Calendar Spread Example - Real life diagonal spread example: Diagonal put calendar spreads in ishares russell 2000 etf (iwm) diagonal calendar spreads are. They are most profitable when the. Calendar spreads work by exploiting the fundamental principle that options decay at different rates. A calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type. Calendar spreads allow traders to construct a trade that minimizes the effects of time.

Calendar spreads allow traders to construct a trade that minimizes the effects of time. Calendar spreads work by exploiting the fundamental principle that options decay at different rates. They are most profitable when the. Real life diagonal spread example: A calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type. Diagonal put calendar spreads in ishares russell 2000 etf (iwm) diagonal calendar spreads are.

Calendar spreads work by exploiting the fundamental principle that options decay at different rates. Diagonal put calendar spreads in ishares russell 2000 etf (iwm) diagonal calendar spreads are. Calendar spreads allow traders to construct a trade that minimizes the effects of time. Real life diagonal spread example: A calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type. They are most profitable when the.

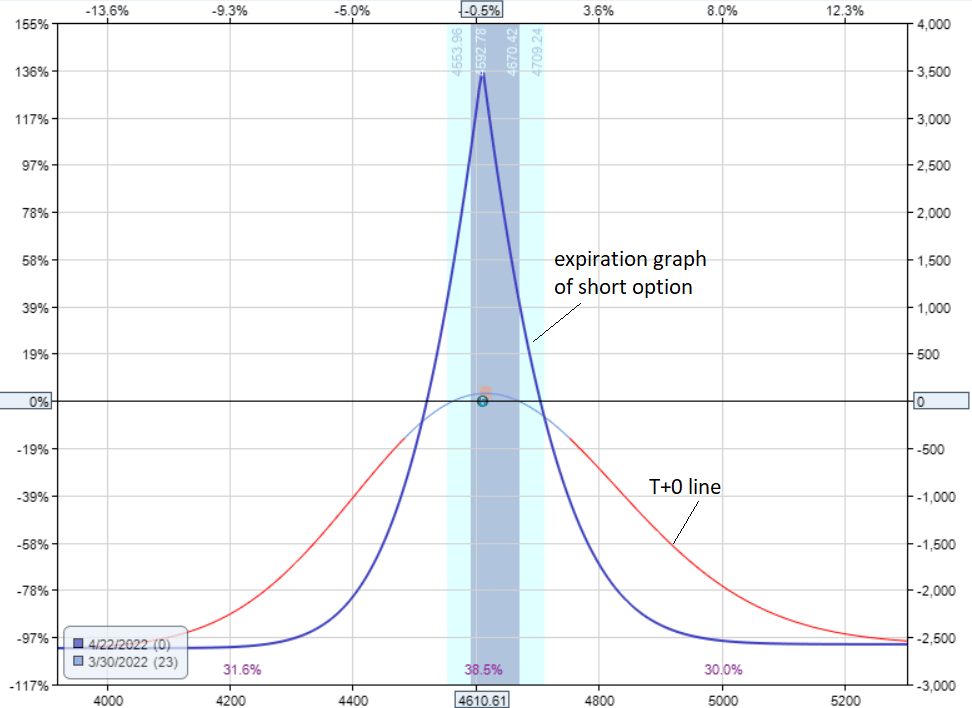

How Calendar Spreads Work (Best Explanation) projectoption

Calendar spreads work by exploiting the fundamental principle that options decay at different rates. Real life diagonal spread example: Calendar spreads allow traders to construct a trade that minimizes the effects of time. They are most profitable when the. Diagonal put calendar spreads in ishares russell 2000 etf (iwm) diagonal calendar spreads are.

