Discount On Shares In Balance Sheet - When a company issues shares at a price less than their face value, it is said to have issued them at a discount. Learn issue of shares journal entries with example for par, premium, discount & bonus shares. When shares are issued at a price lower than their face value, they are said to have been issued at a discount. The discount on common stock account is used to record the discount. For example, if a company. Discount on issue of shares being a capital loss to a company, should be debited to “discount on shares account” and shown as an asset in the. For example, if a share of rs 100 is. This account is a contra equity account that reduces the common stock. The discount amount is recorded separately in the books as a “discount on issue of shares” and is considered a capital loss.

The discount amount is recorded separately in the books as a “discount on issue of shares” and is considered a capital loss. This account is a contra equity account that reduces the common stock. For example, if a share of rs 100 is. Discount on issue of shares being a capital loss to a company, should be debited to “discount on shares account” and shown as an asset in the. The discount on common stock account is used to record the discount. When shares are issued at a price lower than their face value, they are said to have been issued at a discount. Learn issue of shares journal entries with example for par, premium, discount & bonus shares. When a company issues shares at a price less than their face value, it is said to have issued them at a discount. For example, if a company.

Discount on issue of shares being a capital loss to a company, should be debited to “discount on shares account” and shown as an asset in the. When a company issues shares at a price less than their face value, it is said to have issued them at a discount. Learn issue of shares journal entries with example for par, premium, discount & bonus shares. For example, if a share of rs 100 is. When shares are issued at a price lower than their face value, they are said to have been issued at a discount. For example, if a company. This account is a contra equity account that reduces the common stock. The discount amount is recorded separately in the books as a “discount on issue of shares” and is considered a capital loss. The discount on common stock account is used to record the discount.

Accounting Entries on Reissue of Forfeited Shares

Discount on issue of shares being a capital loss to a company, should be debited to “discount on shares account” and shown as an asset in the. Learn issue of shares journal entries with example for par, premium, discount & bonus shares. The discount on common stock account is used to record the discount. When shares are issued at a.

Issue of Debentures Accounting Treatment of Issue of Debenture and

Discount on issue of shares being a capital loss to a company, should be debited to “discount on shares account” and shown as an asset in the. When a company issues shares at a price less than their face value, it is said to have issued them at a discount. For example, if a share of rs 100 is. Learn.

