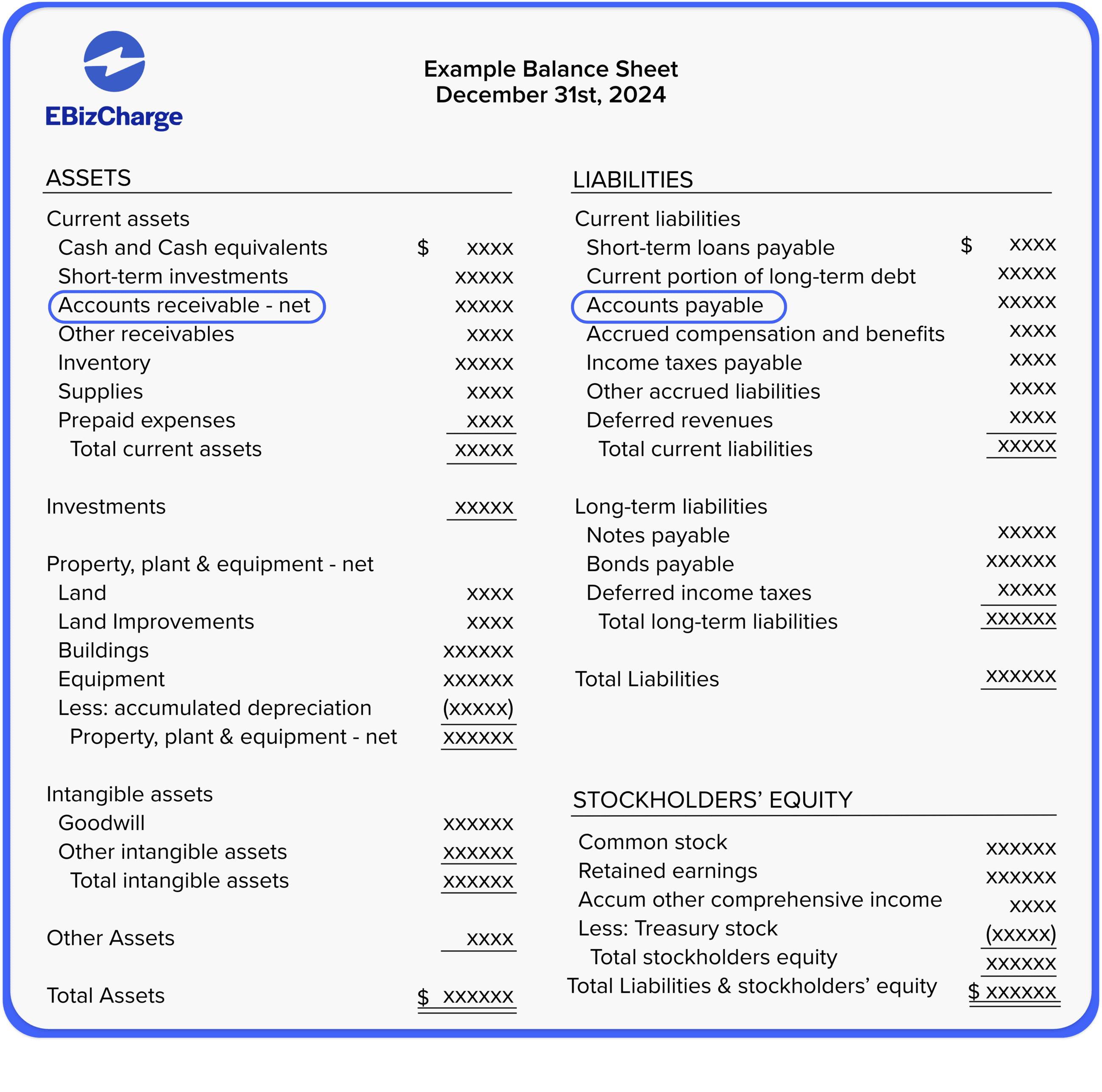

The Balance Sheet A Howto Guide for Businesses

It is still only reported on the income statement. Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. Rent expense on the balance sheet. Rent also impacts the balance sheet in the context of lease accounting. In short, organizations will now have to record both an asset and a.

