Accruals Balance Sheet - If an accrual is recorded for an expense, you are debiting the expense account and crediting an accrued liability account. Learn how accruals influence financial statements and analysis, and understand the differences between accrual and cash.

Learn how accruals influence financial statements and analysis, and understand the differences between accrual and cash. If an accrual is recorded for an expense, you are debiting the expense account and crediting an accrued liability account.

Learn how accruals influence financial statements and analysis, and understand the differences between accrual and cash. If an accrual is recorded for an expense, you are debiting the expense account and crediting an accrued liability account.

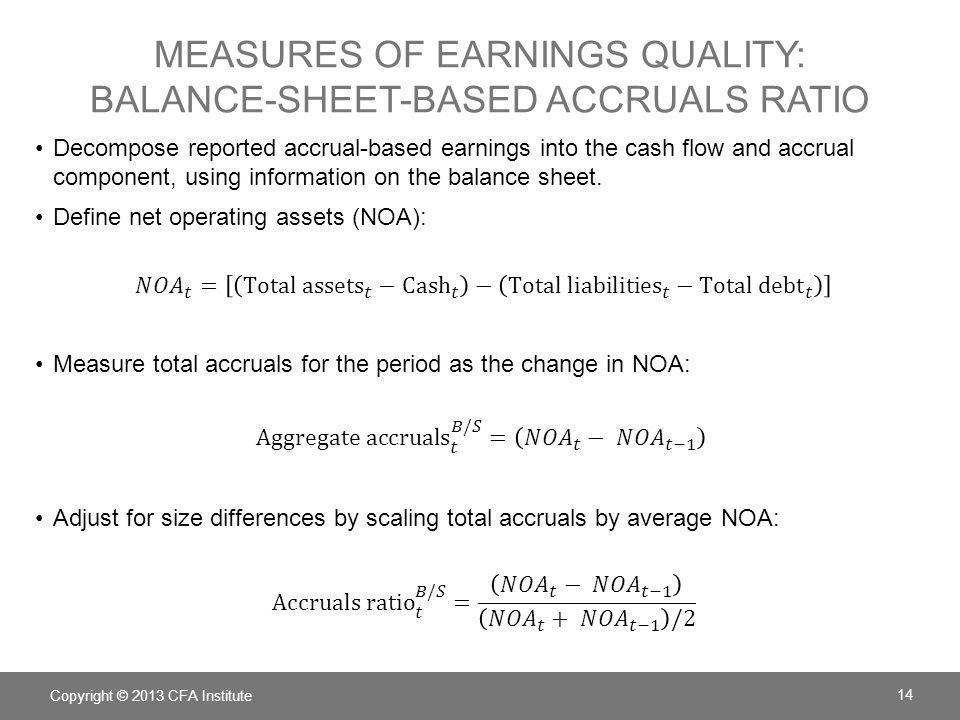

Chapter 16 Evaluating Financial Reporting Quality ppt download

If an accrual is recorded for an expense, you are debiting the expense account and crediting an accrued liability account. Learn how accruals influence financial statements and analysis, and understand the differences between accrual and cash.