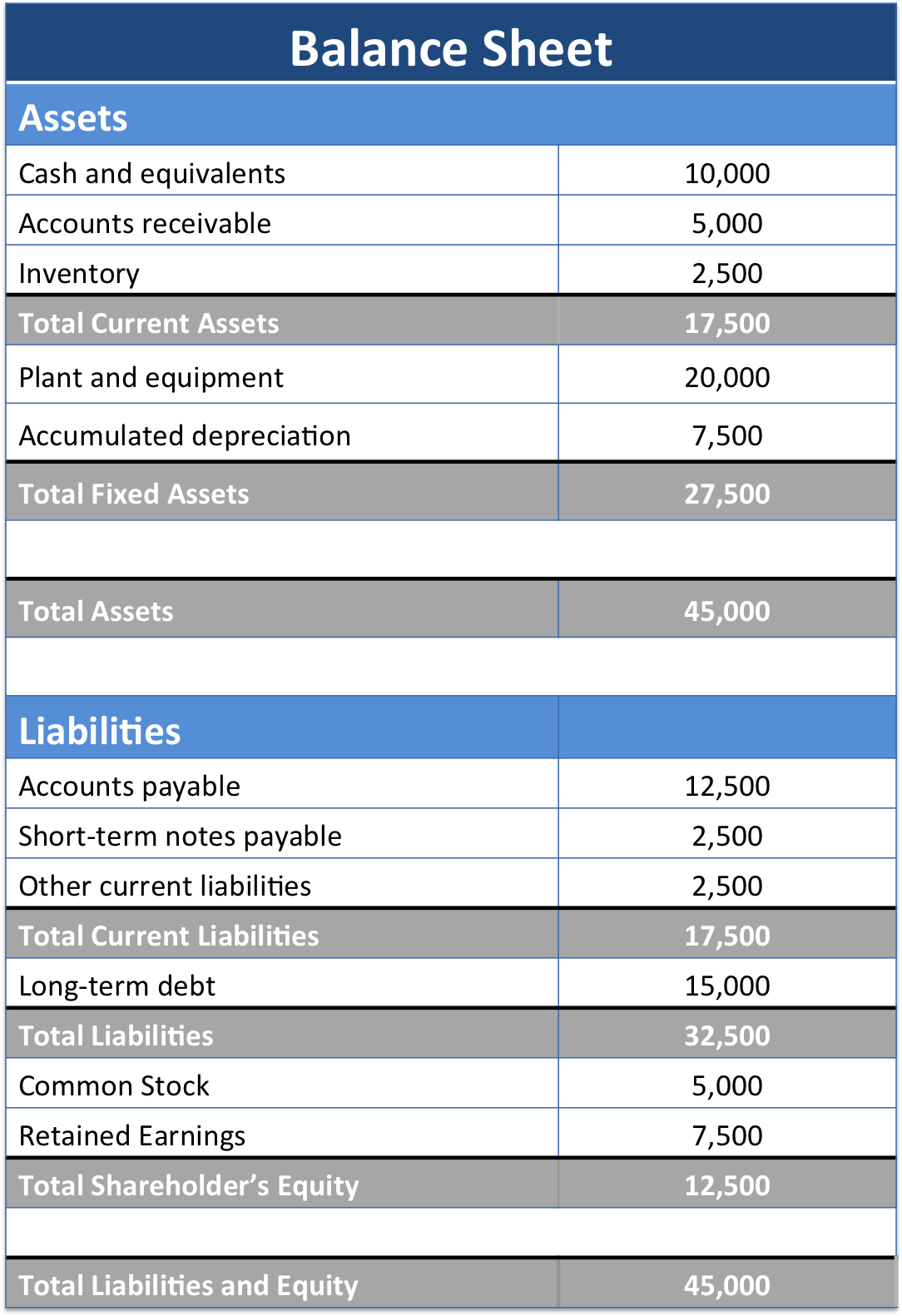

Balance sheet example track assets and liabilities

When shares are issued at a price lower than their face value, they are said to have been issued at a discount. For example, if a company. The discount on common stock account is used to record the discount. Discount on issue of shares being a capital loss to a company, should be debited to “discount on shares account” and.

