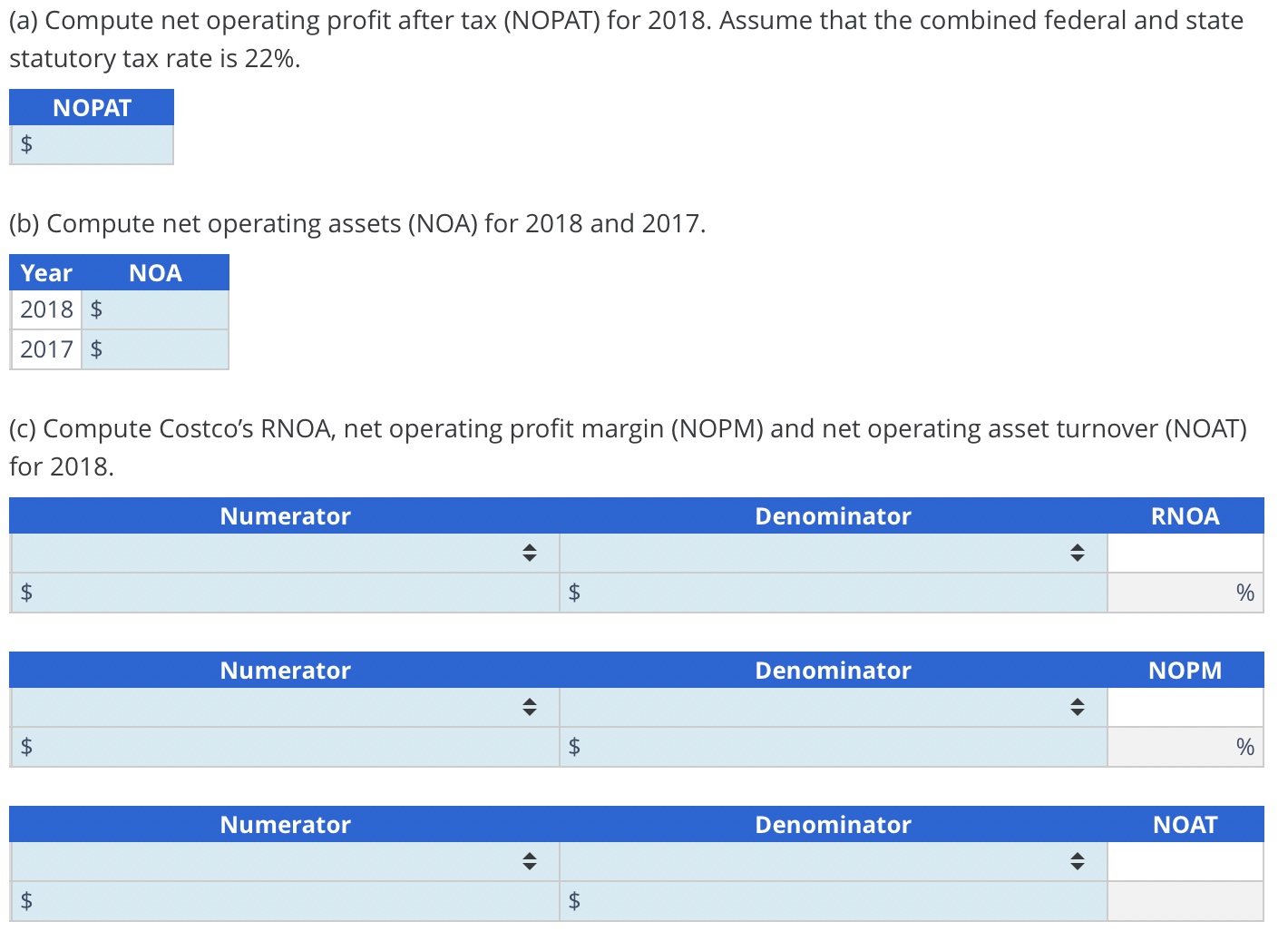

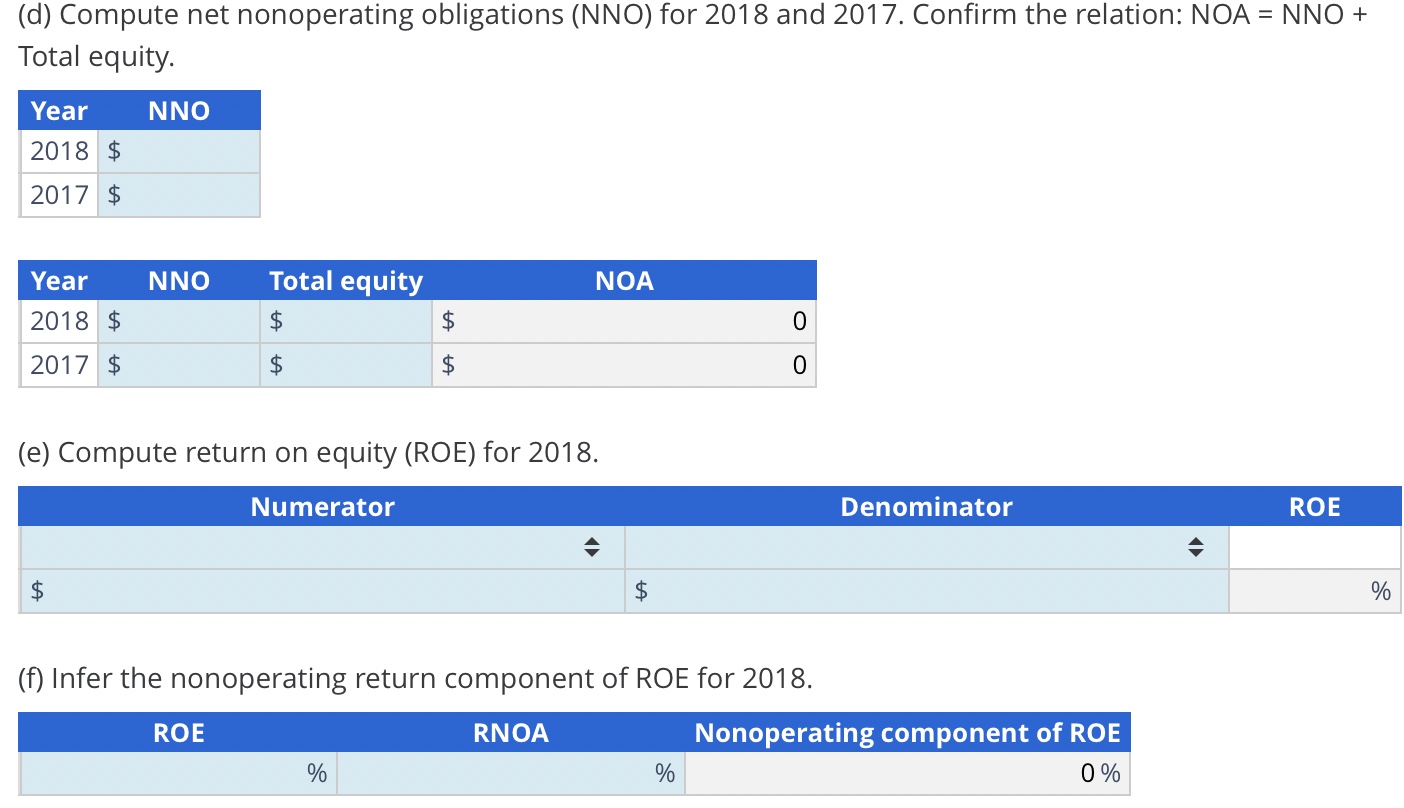

Balance Sheets And Income Statements For Costco Wholesale Corporation Follow - Free expert solution to analysis and interpretation of profitability balance sheets and income statements for costco wholesale. Compute and disaggregate costco's rnoa into net operating profit margin (nopm) and net operating asset turnover (noat) for 2018; In the analysis, we have compared the key financial ratios of the company with the average (median) values of those ratios.