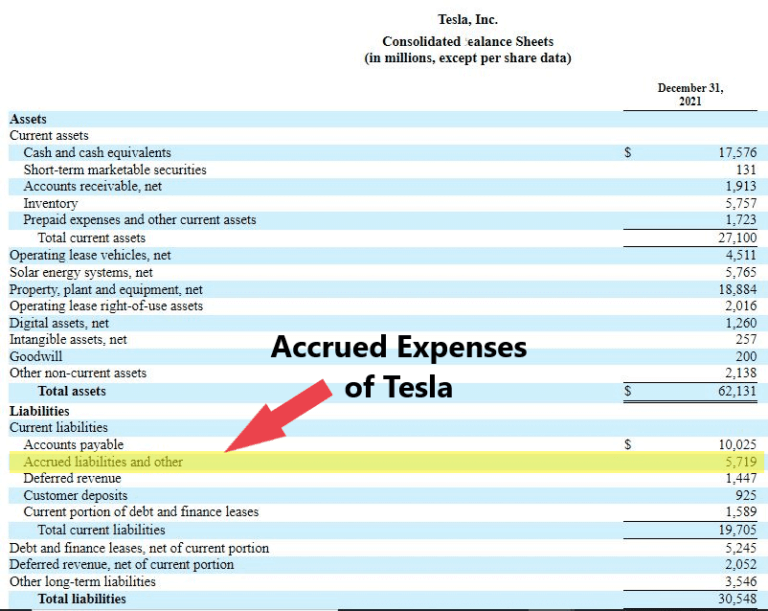

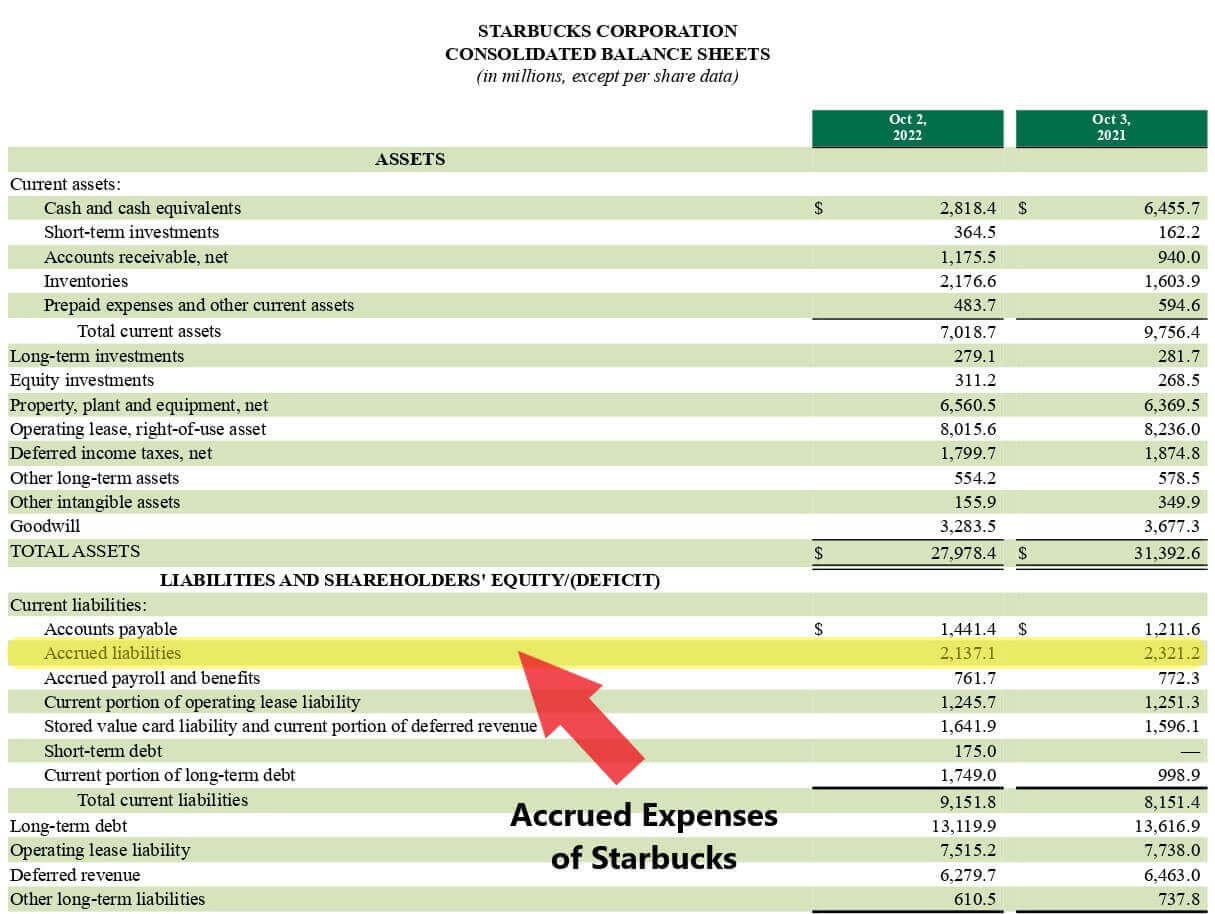

Accrued Expense Examples of Accrued Expenses

If an accrual is recorded for an expense, you are debiting the expense account and crediting an accrued liability account. Learn how accruals influence financial statements and analysis, and understand the differences between accrual and cash.