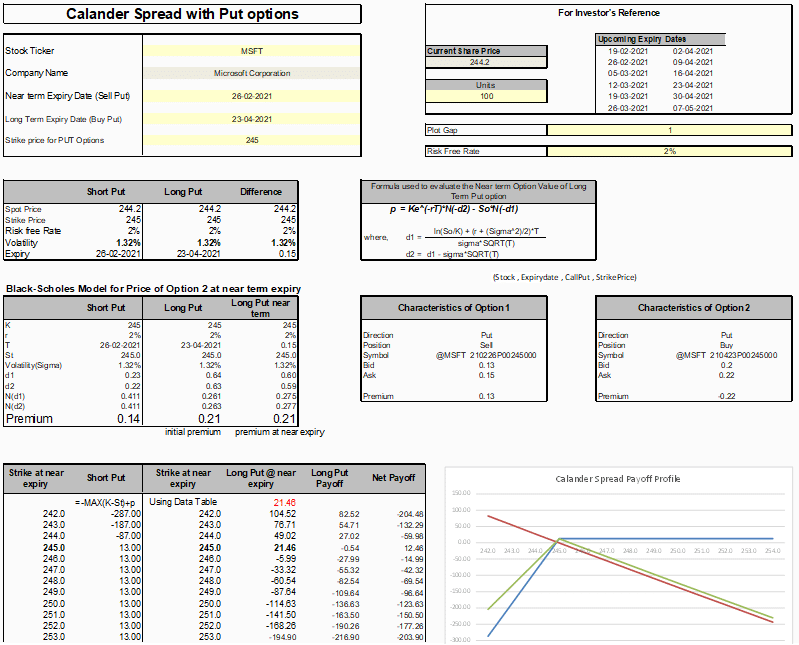

Calendar Spread Options Examples Mavra Sibella

Diagonal put calendar spreads in ishares russell 2000 etf (iwm) diagonal calendar spreads are. A calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type. They are most profitable when the. Calendar spreads work by exploiting the fundamental principle that options decay at different rates. Real life diagonal spread example:

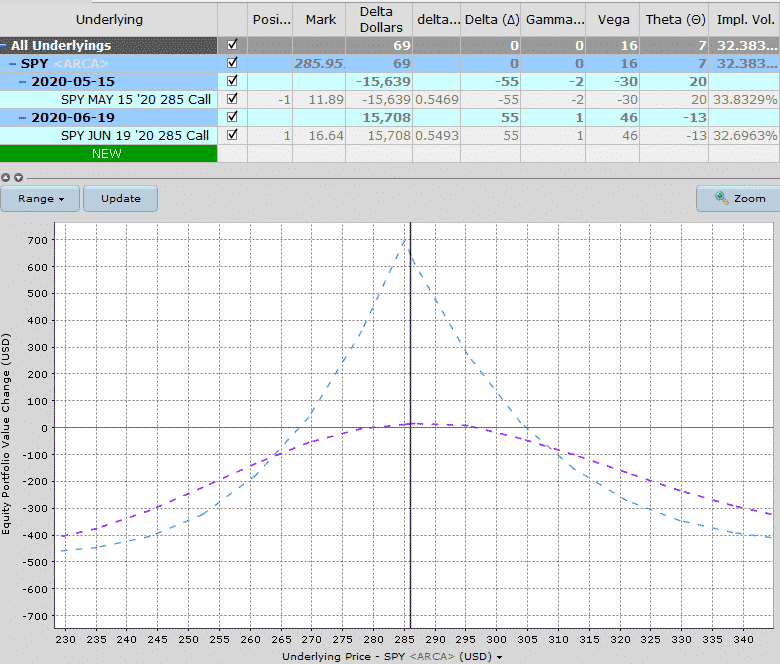

Calendar Spread Options Kelsy Mellisa

Calendar spreads allow traders to construct a trade that minimizes the effects of time. They are most profitable when the. A calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type. Calendar spreads work by exploiting the fundamental principle that options decay at different rates. Real life diagonal spread example:

