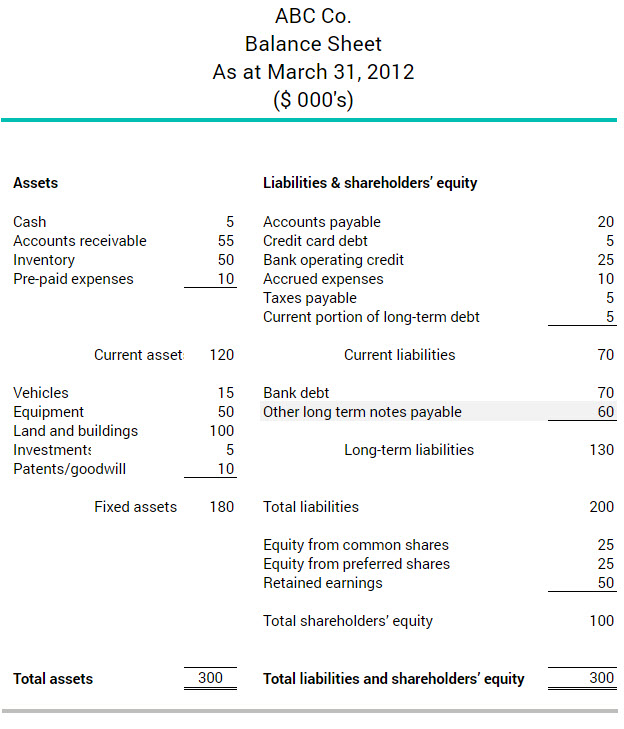

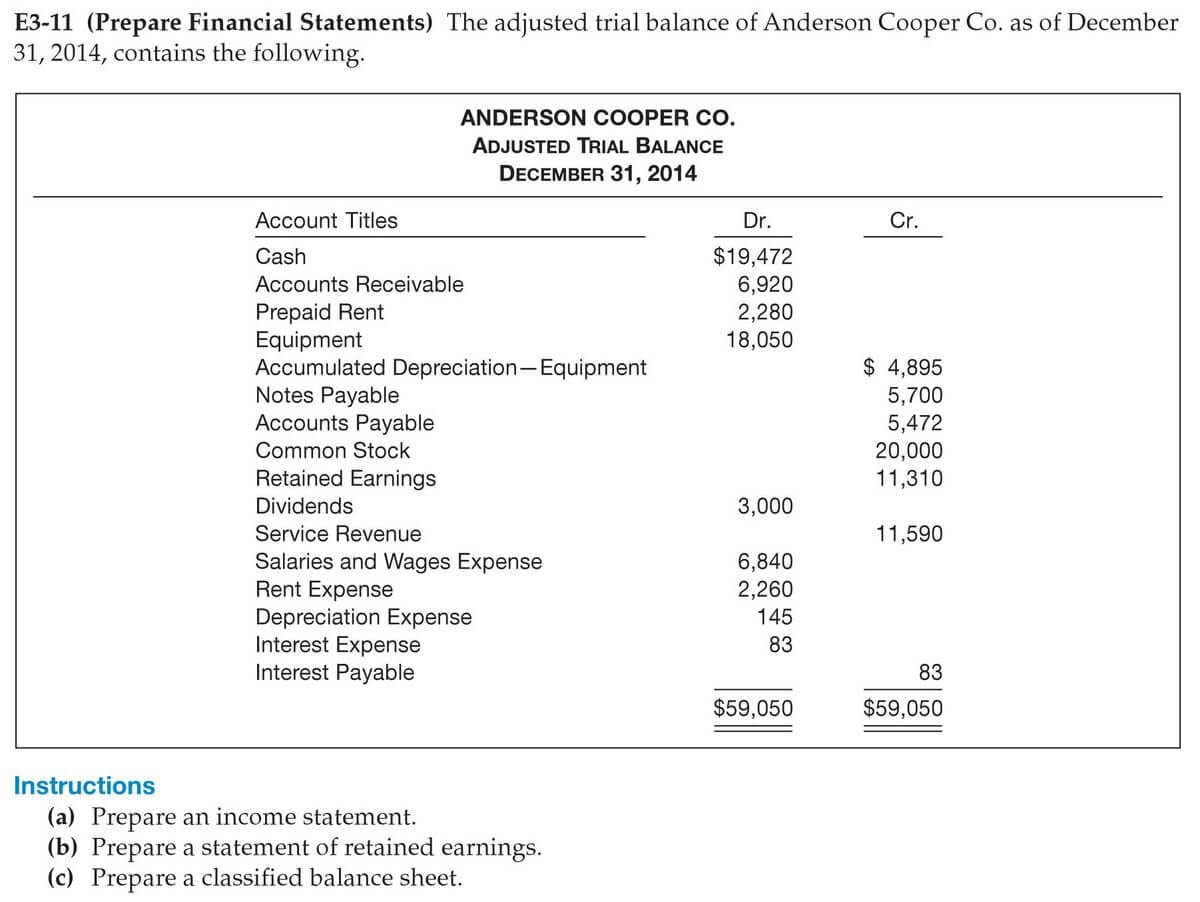

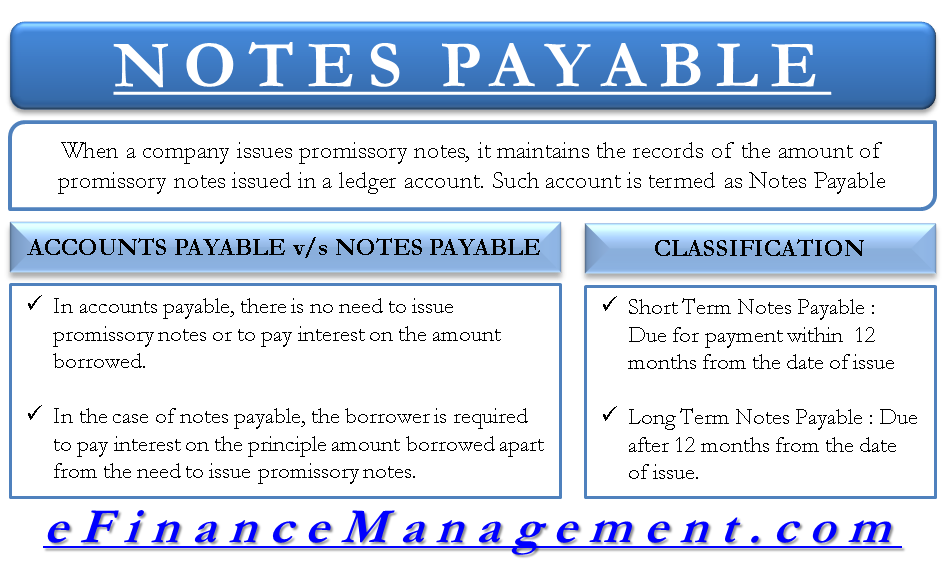

Does Notes Payable Go On The Balance Sheet - Notes payable on the balance sheet take a spot under the liabilities column. Where is notes payable on balance sheet? The discount on notes payable account normally has a debit balance because it is a contra account to notes payable account (a. While notes payable is a liability,. Both the items of notes payable and notes receivable can be found on the balance sheet of a business. A note payable is shown under either current or long term liabilities on the balance. They are considered current liabilities when the amount is due within.

They are considered current liabilities when the amount is due within. Notes payable on the balance sheet take a spot under the liabilities column. A note payable is shown under either current or long term liabilities on the balance. Where is notes payable on balance sheet? The discount on notes payable account normally has a debit balance because it is a contra account to notes payable account (a. While notes payable is a liability,. Both the items of notes payable and notes receivable can be found on the balance sheet of a business.