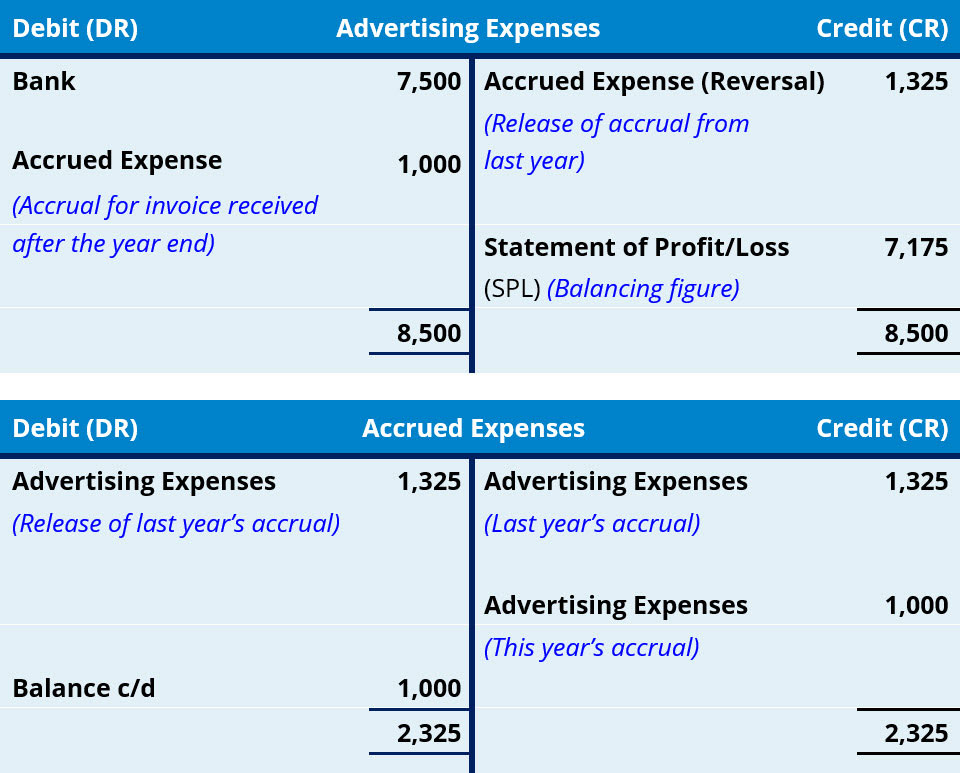

How To Make Sense Of AAT Accruals And Prepayments Part 2 Accountancy

Learn how accruals influence financial statements and analysis, and understand the differences between accrual and cash. If an accrual is recorded for an expense, you are debiting the expense account and crediting an accrued liability account.