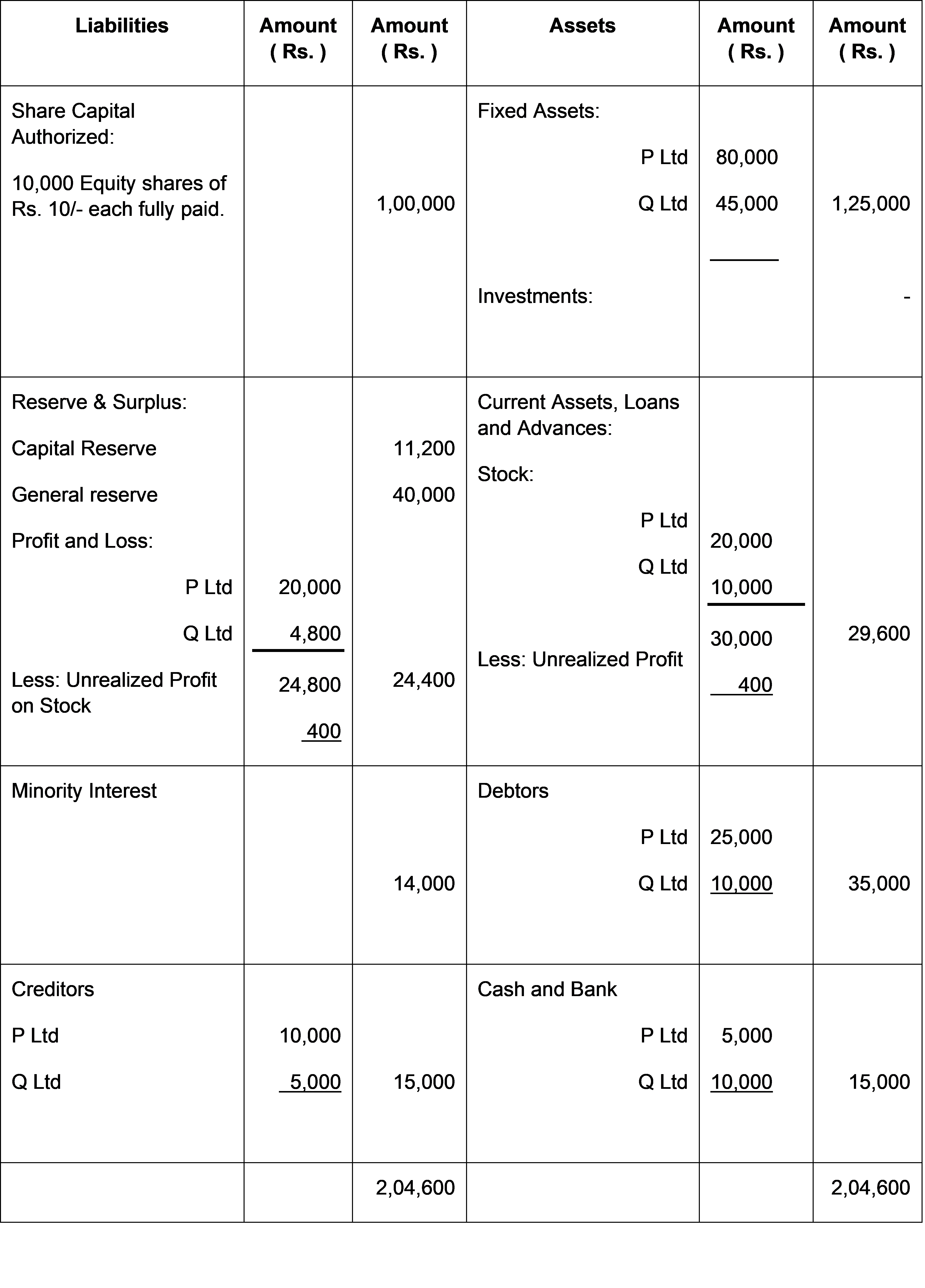

Following was the Balance sheet of M.M.Ltd at on 31.3.2015 Refer image

The discount amount is recorded separately in the books as a “discount on issue of shares” and is considered a capital loss. Discount on issue of shares being a capital loss to a company, should be debited to “discount on shares account” and shown as an asset in the. This account is a contra equity account that reduces the common.

Consolidated Balance Sheet and Steps to Prepare Tally Solutions

The discount amount is recorded separately in the books as a “discount on issue of shares” and is considered a capital loss. The discount on common stock account is used to record the discount. For example, if a share of rs 100 is. Discount on issue of shares being a capital loss to a company, should be debited to “discount.