In the analysis, we have compared the key financial ratios of the company with the average (median) values of those ratios. Compute and disaggregate costco's rnoa into net operating profit margin (nopm) and net operating asset turnover (noat) for 2018; Free expert solution to analysis and interpretation of profitability balance sheets and income statements for costco wholesale.

In the analysis, we have compared the key financial ratios of the company with the average (median) values of those ratios. Compute and disaggregate costco's rnoa into net operating profit margin (nopm) and net operating asset turnover (noat) for 2018; Free expert solution to analysis and interpretation of profitability balance sheets and income statements for costco wholesale.

Direct Computation of Nonoperating Return with Noncontrolling Interest

Free expert solution to analysis and interpretation of profitability balance sheets and income statements for costco wholesale. Compute and disaggregate costco's rnoa into net operating profit margin (nopm) and net operating asset turnover (noat) for 2018; In the analysis, we have compared the key financial ratios of the company with the average (median) values of those ratios.

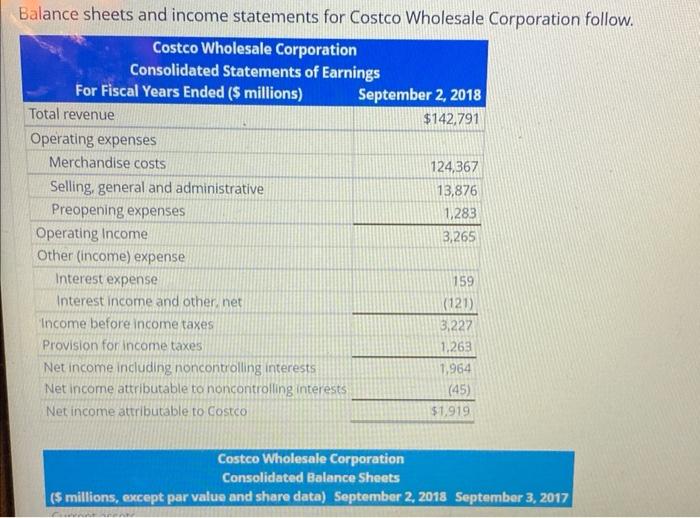

Costco Wholesale Corporation Consolidated Statements of

In the analysis, we have compared the key financial ratios of the company with the average (median) values of those ratios. Free expert solution to analysis and interpretation of profitability balance sheets and income statements for costco wholesale. Compute and disaggregate costco's rnoa into net operating profit margin (nopm) and net operating asset turnover (noat) for 2018;

