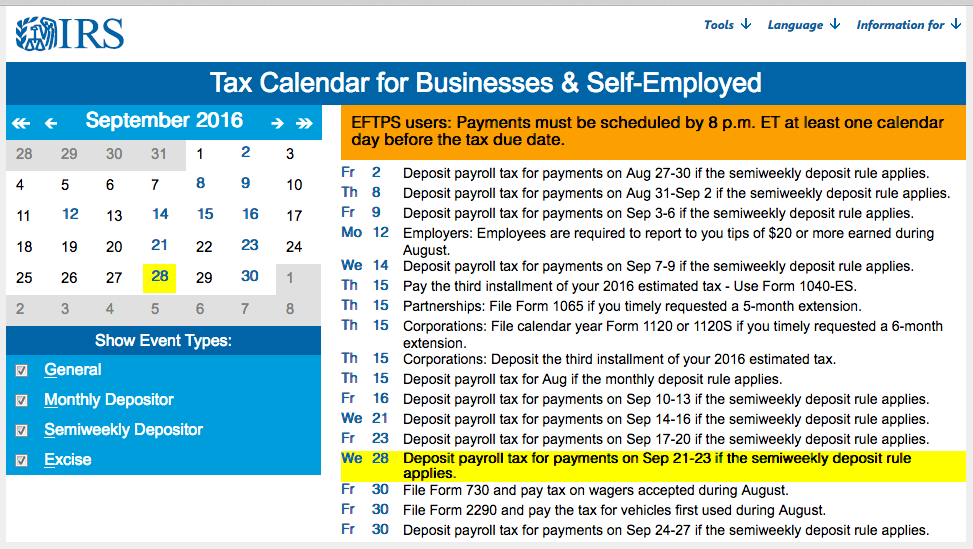

Calendar Year Tax - Many businesses, especially smaller ones with. If you use a calendar year, your income tax return is due by march 15 for s corporations and partnerships or april 15 for c. Every taxpayer (individuals, business entities, etc.) must figure taxable income for an annual accounting period called a tax year. For individuals, the calendar year typically serves as the basis for personal tax filing. To decide which calendar (s) to use, first look at the general tax calendar, later, and highlight the dates that apply to you.

To decide which calendar (s) to use, first look at the general tax calendar, later, and highlight the dates that apply to you. If you use a calendar year, your income tax return is due by march 15 for s corporations and partnerships or april 15 for c. Many businesses, especially smaller ones with. For individuals, the calendar year typically serves as the basis for personal tax filing. Every taxpayer (individuals, business entities, etc.) must figure taxable income for an annual accounting period called a tax year.

Many businesses, especially smaller ones with. Every taxpayer (individuals, business entities, etc.) must figure taxable income for an annual accounting period called a tax year. To decide which calendar (s) to use, first look at the general tax calendar, later, and highlight the dates that apply to you. If you use a calendar year, your income tax return is due by march 15 for s corporations and partnerships or april 15 for c. For individuals, the calendar year typically serves as the basis for personal tax filing.