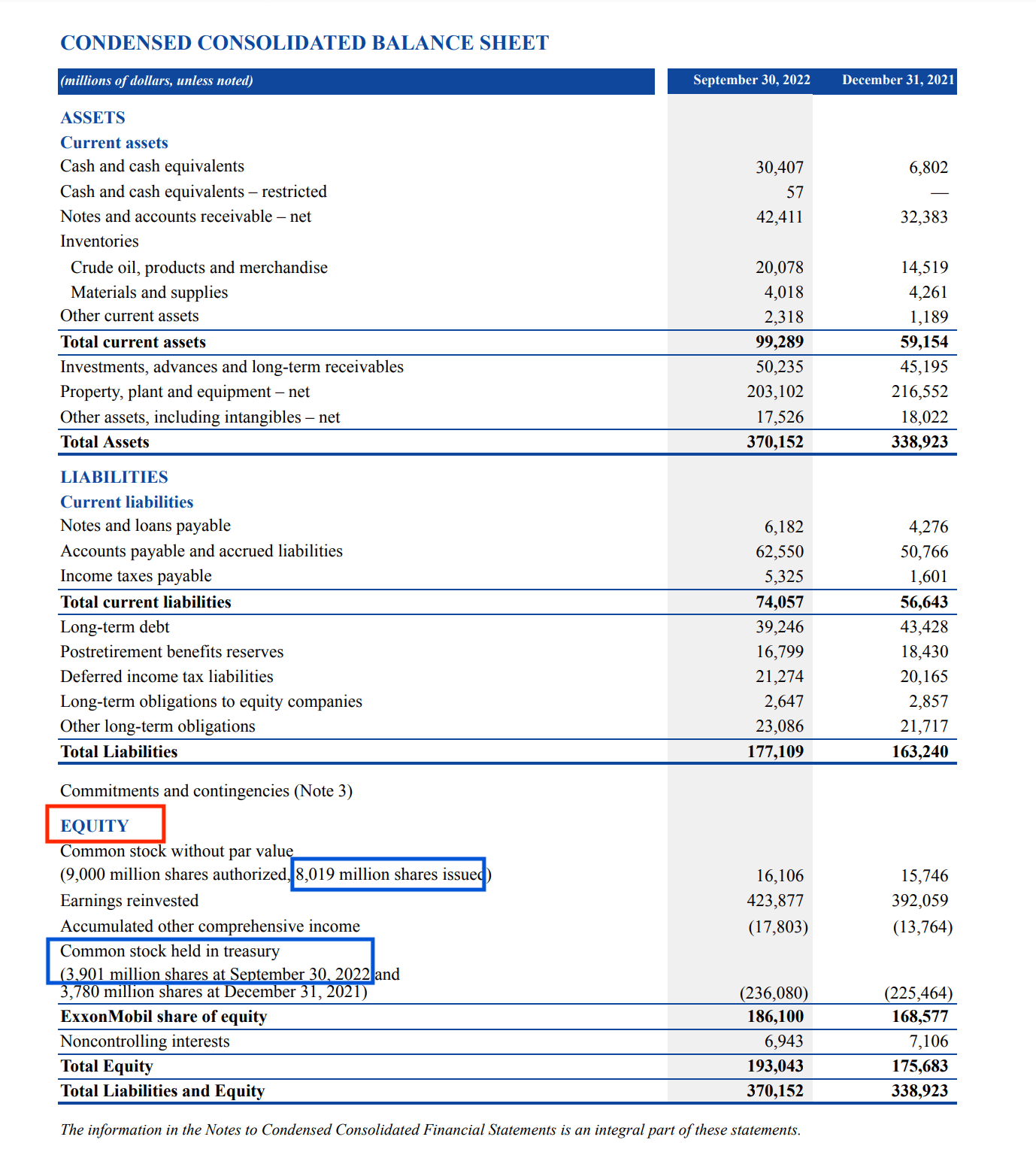

Shares Outstanding Types, How to Find, and Float Stock Analysis

Learn issue of shares journal entries with example for par, premium, discount & bonus shares. The discount on common stock account is used to record the discount. Discount on issue of shares being a capital loss to a company, should be debited to “discount on shares account” and shown as an asset in the. This account is a contra equity.

How To Prepare a Balance Sheet A StepbyStep Guide Capterra

For example, if a company. Discount on issue of shares being a capital loss to a company, should be debited to “discount on shares account” and shown as an asset in the. The discount amount is recorded separately in the books as a “discount on issue of shares” and is considered a capital loss. This account is a contra equity.

