Balance Sheet Contingent Liabilities - Contingent liabilities are recorded to ensure the financial statements fully reflect the true position of the company at the time of the balance sheet. When a probable contingent liability is recognized, it is recorded as a liability on the balance sheet, which directly affects the. Generally accepted accounting principles (gaap), some contingent losses may be reported on the balance sheet and income.

Contingent liabilities are recorded to ensure the financial statements fully reflect the true position of the company at the time of the balance sheet. When a probable contingent liability is recognized, it is recorded as a liability on the balance sheet, which directly affects the. Generally accepted accounting principles (gaap), some contingent losses may be reported on the balance sheet and income.

Generally accepted accounting principles (gaap), some contingent losses may be reported on the balance sheet and income. Contingent liabilities are recorded to ensure the financial statements fully reflect the true position of the company at the time of the balance sheet. When a probable contingent liability is recognized, it is recorded as a liability on the balance sheet, which directly affects the.

Contingent Liabilities In Balance Sheet Ppt Powerpoint Presentation

Generally accepted accounting principles (gaap), some contingent losses may be reported on the balance sheet and income. Contingent liabilities are recorded to ensure the financial statements fully reflect the true position of the company at the time of the balance sheet. When a probable contingent liability is recognized, it is recorded as a liability on the balance sheet, which directly.

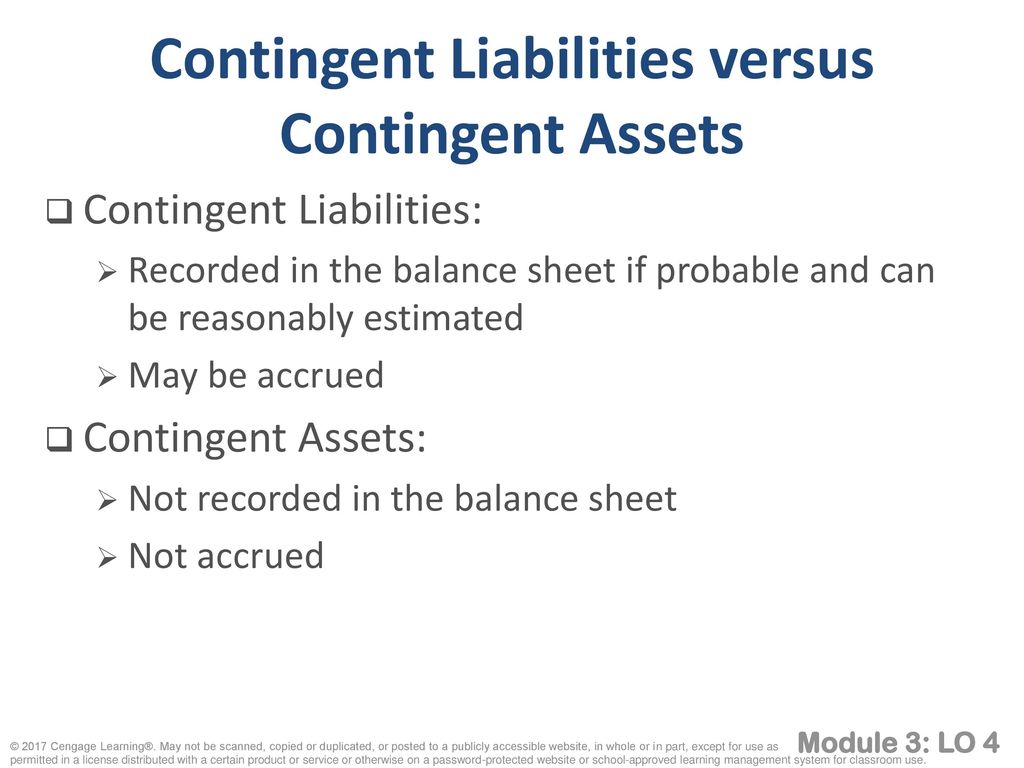

PPT Contingent Assets & Liabilities PowerPoint Presentation, free

Contingent liabilities are recorded to ensure the financial statements fully reflect the true position of the company at the time of the balance sheet. When a probable contingent liability is recognized, it is recorded as a liability on the balance sheet, which directly affects the. Generally accepted accounting principles (gaap), some contingent losses may be reported on the balance sheet.

