Development Cost In Balance Sheet - Capitalized r&d costs appear on the balance sheet as intangible assets, boosting asset values and improving metrics such as roa and. Research and development (r&d) costs need to be considered to determine whether they should be capitalized or expensed as. If computer software is acquired for use in a research and development project, charge its cost to expense as incurred. The decision to capitalize or expense r&d costs is a significant one, impacting a company’s financial statements and tax. Development costs are considered intangible assets on the balance sheet until the project they are associated with becomes operational.

Capitalized r&d costs appear on the balance sheet as intangible assets, boosting asset values and improving metrics such as roa and. If computer software is acquired for use in a research and development project, charge its cost to expense as incurred. Research and development (r&d) costs need to be considered to determine whether they should be capitalized or expensed as. The decision to capitalize or expense r&d costs is a significant one, impacting a company’s financial statements and tax. Development costs are considered intangible assets on the balance sheet until the project they are associated with becomes operational.

Capitalized r&d costs appear on the balance sheet as intangible assets, boosting asset values and improving metrics such as roa and. If computer software is acquired for use in a research and development project, charge its cost to expense as incurred. The decision to capitalize or expense r&d costs is a significant one, impacting a company’s financial statements and tax. Development costs are considered intangible assets on the balance sheet until the project they are associated with becomes operational. Research and development (r&d) costs need to be considered to determine whether they should be capitalized or expensed as.

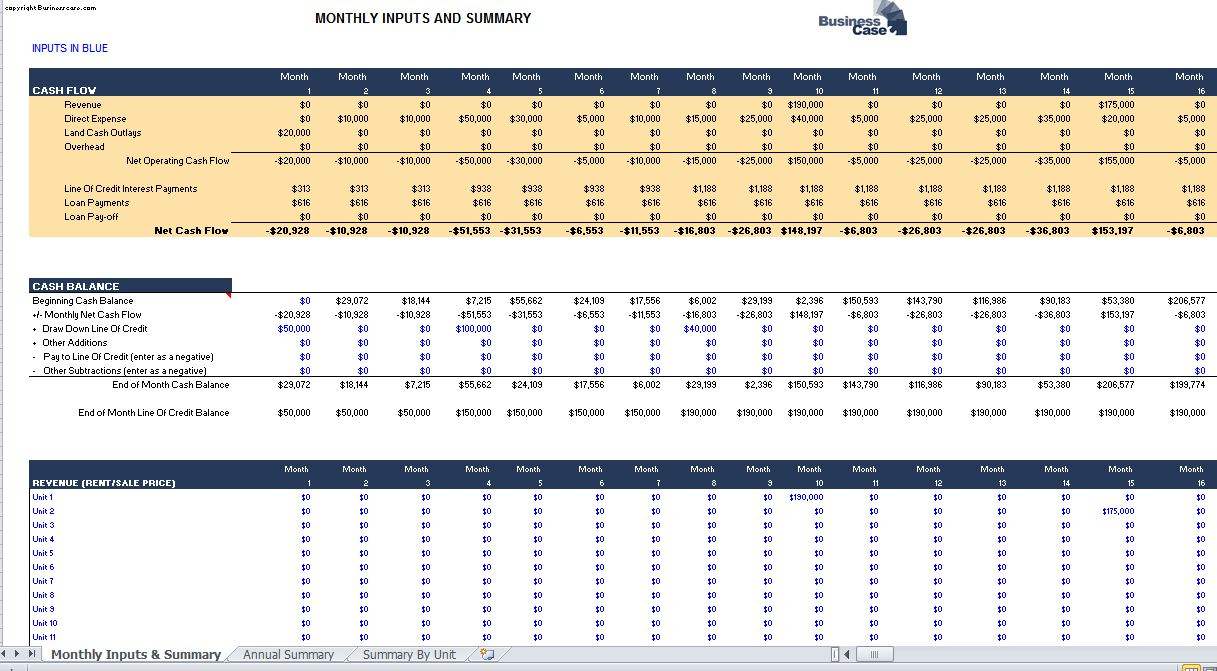

Research and Development Cost Model Plan Projections

If computer software is acquired for use in a research and development project, charge its cost to expense as incurred. Research and development (r&d) costs need to be considered to determine whether they should be capitalized or expensed as. Development costs are considered intangible assets on the balance sheet until the project they are associated with becomes operational. The decision.

Capitalizing R&D Expenses How to Do It and Its Effect on Valuation

Capitalized r&d costs appear on the balance sheet as intangible assets, boosting asset values and improving metrics such as roa and. If computer software is acquired for use in a research and development project, charge its cost to expense as incurred. The decision to capitalize or expense r&d costs is a significant one, impacting a company’s financial statements and tax..

