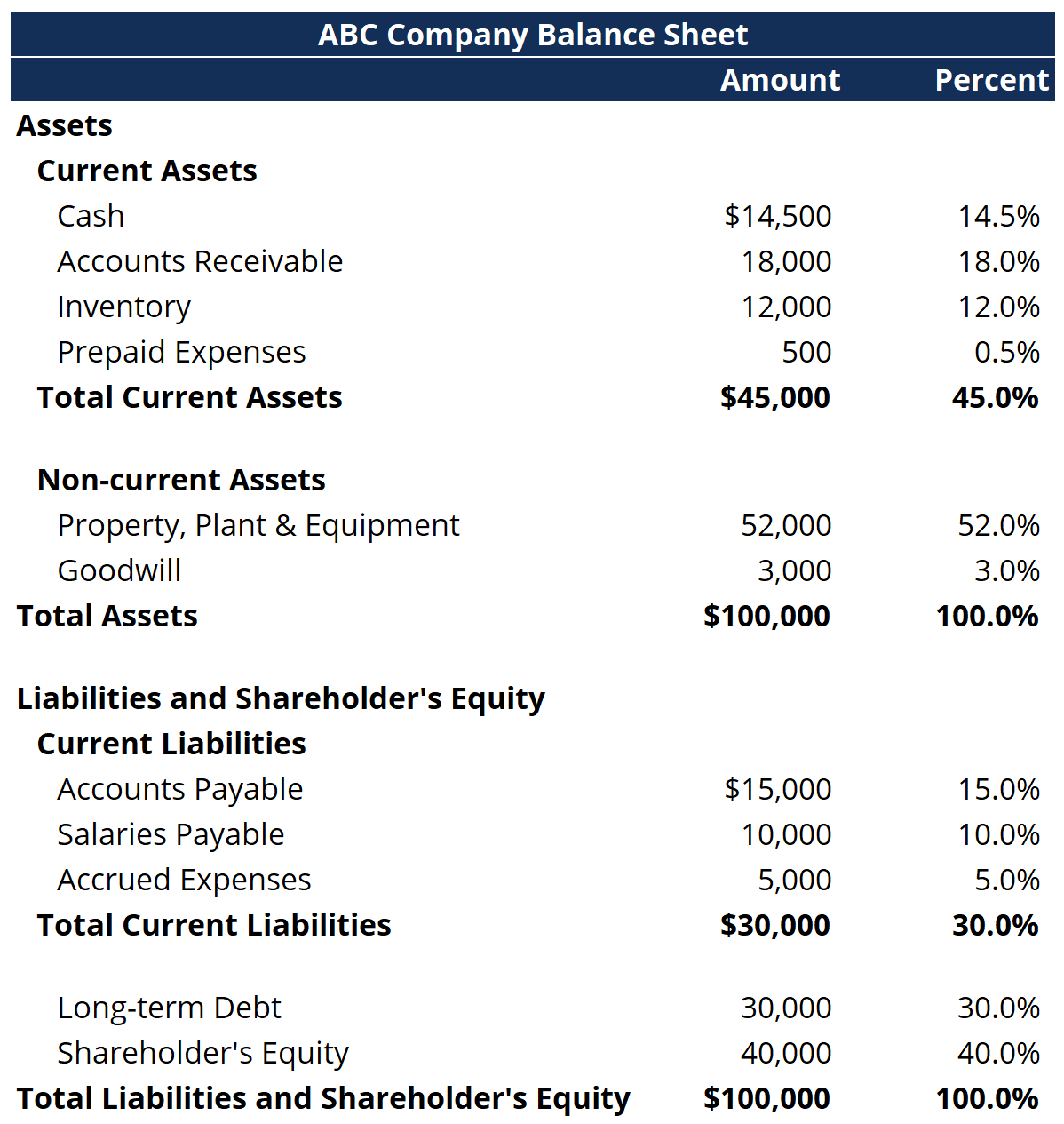

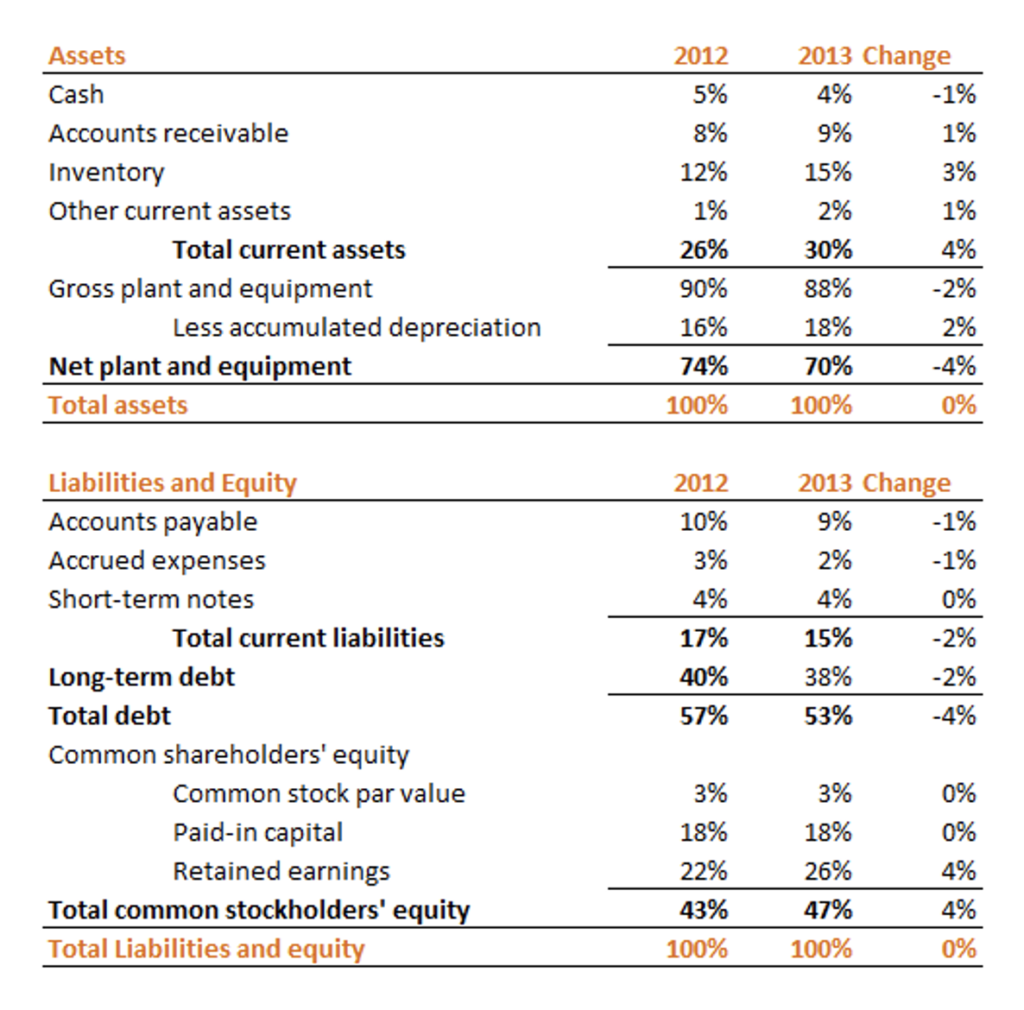

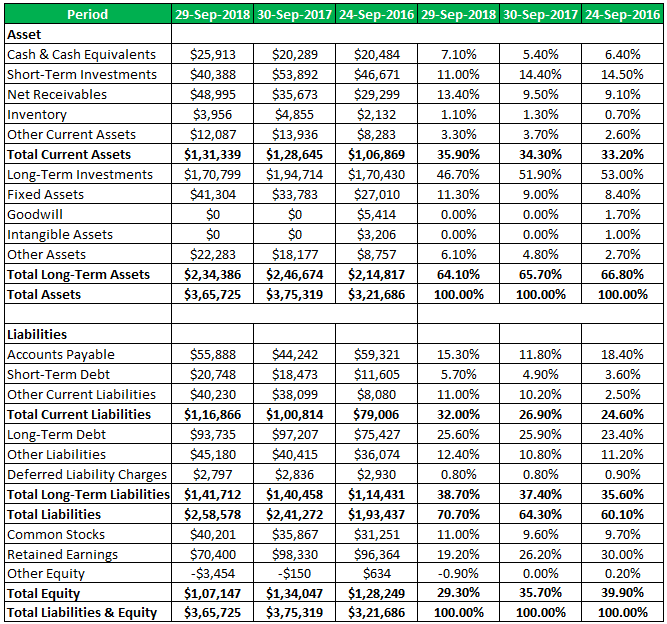

Common Size Balance Sheets - A statement that shows the percentage relation of each asset/liability to the total. What is a common size balance sheet? The common size balance sheet formula converts traditional financial statements into a comparative format by dividing each line.