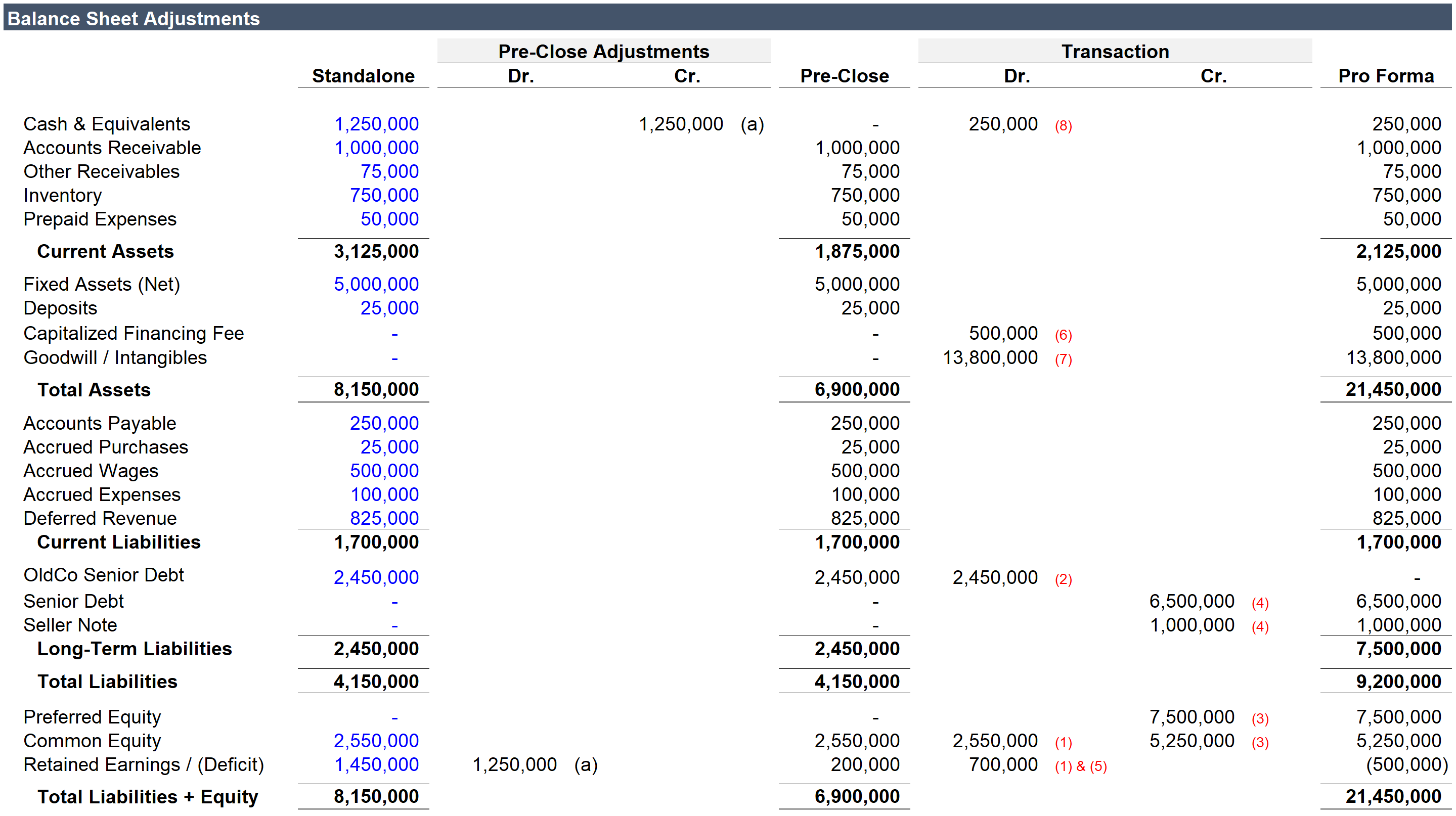

LBO Pro Forma Balance Sheet Adjustments A Simple Model

For example, if a share of rs 100 is. Learn issue of shares journal entries with example for par, premium, discount & bonus shares. When a company issues shares at a price less than their face value, it is said to have issued them at a discount. For example, if a company. The discount amount is recorded separately in the.