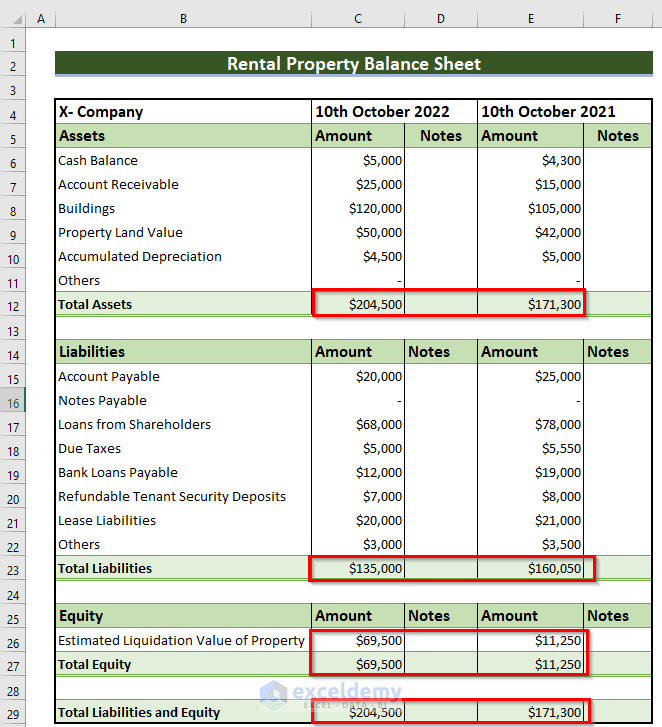

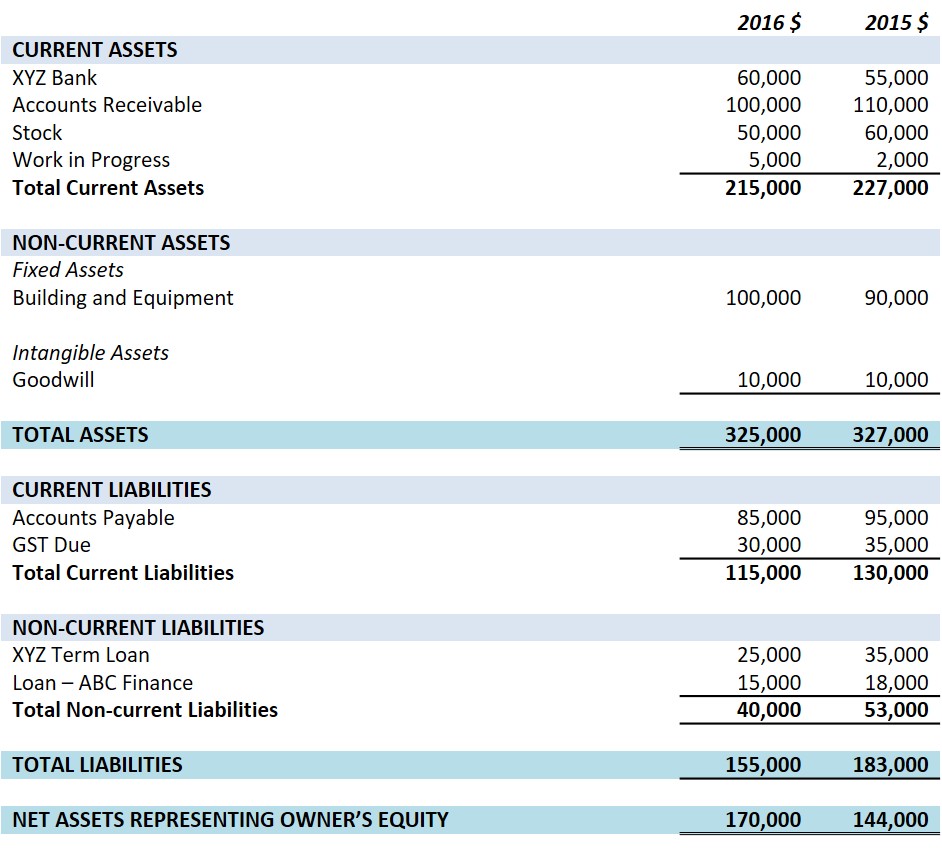

Rental Property Balance Sheet in Excel 2 Methods (Free Template)

Rent expense on the balance sheet. Rent expense is not reported on the balance sheet. In short, expenses appear directly in the income statement and indirectly in the balance sheet. Rent also impacts the balance sheet in the context of lease accounting. Under standards like ifrs 16 and asc 842, companies.