A statement that shows the percentage relation of each asset/liability to the total. What is a common size balance sheet? The common size balance sheet formula converts traditional financial statements into a comparative format by dividing each line.

A statement that shows the percentage relation of each asset/liability to the total. The common size balance sheet formula converts traditional financial statements into a comparative format by dividing each line. What is a common size balance sheet?

Common Size Analysis Overview, Examples, How to Perform

The common size balance sheet formula converts traditional financial statements into a comparative format by dividing each line. What is a common size balance sheet? A statement that shows the percentage relation of each asset/liability to the total.

Common Size Balance Sheet Meaning, Objectives, Format & Example

A statement that shows the percentage relation of each asset/liability to the total. The common size balance sheet formula converts traditional financial statements into a comparative format by dividing each line. What is a common size balance sheet?

How to Figure the Common Size BalanceSheet Percentages Online Accounting

What is a common size balance sheet? The common size balance sheet formula converts traditional financial statements into a comparative format by dividing each line. A statement that shows the percentage relation of each asset/liability to the total.

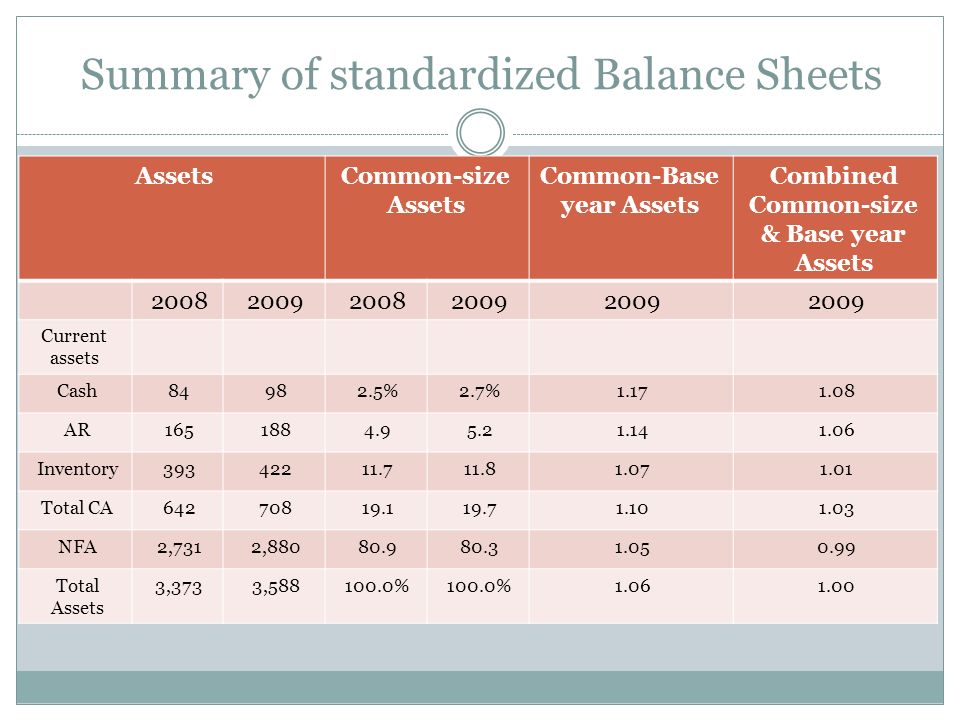

What is a CommonSize Balance Sheet? 365 Financial Analyst

What is a common size balance sheet? The common size balance sheet formula converts traditional financial statements into a comparative format by dividing each line. A statement that shows the percentage relation of each asset/liability to the total.