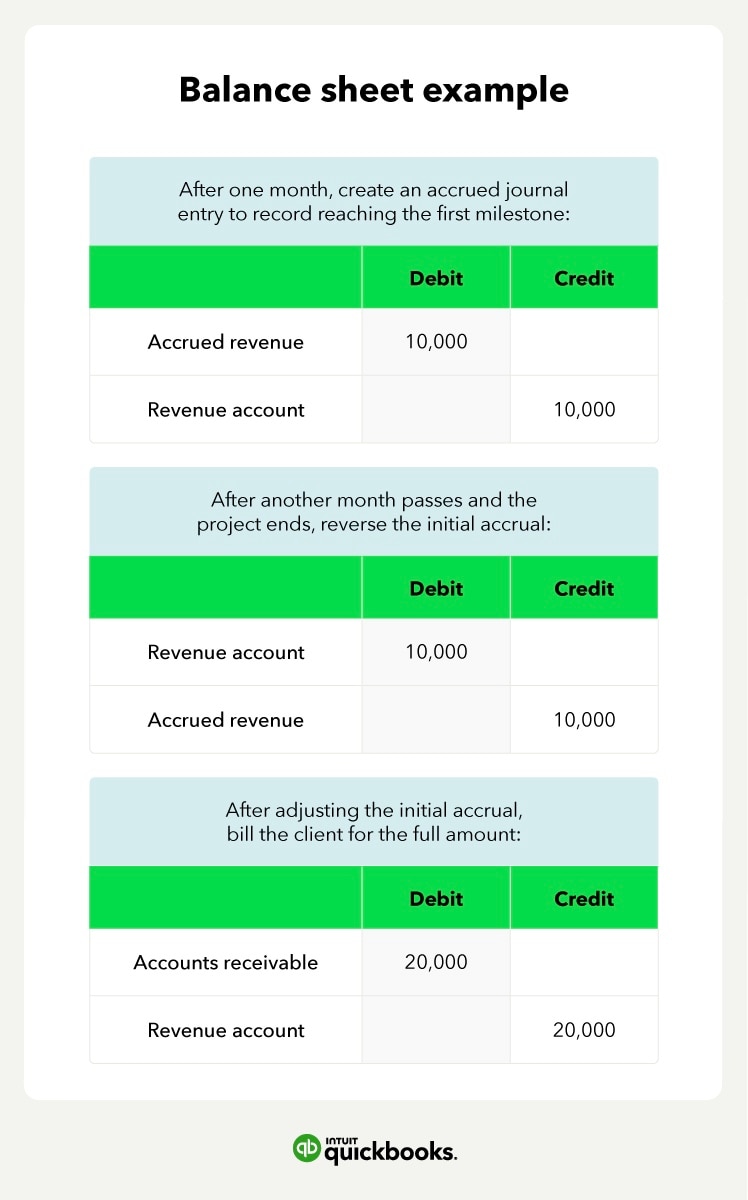

What is Accrued Journal Entry, Examples, How it Works?

If an accrual is recorded for an expense, you are debiting the expense account and crediting an accrued liability account. Learn how accruals influence financial statements and analysis, and understand the differences between accrual and cash.

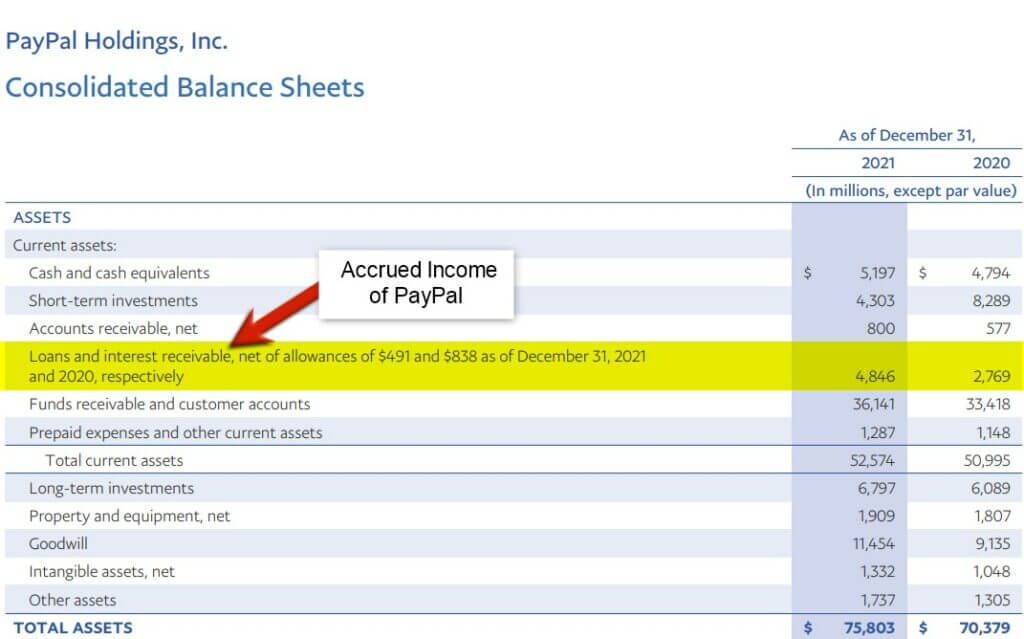

Accrued revenue how to record it in 2023 QuickBooks

If an accrual is recorded for an expense, you are debiting the expense account and crediting an accrued liability account. Learn how accruals influence financial statements and analysis, and understand the differences between accrual and cash.

Accrued Expense Examples of Accrued Expenses

Learn how accruals influence financial statements and analysis, and understand the differences between accrual and cash. If an accrual is recorded for an expense, you are debiting the expense account and crediting an accrued liability account.