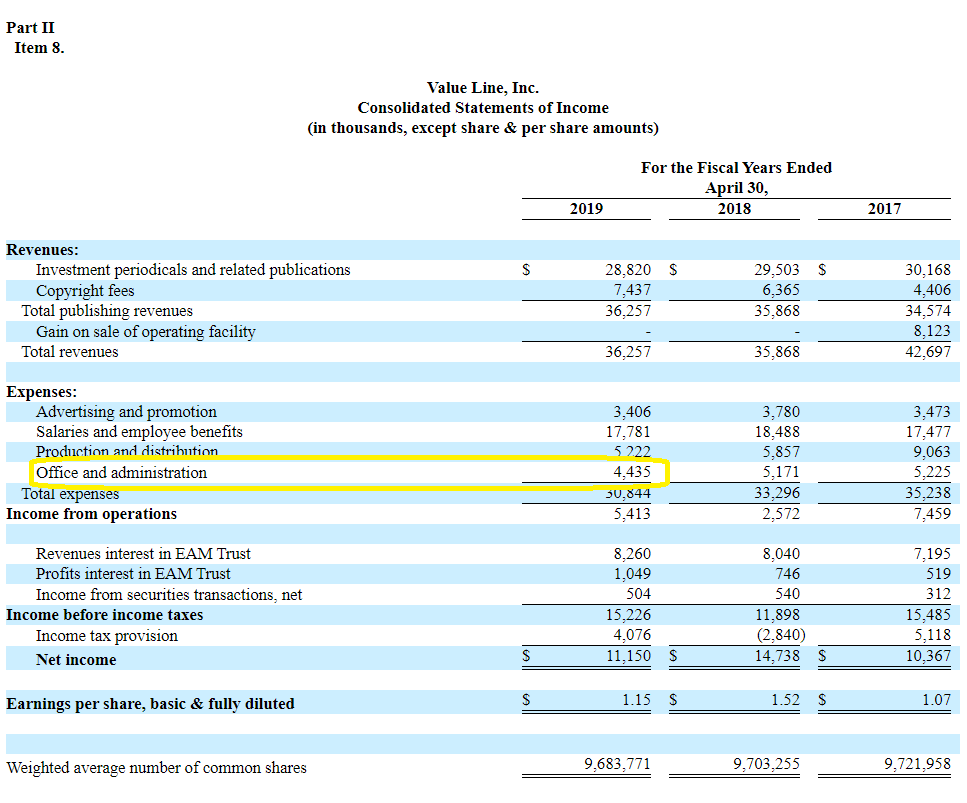

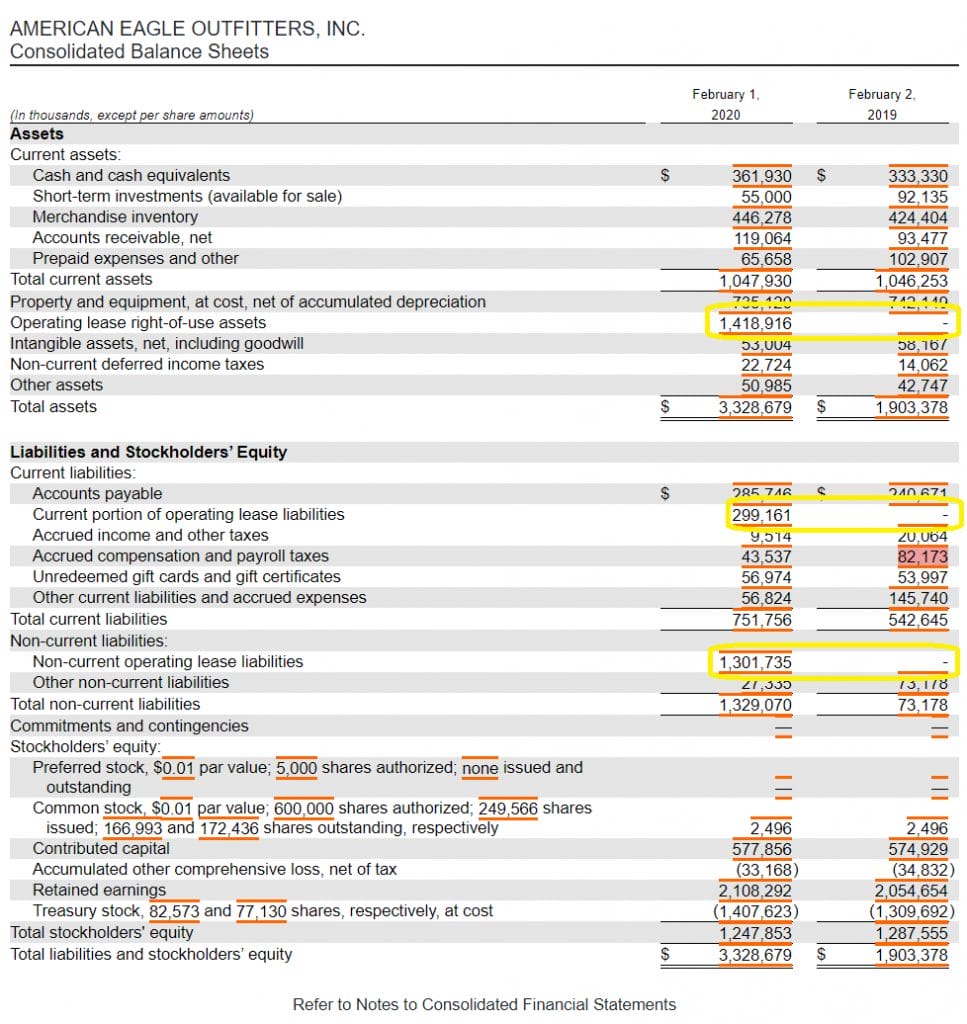

The Potential Impact of Lease Accounting on Equity Valuation The CPA

It is still only reported on the income statement. Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. Under standards like ifrs 16 and asc 842, companies. Rent also impacts the balance sheet in the context of lease accounting. In short, expenses appear directly in the income statement and.

Accounting for Operating Leases in the Balance Sheet Simply Explained

In short, organizations will now have to record both an asset and a liability for their operating leases. Rent also impacts the balance sheet in the context of lease accounting. Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. It is useful to always read both. Rent expense is.

ASC 842 Summary of Balance Sheet Changes for 2020

Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. It is useful to always read both. Rent expense is not reported on the balance sheet. Rent expense on the balance sheet. In short, organizations will now have to record both an asset and a liability for their operating leases.

What are Accounts Receivable and Accounts Payable?

Rent expense on the balance sheet. It is still only reported on the income statement. Rent expense is not reported on the balance sheet. In short, organizations will now have to record both an asset and a liability for their operating leases. Under standards like ifrs 16 and asc 842, companies.

Beginner's Guide To Understanding Your Balance Sheet (1) Elements Of

In short, organizations will now have to record both an asset and a liability for their operating leases. It is useful to always read both. In short, expenses appear directly in the income statement and indirectly in the balance sheet. It is still only reported on the income statement. Under standards like ifrs 16 and asc 842, companies.

Accounting for Operating Leases in the Balance Sheet Simply Explained

In short, organizations will now have to record both an asset and a liability for their operating leases. Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax. It is still only reported on the income statement. Under standards like ifrs 16 and asc 842, companies. Rent expense on the.

Rent Also Impacts The Balance Sheet In The Context Of Lease Accounting.

Under standards like ifrs 16 and asc 842, companies. In short, expenses appear directly in the income statement and indirectly in the balance sheet. Rent expense on the balance sheet. In short, organizations will now have to record both an asset and a liability for their operating leases.

Rent Expense Is Not Reported On The Balance Sheet.

It is still only reported on the income statement. It is useful to always read both. Learn how to accurately account for rent expenses in financial statements and understand their impact on cash flow and tax.