They are considered current liabilities when the amount is due within. Notes payable on the balance sheet take a spot under the liabilities column. The discount on notes payable account normally has a debit balance because it is a contra account to notes payable account (a. Both the items of notes payable and notes receivable can be found on the balance sheet of a business. While notes payable is a liability,. A note payable is shown under either current or long term liabilities on the balance. Where is notes payable on balance sheet?

Notes Payable Learn How to Book NP on a Balance Sheet

While notes payable is a liability,. They are considered current liabilities when the amount is due within. Notes payable on the balance sheet take a spot under the liabilities column. Both the items of notes payable and notes receivable can be found on the balance sheet of a business. Where is notes payable on balance sheet?

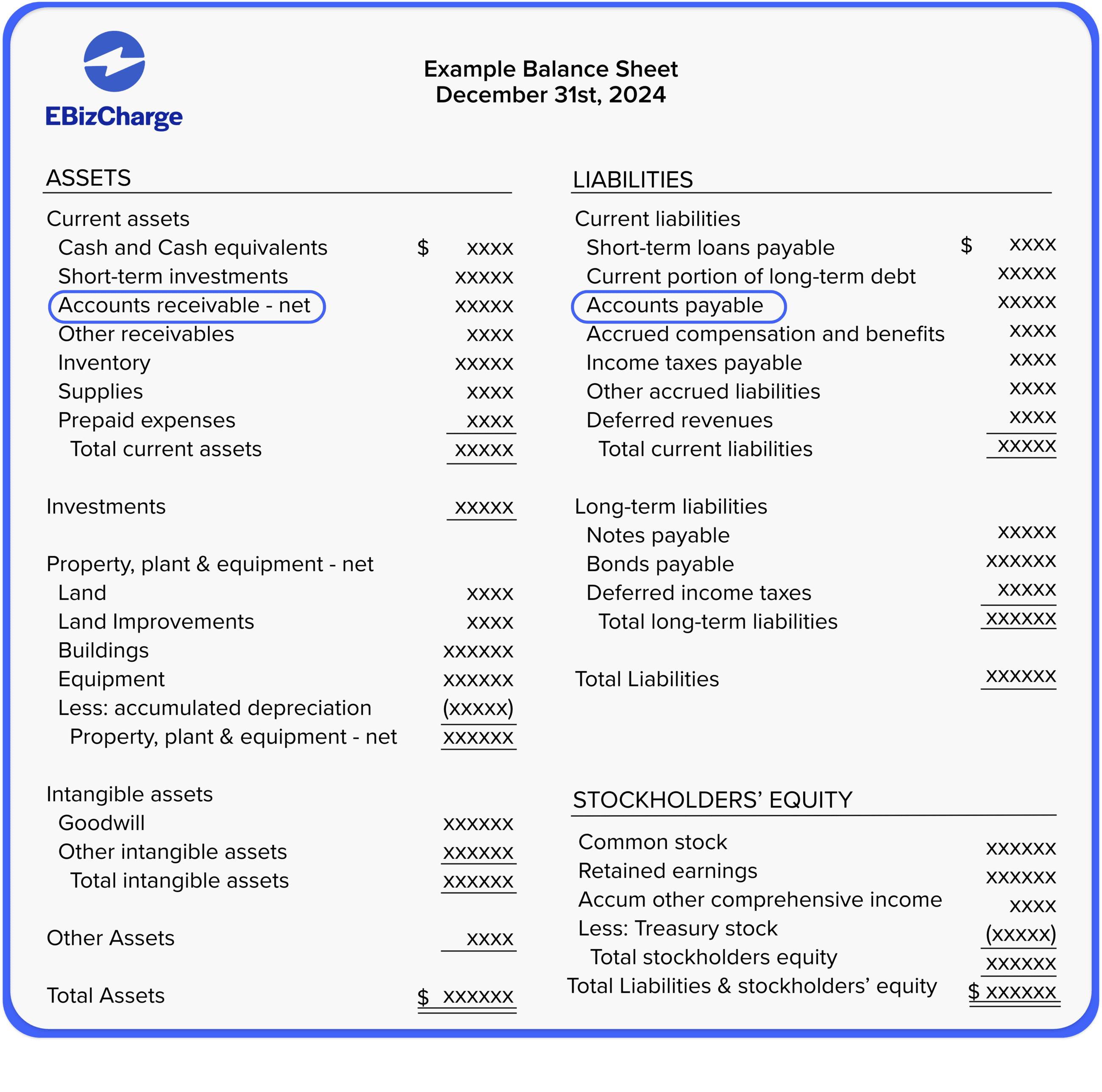

How Do Accounts Payable Show on the Balance Sheet?

Notes payable on the balance sheet take a spot under the liabilities column. They are considered current liabilities when the amount is due within. Both the items of notes payable and notes receivable can be found on the balance sheet of a business. A note payable is shown under either current or long term liabilities on the balance. The discount.

Notes Payable Accounting Double Entry Bookkeeping

While notes payable is a liability,. The discount on notes payable account normally has a debit balance because it is a contra account to notes payable account (a. Notes payable on the balance sheet take a spot under the liabilities column. Where is notes payable on balance sheet? They are considered current liabilities when the amount is due within.

What is accounts receivable? Definition and examples

Both the items of notes payable and notes receivable can be found on the balance sheet of a business. Where is notes payable on balance sheet? The discount on notes payable account normally has a debit balance because it is a contra account to notes payable account (a. Notes payable on the balance sheet take a spot under the liabilities.

Notes to Balance Sheet Accounting Education

While notes payable is a liability,. Notes payable on the balance sheet take a spot under the liabilities column. Where is notes payable on balance sheet? The discount on notes payable account normally has a debit balance because it is a contra account to notes payable account (a. They are considered current liabilities when the amount is due within.