The Product Development Process How to Create a New Product

The decision to capitalize or expense r&d costs is a significant one, impacting a company’s financial statements and tax. If computer software is acquired for use in a research and development project, charge its cost to expense as incurred. Capitalized r&d costs appear on the balance sheet as intangible assets, boosting asset values and improving metrics such as roa and..

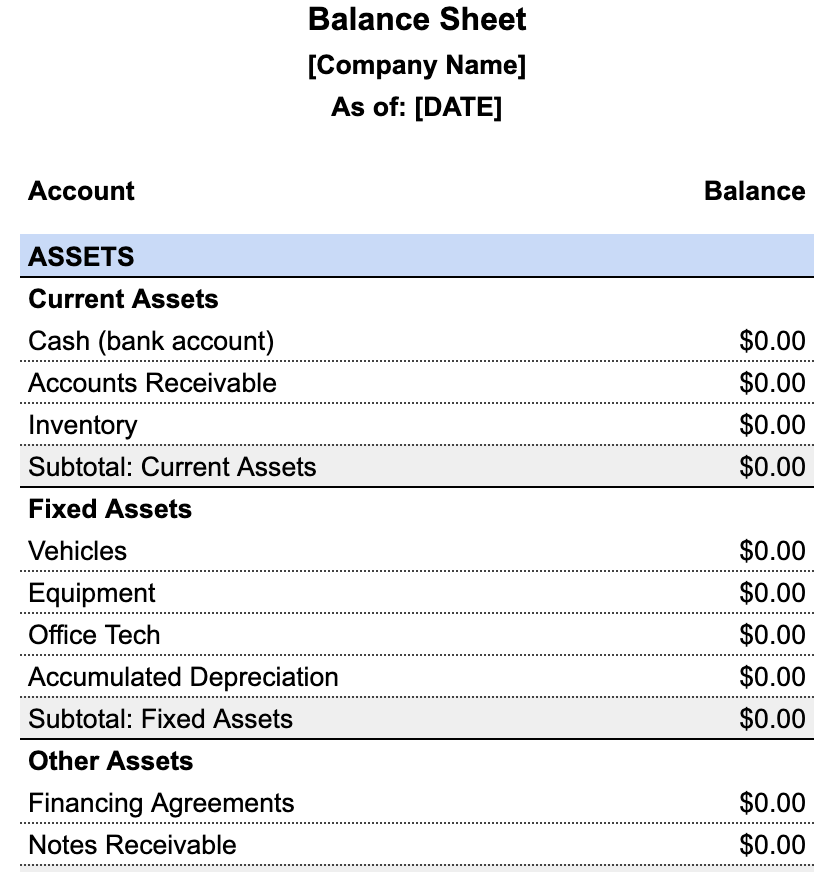

What Are The Two Parts Of A Balance Sheet at Dennis Fleming blog

If computer software is acquired for use in a research and development project, charge its cost to expense as incurred. The decision to capitalize or expense r&d costs is a significant one, impacting a company’s financial statements and tax. Capitalized r&d costs appear on the balance sheet as intangible assets, boosting asset values and improving metrics such as roa and..

The Balance Sheet A Howto Guide for Businesses

The decision to capitalize or expense r&d costs is a significant one, impacting a company’s financial statements and tax. Research and development (r&d) costs need to be considered to determine whether they should be capitalized or expensed as. Capitalized r&d costs appear on the balance sheet as intangible assets, boosting asset values and improving metrics such as roa and. Development.