Common Size Balance Sheet Meaning, Objectives, Format & Example

The common size balance sheet formula converts traditional financial statements into a comparative format by dividing each line. What is a common size balance sheet? A statement that shows the percentage relation of each asset/liability to the total.

Common Size Balance Sheet

A statement that shows the percentage relation of each asset/liability to the total. The common size balance sheet formula converts traditional financial statements into a comparative format by dividing each line. What is a common size balance sheet?

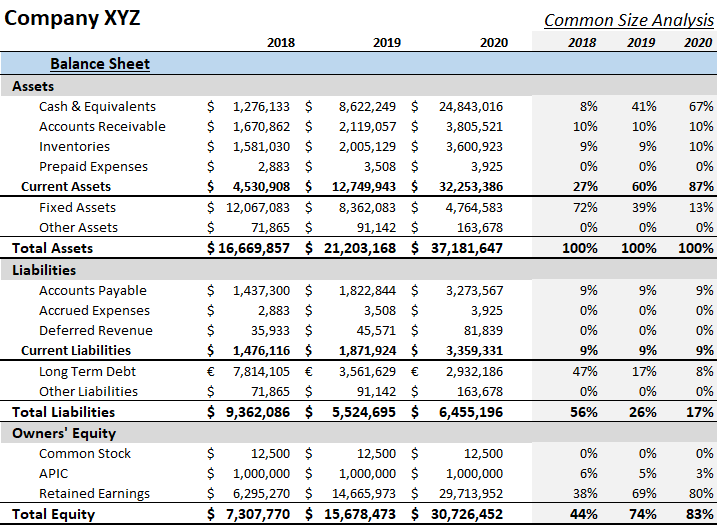

Common Size Balance Sheet Analysis (Format, Examples)

What is a common size balance sheet? The common size balance sheet formula converts traditional financial statements into a comparative format by dividing each line. A statement that shows the percentage relation of each asset/liability to the total.

Common Size Balance Sheet Analysis (Format, Examples)

The common size balance sheet formula converts traditional financial statements into a comparative format by dividing each line. What is a common size balance sheet? A statement that shows the percentage relation of each asset/liability to the total.

Common Size Balance Sheet Double Entry Bookkeeping

What is a common size balance sheet? A statement that shows the percentage relation of each asset/liability to the total. The common size balance sheet formula converts traditional financial statements into a comparative format by dividing each line.

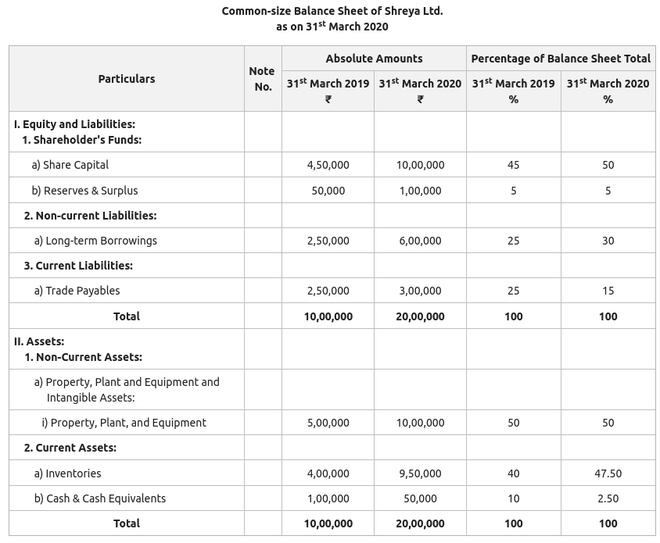

Common Size Balance Sheet Definition, Formula, Example

What is a common size balance sheet? The common size balance sheet formula converts traditional financial statements into a comparative format by dividing each line. A statement that shows the percentage relation of each asset/liability to the total.

The Common Size Balance Sheet Formula Converts Traditional Financial Statements Into A Comparative Format By Dividing Each Line.

A statement that shows the percentage relation of each asset/liability to the total. What is a common size balance sheet?

:max_bytes(150000):strip_icc()/Commonsizebalancesheet_final-63f083ed70e64e9da232560ae41429ce.png)