What are notes payable BDC.ca

While notes payable is a liability,. The discount on notes payable account normally has a debit balance because it is a contra account to notes payable account (a. Notes payable on the balance sheet take a spot under the liabilities column. Where is notes payable on balance sheet? They are considered current liabilities when the amount is due within.

What Are Notes Payable? Definition With Examples

While notes payable is a liability,. A note payable is shown under either current or long term liabilities on the balance. They are considered current liabilities when the amount is due within. Both the items of notes payable and notes receivable can be found on the balance sheet of a business. Where is notes payable on balance sheet?

What are Accounts Receivable and Accounts Payable?

A note payable is shown under either current or long term liabilities on the balance. The discount on notes payable account normally has a debit balance because it is a contra account to notes payable account (a. They are considered current liabilities when the amount is due within. While notes payable is a liability,. Where is notes payable on balance.

Balance Sheet Example Notes Receivable at Madeline Mair blog

Both the items of notes payable and notes receivable can be found on the balance sheet of a business. A note payable is shown under either current or long term liabilities on the balance. Notes payable on the balance sheet take a spot under the liabilities column. Where is notes payable on balance sheet? They are considered current liabilities when.

Notes Payable That Are Due in Two Years Are

Both the items of notes payable and notes receivable can be found on the balance sheet of a business. Notes payable on the balance sheet take a spot under the liabilities column. A note payable is shown under either current or long term liabilities on the balance. While notes payable is a liability,. They are considered current liabilities when the.

The Discount On Notes Payable Account Normally Has A Debit Balance Because It Is A Contra Account To Notes Payable Account (A.

They are considered current liabilities when the amount is due within. A note payable is shown under either current or long term liabilities on the balance. Both the items of notes payable and notes receivable can be found on the balance sheet of a business. Where is notes payable on balance sheet?

While Notes Payable Is A Liability,.

Notes payable on the balance sheet take a spot under the liabilities column.