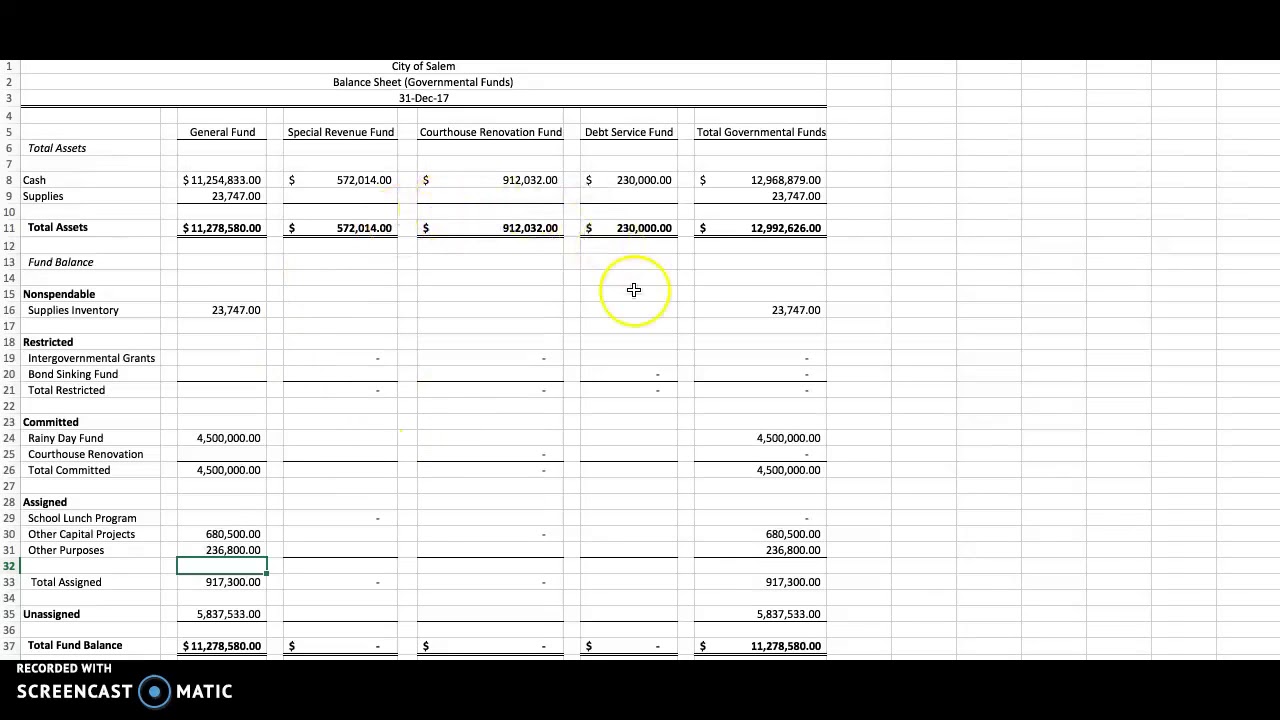

Where Do Accruals Appear on the Balance Sheet? SuperfastCPA CPA Review

Learn how accruals influence financial statements and analysis, and understand the differences between accrual and cash. If an accrual is recorded for an expense, you are debiting the expense account and crediting an accrued liability account.