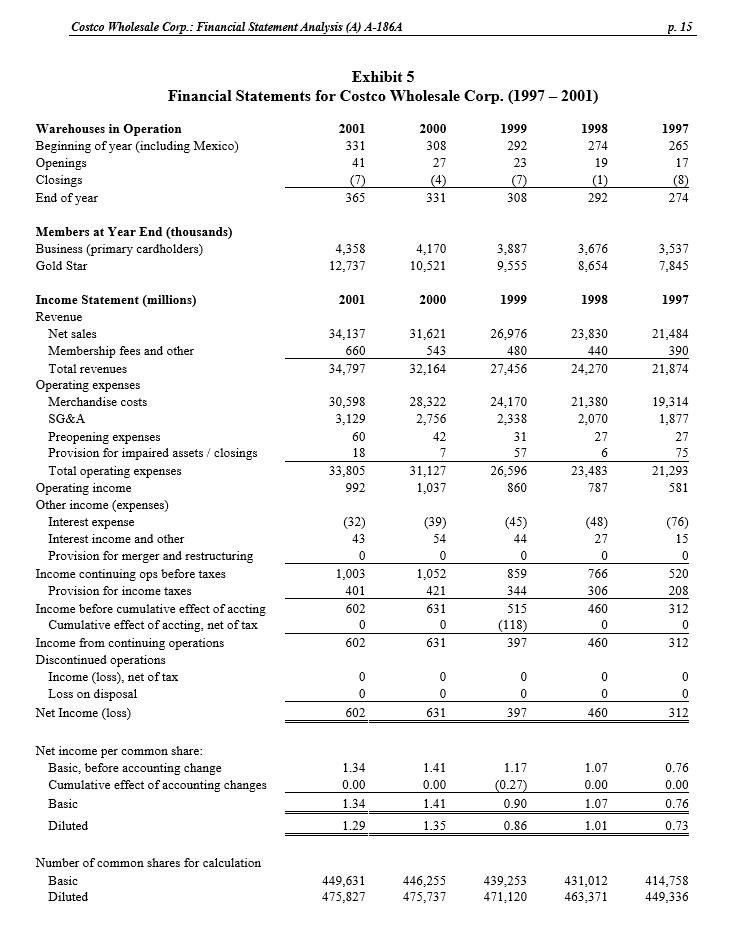

Costco Wholesale Corporation Financial Statement

Free expert solution to analysis and interpretation of profitability balance sheets and income statements for costco wholesale. In the analysis, we have compared the key financial ratios of the company with the average (median) values of those ratios. Compute and disaggregate costco's rnoa into net operating profit margin (nopm) and net operating asset turnover (noat) for 2018;

Solved Balance sheets and statements for Costco

Compute and disaggregate costco's rnoa into net operating profit margin (nopm) and net operating asset turnover (noat) for 2018; Free expert solution to analysis and interpretation of profitability balance sheets and income statements for costco wholesale. In the analysis, we have compared the key financial ratios of the company with the average (median) values of those ratios.

Balance Sheets and Statements For Costco Wholesale Corporation

In the analysis, we have compared the key financial ratios of the company with the average (median) values of those ratios. Compute and disaggregate costco's rnoa into net operating profit margin (nopm) and net operating asset turnover (noat) for 2018; Free expert solution to analysis and interpretation of profitability balance sheets and income statements for costco wholesale.

Solved Balance sheets and statements for Costco

Compute and disaggregate costco's rnoa into net operating profit margin (nopm) and net operating asset turnover (noat) for 2018; Free expert solution to analysis and interpretation of profitability balance sheets and income statements for costco wholesale. In the analysis, we have compared the key financial ratios of the company with the average (median) values of those ratios.

Solved Balance sheets and statements for Costco

In the analysis, we have compared the key financial ratios of the company with the average (median) values of those ratios. Free expert solution to analysis and interpretation of profitability balance sheets and income statements for costco wholesale. Compute and disaggregate costco's rnoa into net operating profit margin (nopm) and net operating asset turnover (noat) for 2018;

Solved Balance sheets and statements for Costco

Compute and disaggregate costco's rnoa into net operating profit margin (nopm) and net operating asset turnover (noat) for 2018; In the analysis, we have compared the key financial ratios of the company with the average (median) values of those ratios. Free expert solution to analysis and interpretation of profitability balance sheets and income statements for costco wholesale.

Analysis and Interpretation of Profitability Balance sheets and

Compute and disaggregate costco's rnoa into net operating profit margin (nopm) and net operating asset turnover (noat) for 2018; Free expert solution to analysis and interpretation of profitability balance sheets and income statements for costco wholesale. In the analysis, we have compared the key financial ratios of the company with the average (median) values of those ratios.

Solved Balance sheets and statements for Costco

In the analysis, we have compared the key financial ratios of the company with the average (median) values of those ratios. Free expert solution to analysis and interpretation of profitability balance sheets and income statements for costco wholesale. Compute and disaggregate costco's rnoa into net operating profit margin (nopm) and net operating asset turnover (noat) for 2018;

Free Expert Solution To Analysis And Interpretation Of Profitability Balance Sheets And Income Statements For Costco Wholesale.

In the analysis, we have compared the key financial ratios of the company with the average (median) values of those ratios. Compute and disaggregate costco's rnoa into net operating profit margin (nopm) and net operating asset turnover (noat) for 2018;