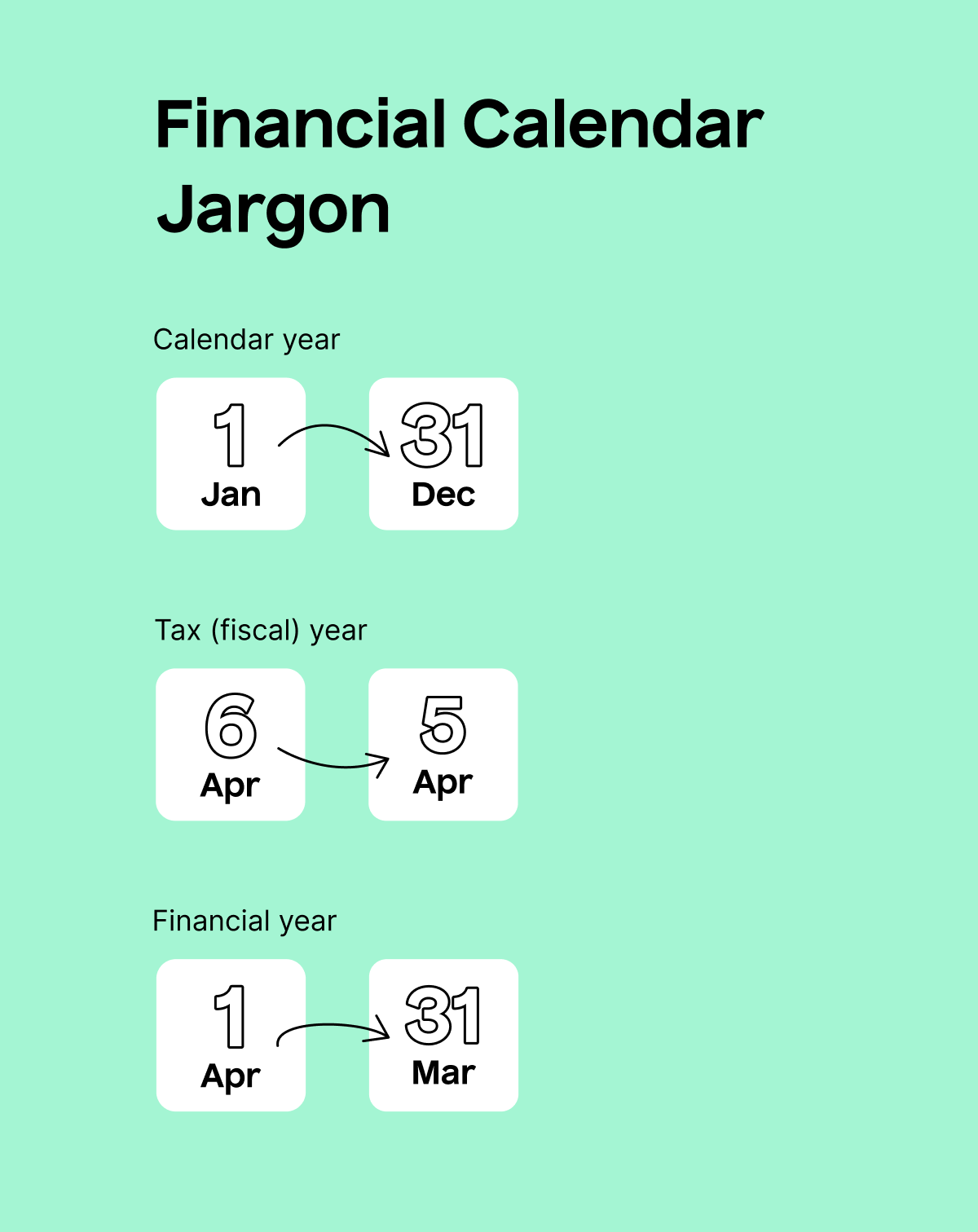

What is the tax year? TaxScouts

For individuals, the calendar year typically serves as the basis for personal tax filing. Every taxpayer (individuals, business entities, etc.) must figure taxable income for an annual accounting period called a tax year. Many businesses, especially smaller ones with. If you use a calendar year, your income tax return is due by march 15 for s corporations and partnerships or.

Comprehensive Tax Compliance Calendar for FY 202223 Covering Important

For individuals, the calendar year typically serves as the basis for personal tax filing. To decide which calendar (s) to use, first look at the general tax calendar, later, and highlight the dates that apply to you. Many businesses, especially smaller ones with. Every taxpayer (individuals, business entities, etc.) must figure taxable income for an annual accounting period called a.

Tax Calendar 2024Important Due Dates By IRS Markets Today US

Many businesses, especially smaller ones with. If you use a calendar year, your income tax return is due by march 15 for s corporations and partnerships or april 15 for c. To decide which calendar (s) to use, first look at the general tax calendar, later, and highlight the dates that apply to you. For individuals, the calendar year typically.

Fiscal Year Vs Calendar Year Tax David P. Justice

For individuals, the calendar year typically serves as the basis for personal tax filing. If you use a calendar year, your income tax return is due by march 15 for s corporations and partnerships or april 15 for c. To decide which calendar (s) to use, first look at the general tax calendar, later, and highlight the dates that apply.

What Is The Tax Calendar Year Barbara Li

To decide which calendar (s) to use, first look at the general tax calendar, later, and highlight the dates that apply to you. For individuals, the calendar year typically serves as the basis for personal tax filing. If you use a calendar year, your income tax return is due by march 15 for s corporations and partnerships or april 15.

2024 tax calendar » Harper & Company CPA Plus

Many businesses, especially smaller ones with. To decide which calendar (s) to use, first look at the general tax calendar, later, and highlight the dates that apply to you. If you use a calendar year, your income tax return is due by march 15 for s corporations and partnerships or april 15 for c. For individuals, the calendar year typically.

Tax Calendar 2023 Full list of due dates and activities to be

For individuals, the calendar year typically serves as the basis for personal tax filing. Every taxpayer (individuals, business entities, etc.) must figure taxable income for an annual accounting period called a tax year. If you use a calendar year, your income tax return is due by march 15 for s corporations and partnerships or april 15 for c. Many businesses,.

Difference Between Fiscal And Calendar Year

Many businesses, especially smaller ones with. If you use a calendar year, your income tax return is due by march 15 for s corporations and partnerships or april 15 for c. To decide which calendar (s) to use, first look at the general tax calendar, later, and highlight the dates that apply to you. For individuals, the calendar year typically.

What Is The Difference Between Plan Year And Calendar Year Meara

To decide which calendar (s) to use, first look at the general tax calendar, later, and highlight the dates that apply to you. Every taxpayer (individuals, business entities, etc.) must figure taxable income for an annual accounting period called a tax year. If you use a calendar year, your income tax return is due by march 15 for s corporations.

2023 2024 Fiscal Year Wall Planner A2 Size Full Year Desertcart Bahamas

For individuals, the calendar year typically serves as the basis for personal tax filing. If you use a calendar year, your income tax return is due by march 15 for s corporations and partnerships or april 15 for c. Many businesses, especially smaller ones with. Every taxpayer (individuals, business entities, etc.) must figure taxable income for an annual accounting period.

To Decide Which Calendar (S) To Use, First Look At The General Tax Calendar, Later, And Highlight The Dates That Apply To You.

Many businesses, especially smaller ones with. Every taxpayer (individuals, business entities, etc.) must figure taxable income for an annual accounting period called a tax year. For individuals, the calendar year typically serves as the basis for personal tax filing. If you use a calendar year, your income tax return is due by march 15 for s corporations and partnerships or april 15 for c.