Ideal Common Size Statement Of Profit And Loss Contingent Liabilities

When a probable contingent liability is recognized, it is recorded as a liability on the balance sheet, which directly affects the. Generally accepted accounting principles (gaap), some contingent losses may be reported on the balance sheet and income. Contingent liabilities are recorded to ensure the financial statements fully reflect the true position of the company at the time of the.

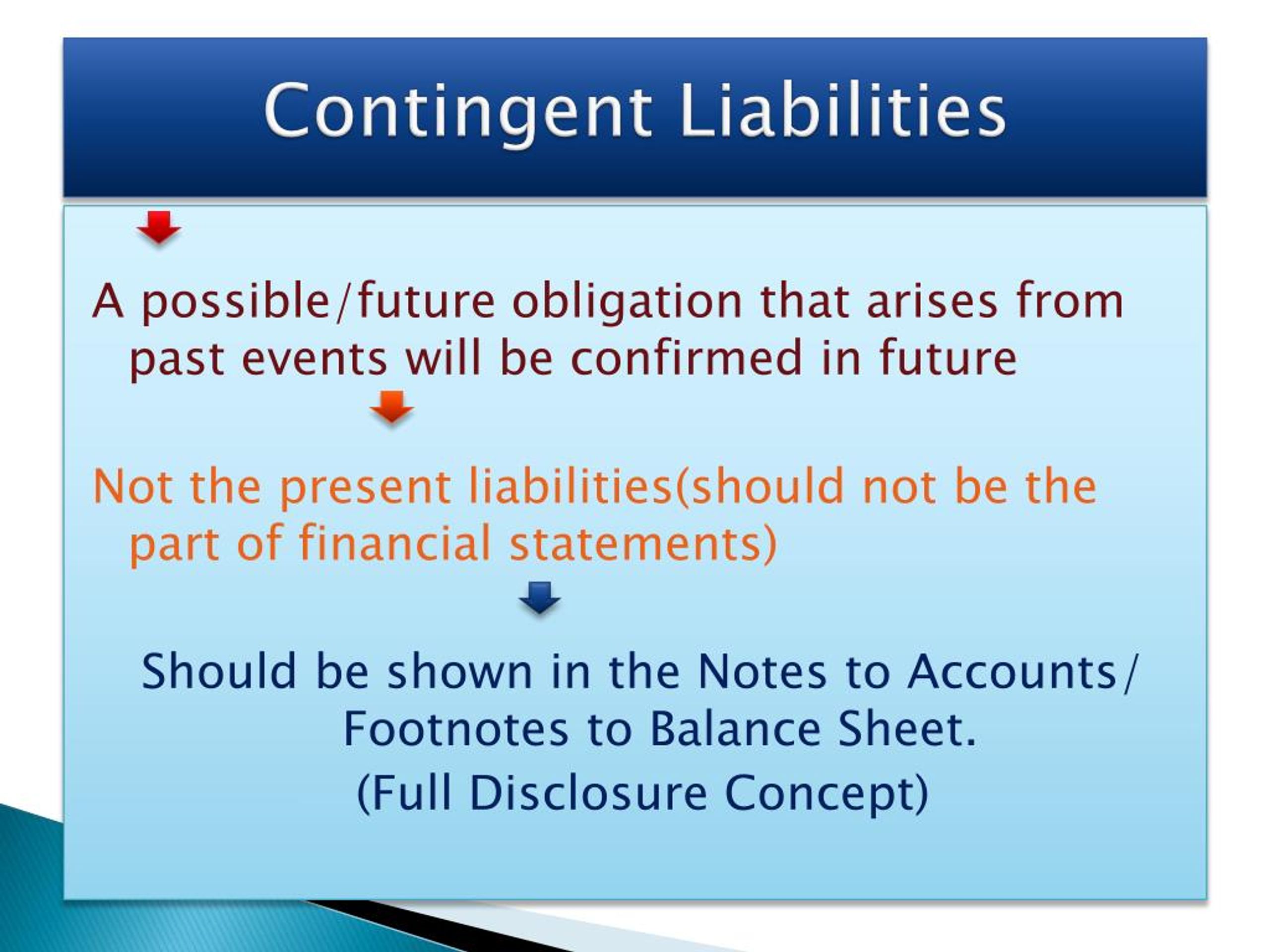

What is the meaning of contingent liabilities and its examples

When a probable contingent liability is recognized, it is recorded as a liability on the balance sheet, which directly affects the. Contingent liabilities are recorded to ensure the financial statements fully reflect the true position of the company at the time of the balance sheet. Generally accepted accounting principles (gaap), some contingent losses may be reported on the balance sheet.

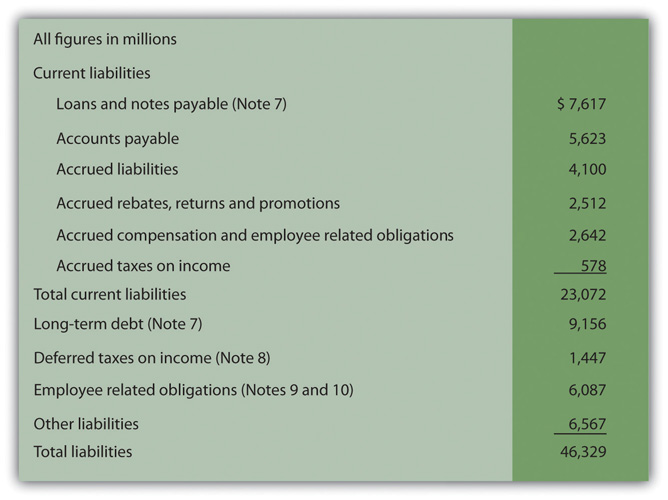

Liabilities Side of Balance Sheet

When a probable contingent liability is recognized, it is recorded as a liability on the balance sheet, which directly affects the. Generally accepted accounting principles (gaap), some contingent losses may be reported on the balance sheet and income. Contingent liabilities are recorded to ensure the financial statements fully reflect the true position of the company at the time of the.

12.3 Define and Apply Accounting Treatment for Contingent Liabilities

When a probable contingent liability is recognized, it is recorded as a liability on the balance sheet, which directly affects the. Contingent liabilities are recorded to ensure the financial statements fully reflect the true position of the company at the time of the balance sheet. Generally accepted accounting principles (gaap), some contingent losses may be reported on the balance sheet.

Contingent Liability Meaning Types And Examples vrogue.co

