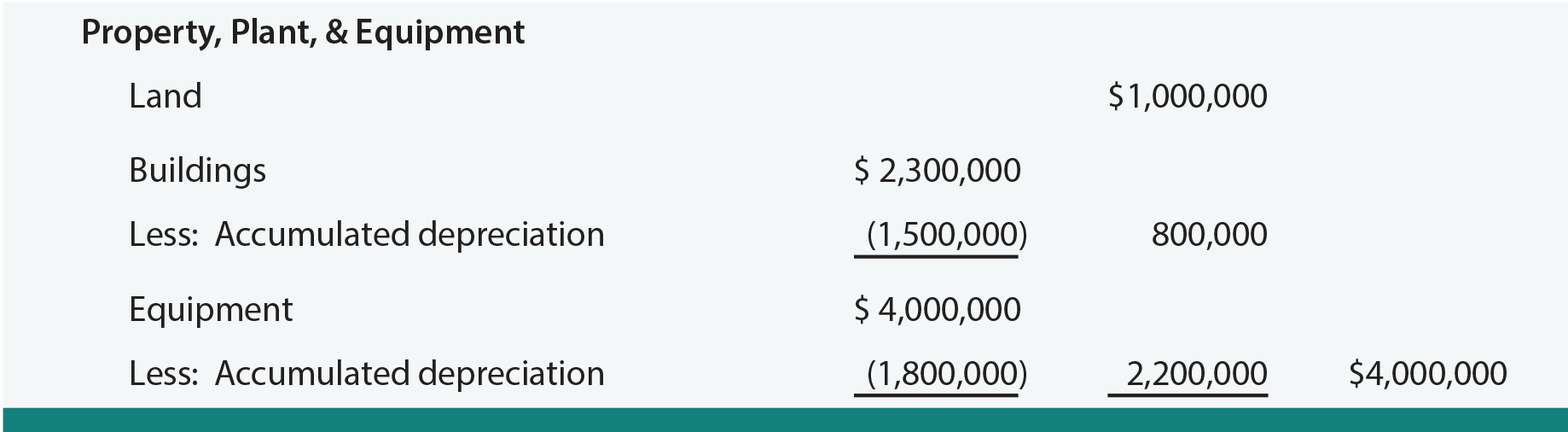

Balance Sheet Ppe - You should capitalize all costs incurred during an asset’s construction or. Ppe 5.2.5 was updated to provide additional guidance on accounting for depreciation expense when a company intends to dispose of. Explore the essentials of pp&e in accounting, including management strategies, valuation, depreciation, and asset lifecycle. Ppe is reported on the balance sheet at historical cost.

Explore the essentials of pp&e in accounting, including management strategies, valuation, depreciation, and asset lifecycle. Ppe 5.2.5 was updated to provide additional guidance on accounting for depreciation expense when a company intends to dispose of. You should capitalize all costs incurred during an asset’s construction or. Ppe is reported on the balance sheet at historical cost.

Ppe is reported on the balance sheet at historical cost. Ppe 5.2.5 was updated to provide additional guidance on accounting for depreciation expense when a company intends to dispose of. You should capitalize all costs incurred during an asset’s construction or. Explore the essentials of pp&e in accounting, including management strategies, valuation, depreciation, and asset lifecycle.

What is PPE in Accounting? Investing for Beginners 101

Explore the essentials of pp&e in accounting, including management strategies, valuation, depreciation, and asset lifecycle. Ppe is reported on the balance sheet at historical cost. You should capitalize all costs incurred during an asset’s construction or. Ppe 5.2.5 was updated to provide additional guidance on accounting for depreciation expense when a company intends to dispose of.