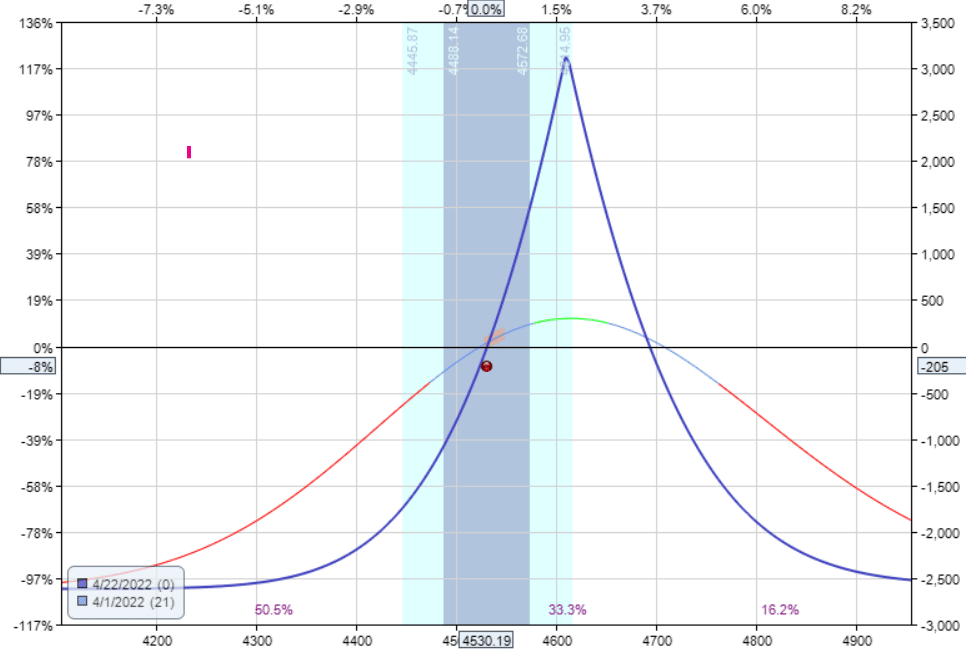

calendar spread example Options Trading IQ

Diagonal put calendar spreads in ishares russell 2000 etf (iwm) diagonal calendar spreads are. They are most profitable when the. Calendar spreads allow traders to construct a trade that minimizes the effects of time. Real life diagonal spread example: A calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type.

Calendar Spread and Long Calendar Option Strategies Market Taker

They are most profitable when the. Calendar spreads work by exploiting the fundamental principle that options decay at different rates. A calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type. Calendar spreads allow traders to construct a trade that minimizes the effects of time. Real life diagonal spread example:

Long Calendar Spread with Puts Strategy With Example

Calendar spreads work by exploiting the fundamental principle that options decay at different rates. They are most profitable when the. Diagonal put calendar spreads in ishares russell 2000 etf (iwm) diagonal calendar spreads are. A calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type. Calendar spreads allow traders to.

calendar spread example Options Trading IQ

Diagonal put calendar spreads in ishares russell 2000 etf (iwm) diagonal calendar spreads are. Real life diagonal spread example: A calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type. They are most profitable when the. Calendar spreads allow traders to construct a trade that minimizes the effects of time.

Option Strategy Long Calendar Spread (Excel Template) MarketXLS

Diagonal put calendar spreads in ishares russell 2000 etf (iwm) diagonal calendar spreads are. They are most profitable when the. Calendar spreads work by exploiting the fundamental principle that options decay at different rates. Calendar spreads allow traders to construct a trade that minimizes the effects of time. Real life diagonal spread example:

Calendar Spreads 101 Everything You Need To Know

Calendar spreads work by exploiting the fundamental principle that options decay at different rates. They are most profitable when the. A calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type. Diagonal put calendar spreads in ishares russell 2000 etf (iwm) diagonal calendar spreads are. Calendar spreads allow traders to.

How to Trade Options Calendar Spreads (Visuals and Examples)

They are most profitable when the. A calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type. Calendar spreads work by exploiting the fundamental principle that options decay at different rates. Real life diagonal spread example: Calendar spreads allow traders to construct a trade that minimizes the effects of time.

Calendar Spreads Work By Exploiting The Fundamental Principle That Options Decay At Different Rates.

Calendar spreads allow traders to construct a trade that minimizes the effects of time. Real life diagonal spread example: A calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type. Diagonal put calendar spreads in ishares russell 2000 etf (iwm) diagonal calendar spreads are.