When a probable contingent liability is recognized, it is recorded as a liability on the balance sheet, which directly affects the. Generally accepted accounting principles (gaap), some contingent losses may be reported on the balance sheet and income. Contingent liabilities are recorded to ensure the financial statements fully reflect the true position of the company at the time of the.

11 Common Types of Liabilities

Generally accepted accounting principles (gaap), some contingent losses may be reported on the balance sheet and income. Contingent liabilities are recorded to ensure the financial statements fully reflect the true position of the company at the time of the balance sheet. When a probable contingent liability is recognized, it is recorded as a liability on the balance sheet, which directly.

Ideal Common Size Statement Of Profit And Loss Contingent Liabilities

When a probable contingent liability is recognized, it is recorded as a liability on the balance sheet, which directly affects the. Contingent liabilities are recorded to ensure the financial statements fully reflect the true position of the company at the time of the balance sheet. Generally accepted accounting principles (gaap), some contingent losses may be reported on the balance sheet.

Current Liabilities, Contingencies, and the Time Value of Money ppt

Contingent liabilities are recorded to ensure the financial statements fully reflect the true position of the company at the time of the balance sheet. When a probable contingent liability is recognized, it is recorded as a liability on the balance sheet, which directly affects the. Generally accepted accounting principles (gaap), some contingent losses may be reported on the balance sheet.

When A Probable Contingent Liability Is Recognized, It Is Recorded As A Liability On The Balance Sheet, Which Directly Affects The.

Contingent liabilities are recorded to ensure the financial statements fully reflect the true position of the company at the time of the balance sheet. Generally accepted accounting principles (gaap), some contingent losses may be reported on the balance sheet and income.

/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)