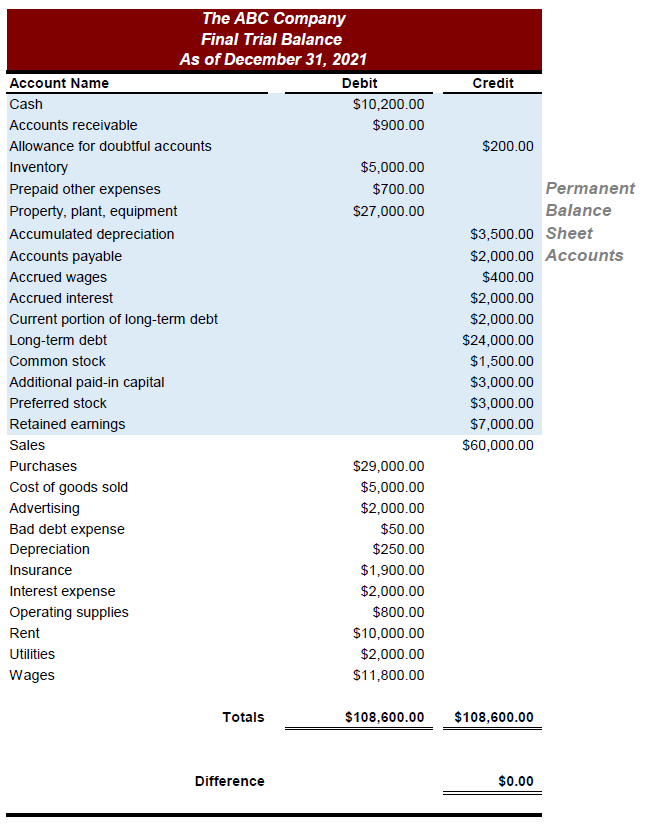

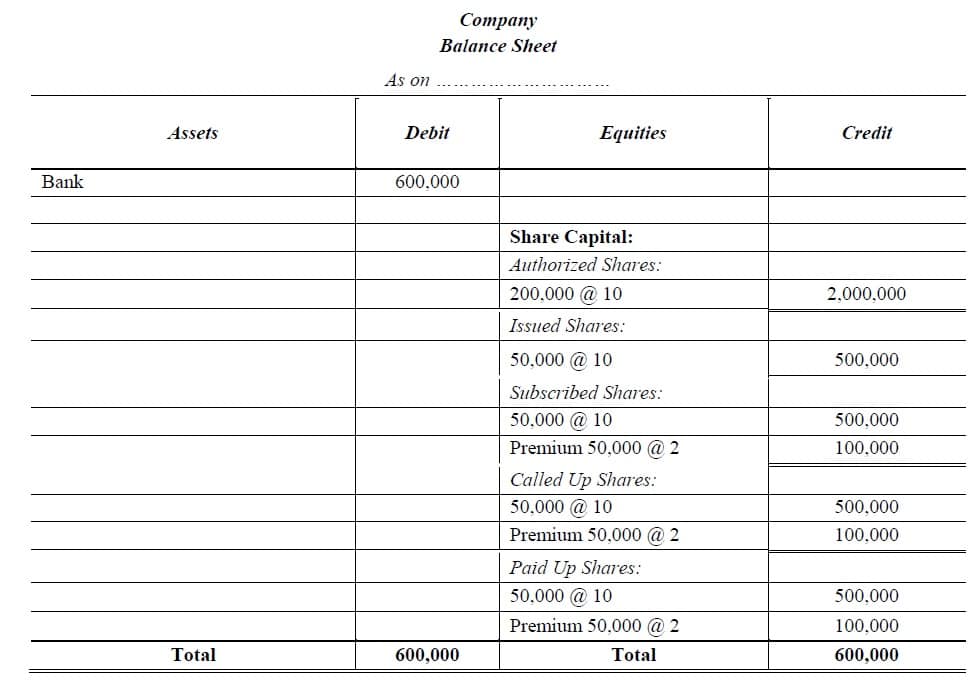

Share Capital Problems and Solutions Accountancy Knowledge

The discount on common stock account is used to record the discount. For example, if a company. The discount amount is recorded separately in the books as a “discount on issue of shares” and is considered a capital loss. This account is a contra equity account that reduces the common stock. Discount on issue of shares being a capital loss.