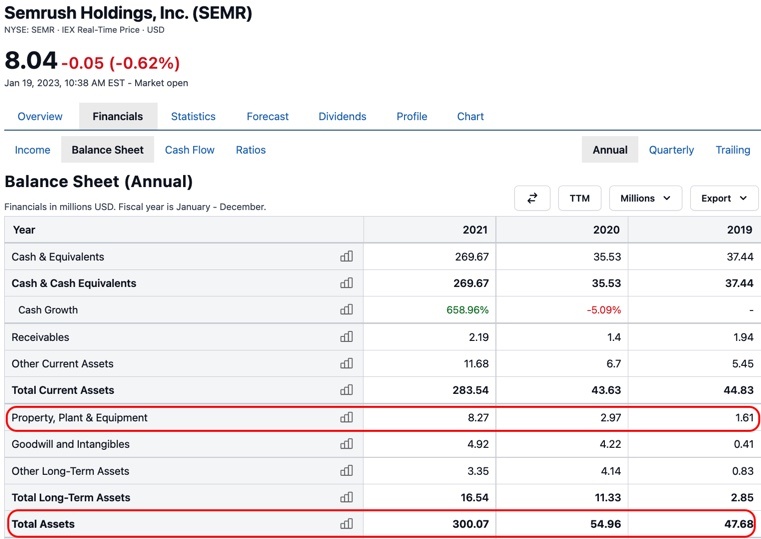

[Solved] Calculate FY 2020 PPE Following is the balance sheet for

Explore the essentials of pp&e in accounting, including management strategies, valuation, depreciation, and asset lifecycle. Ppe is reported on the balance sheet at historical cost. Ppe 5.2.5 was updated to provide additional guidance on accounting for depreciation expense when a company intends to dispose of. You should capitalize all costs incurred during an asset’s construction or.

Property, Plant, and Equipment (PP&E) Definition

Explore the essentials of pp&e in accounting, including management strategies, valuation, depreciation, and asset lifecycle. Ppe 5.2.5 was updated to provide additional guidance on accounting for depreciation expense when a company intends to dispose of. Ppe is reported on the balance sheet at historical cost. You should capitalize all costs incurred during an asset’s construction or.

PP&E (Property, Plant & Equipment) Overview, Formula, Examples

Ppe is reported on the balance sheet at historical cost. Ppe 5.2.5 was updated to provide additional guidance on accounting for depreciation expense when a company intends to dispose of. You should capitalize all costs incurred during an asset’s construction or. Explore the essentials of pp&e in accounting, including management strategies, valuation, depreciation, and asset lifecycle.

What Costs Are Included In Property, Plant, & Equipment

You should capitalize all costs incurred during an asset’s construction or. Ppe is reported on the balance sheet at historical cost. Explore the essentials of pp&e in accounting, including management strategies, valuation, depreciation, and asset lifecycle. Ppe 5.2.5 was updated to provide additional guidance on accounting for depreciation expense when a company intends to dispose of.

Property, Plant, and Equipment PP&E Definition

Explore the essentials of pp&e in accounting, including management strategies, valuation, depreciation, and asset lifecycle. Ppe is reported on the balance sheet at historical cost. Ppe 5.2.5 was updated to provide additional guidance on accounting for depreciation expense when a company intends to dispose of. You should capitalize all costs incurred during an asset’s construction or.

Property, Plant, and Equipment (PP&E) Meaning, Formula, and Examples

Ppe is reported on the balance sheet at historical cost. Ppe 5.2.5 was updated to provide additional guidance on accounting for depreciation expense when a company intends to dispose of. You should capitalize all costs incurred during an asset’s construction or. Explore the essentials of pp&e in accounting, including management strategies, valuation, depreciation, and asset lifecycle.

What is PPE in Accounting? Investing for Beginners 101

You should capitalize all costs incurred during an asset’s construction or. Ppe 5.2.5 was updated to provide additional guidance on accounting for depreciation expense when a company intends to dispose of. Ppe is reported on the balance sheet at historical cost. Explore the essentials of pp&e in accounting, including management strategies, valuation, depreciation, and asset lifecycle.