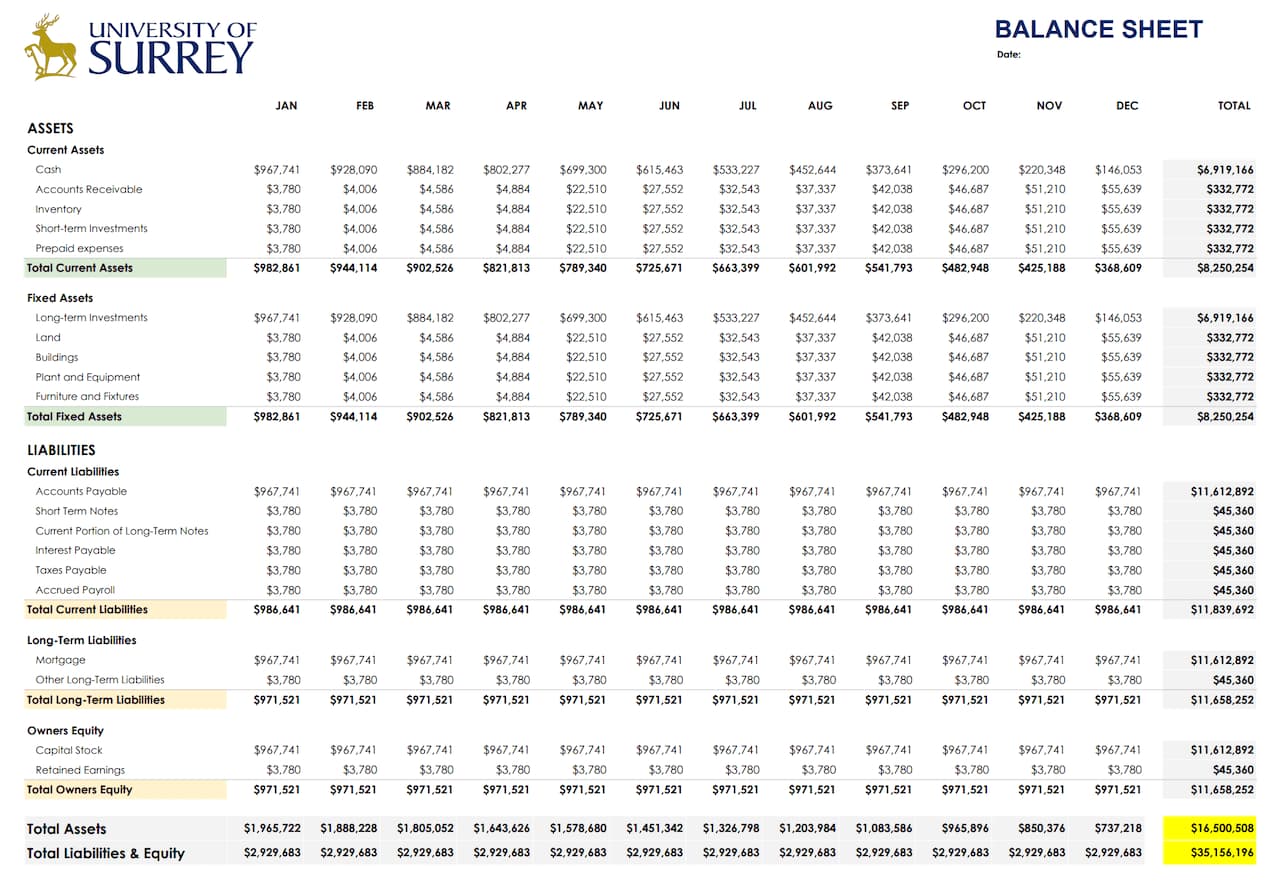

Balance Sheet Format for Construction Company in Excel

If computer software is acquired for use in a research and development project, charge its cost to expense as incurred. Research and development (r&d) costs need to be considered to determine whether they should be capitalized or expensed as. Capitalized r&d costs appear on the balance sheet as intangible assets, boosting asset values and improving metrics such as roa and..

How to Understand Your Balance Sheet A Beginner's Guide 2025

If computer software is acquired for use in a research and development project, charge its cost to expense as incurred. The decision to capitalize or expense r&d costs is a significant one, impacting a company’s financial statements and tax. Research and development (r&d) costs need to be considered to determine whether they should be capitalized or expensed as. Development costs.

Monthly Balance Sheet Template

The decision to capitalize or expense r&d costs is a significant one, impacting a company’s financial statements and tax. Capitalized r&d costs appear on the balance sheet as intangible assets, boosting asset values and improving metrics such as roa and. Research and development (r&d) costs need to be considered to determine whether they should be capitalized or expensed as. Development.

Property Development Costs Spreadsheet

The decision to capitalize or expense r&d costs is a significant one, impacting a company’s financial statements and tax. Research and development (r&d) costs need to be considered to determine whether they should be capitalized or expensed as. If computer software is acquired for use in a research and development project, charge its cost to expense as incurred. Capitalized r&d.

balance sheet,balance point 伤感说说吧

The decision to capitalize or expense r&d costs is a significant one, impacting a company’s financial statements and tax. If computer software is acquired for use in a research and development project, charge its cost to expense as incurred. Capitalized r&d costs appear on the balance sheet as intangible assets, boosting asset values and improving metrics such as roa and..

Development Costs Are Considered Intangible Assets On The Balance Sheet Until The Project They Are Associated With Becomes Operational.

Research and development (r&d) costs need to be considered to determine whether they should be capitalized or expensed as. Capitalized r&d costs appear on the balance sheet as intangible assets, boosting asset values and improving metrics such as roa and. The decision to capitalize or expense r&d costs is a significant one, impacting a company’s financial statements and tax. If computer software is acquired for use in a research and development project, charge its cost to expense as incurred.