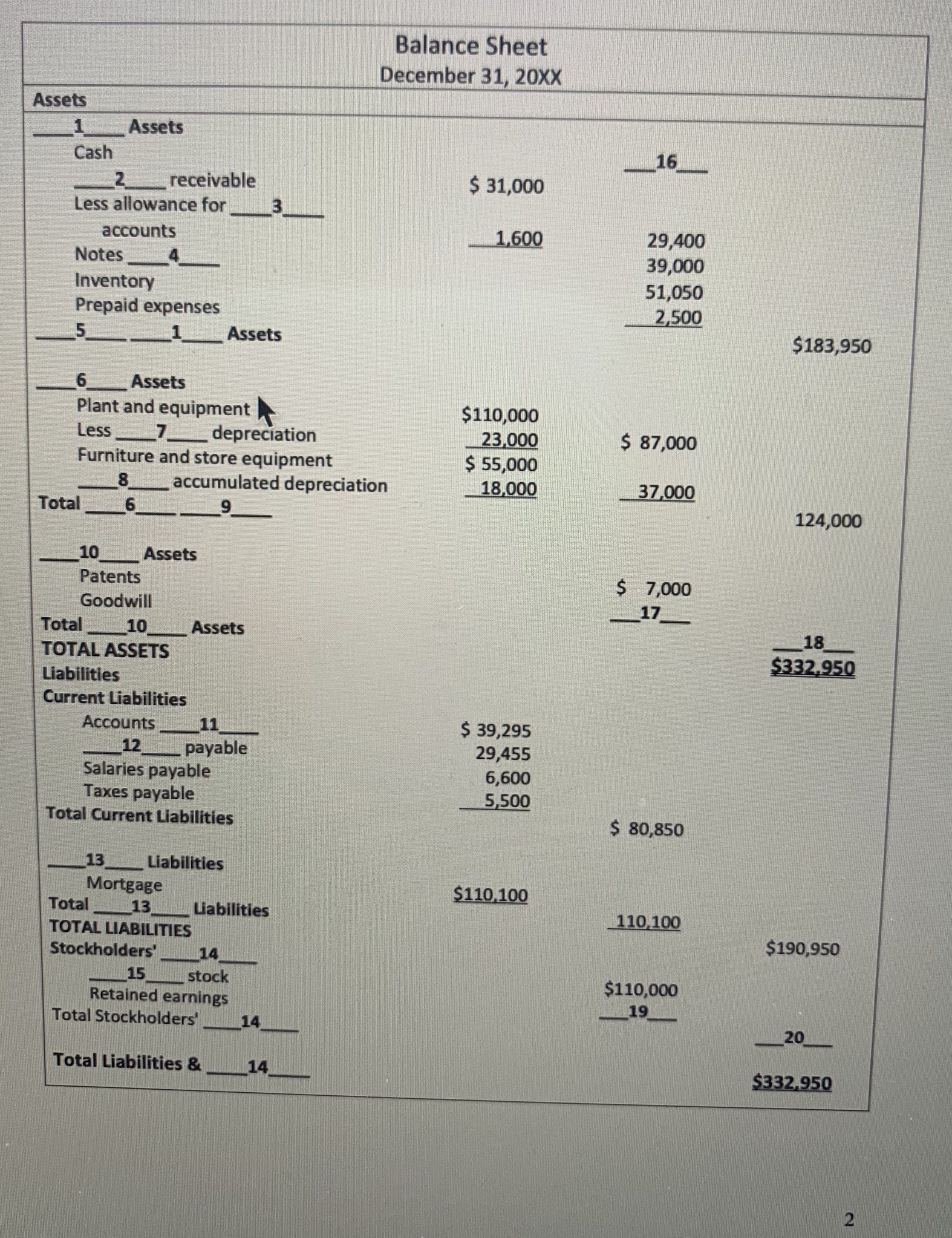

Answered Balance Sheet December 31, 20XX Assets… bartleby

Discount on issue of shares being a capital loss to a company, should be debited to “discount on shares account” and shown as an asset in the. Learn issue of shares journal entries with example for par, premium, discount & bonus shares. For example, if a share of rs 100 is. This account is a contra equity account that reduces.

The Discount Amount Is Recorded Separately In The Books As A “Discount On Issue Of Shares” And Is Considered A Capital Loss.

When a company issues shares at a price less than their face value, it is said to have issued them at a discount. Learn issue of shares journal entries with example for par, premium, discount & bonus shares. For example, if a share of rs 100 is. For example, if a company.

When Shares Are Issued At A Price Lower Than Their Face Value, They Are Said To Have Been Issued At A Discount.

This account is a contra equity account that reduces the common stock. The discount on common stock account is used to record the discount. Discount on issue of shares being a capital loss to a company, should be debited to “discount on shares account” and shown as an asset in the.