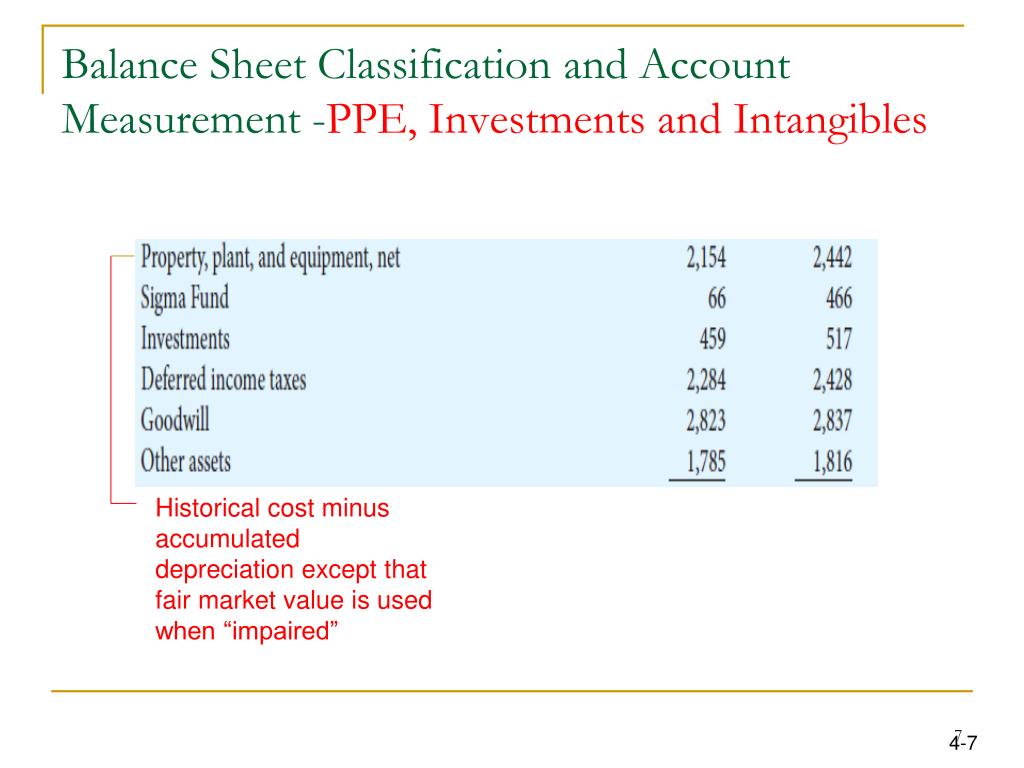

PPT The Balance Sheet Statement PowerPoint Presentation, free

You should capitalize all costs incurred during an asset’s construction or. Ppe is reported on the balance sheet at historical cost. Explore the essentials of pp&e in accounting, including management strategies, valuation, depreciation, and asset lifecycle. Ppe 5.2.5 was updated to provide additional guidance on accounting for depreciation expense when a company intends to dispose of.

PPT Gap Inc. PowerPoint Presentation, free download ID1851791

Explore the essentials of pp&e in accounting, including management strategies, valuation, depreciation, and asset lifecycle. Ppe is reported on the balance sheet at historical cost. You should capitalize all costs incurred during an asset’s construction or. Ppe 5.2.5 was updated to provide additional guidance on accounting for depreciation expense when a company intends to dispose of.

Ppe 5.2.5 Was Updated To Provide Additional Guidance On Accounting For Depreciation Expense When A Company Intends To Dispose Of.

Ppe is reported on the balance sheet at historical cost. Explore the essentials of pp&e in accounting, including management strategies, valuation, depreciation, and asset lifecycle. You should capitalize all costs incurred during an asset’s construction or.

:max_bytes(150000):strip_icc()/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg)

:max_bytes(150000):strip_icc()/Exxonbalancesheet10Q09302018-5c53bbe546e0fb000152e504.jpg)