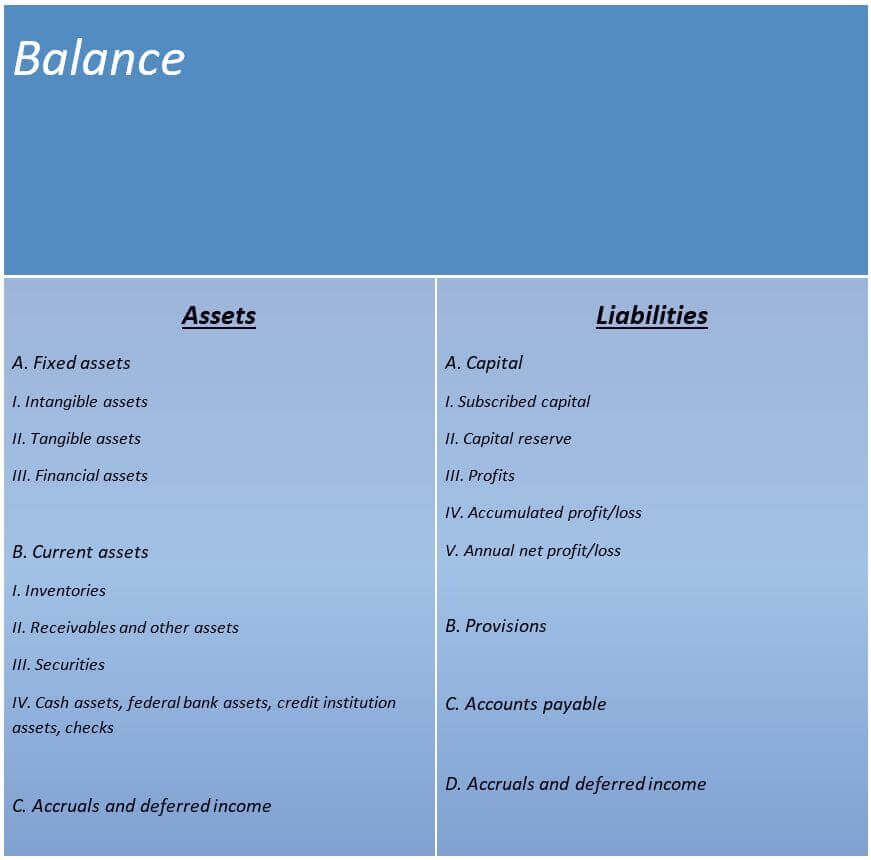

Accruals in accounting the facts IONOS CA

If an accrual is recorded for an expense, you are debiting the expense account and crediting an accrued liability account. Learn how accruals influence financial statements and analysis, and understand the differences between accrual and cash.

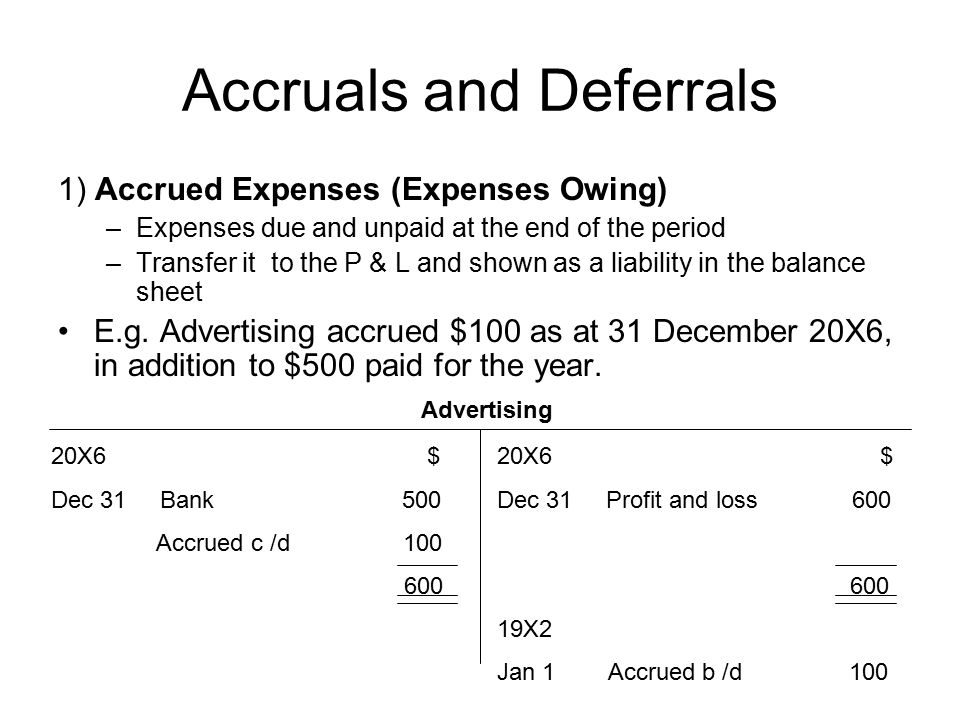

The accrual basis of accounting Business Accounting

Learn how accruals influence financial statements and analysis, and understand the differences between accrual and cash. If an accrual is recorded for an expense, you are debiting the expense account and crediting an accrued liability account.

If An Accrual Is Recorded For An Expense, You Are Debiting The Expense Account And Crediting An Accrued Liability Account.

Learn how accruals influence financial statements and analysis, and understand the differences between accrual and cash.