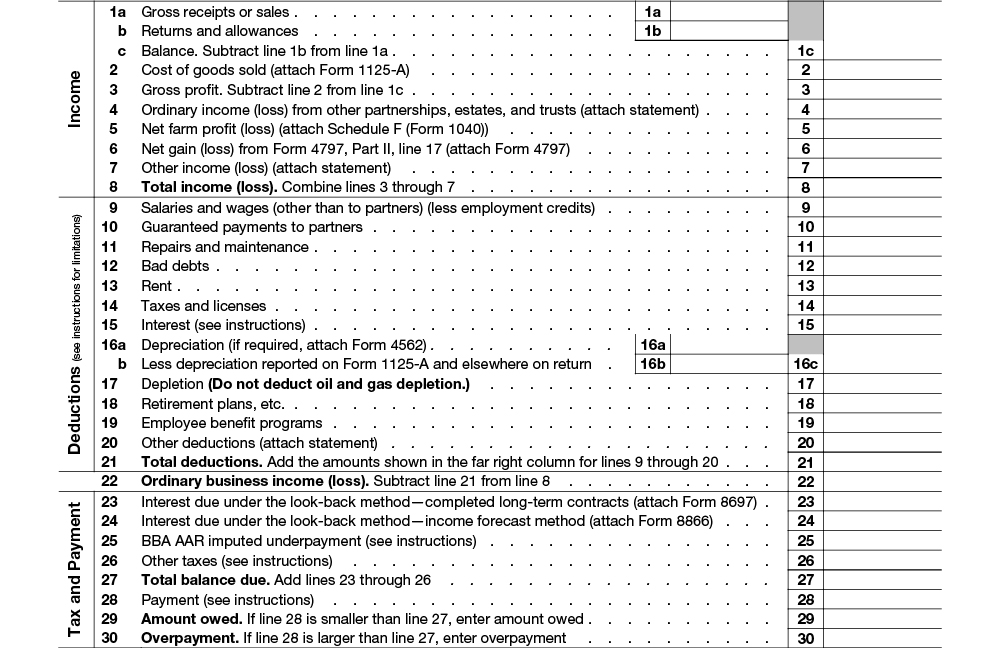

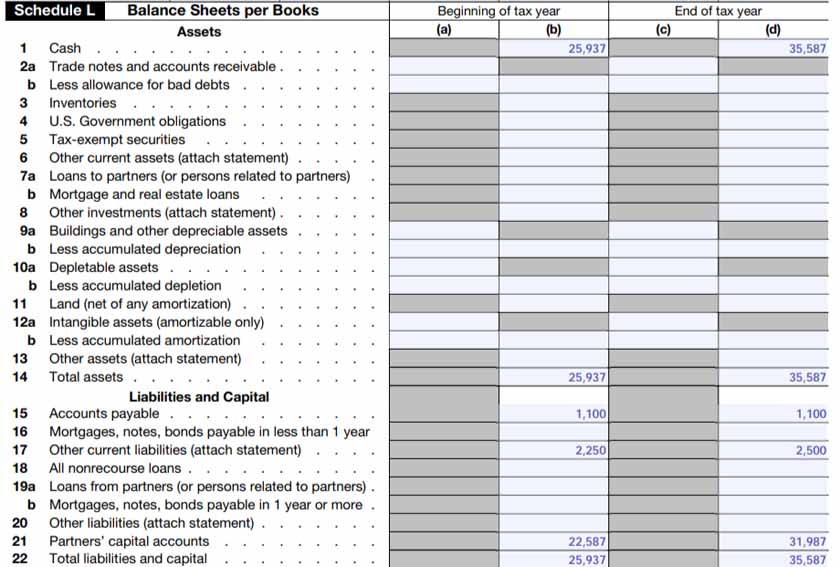

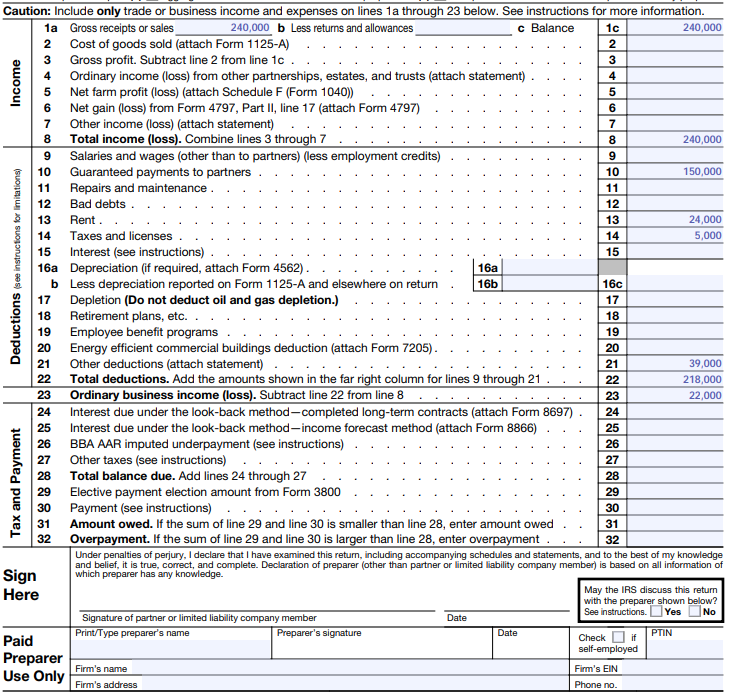

1065 Balance Sheet - It is used to provide a more detailed balance sheet of the partnership's financial position when necessary. The balance sheets are financial statements for a partnership that show its assets, liabilities, and. Go to the input return tab. Form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a. Form 1065, page 1, item f;

Form 1065, page 1, item f; Go to the input return tab. Form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a. The balance sheets are financial statements for a partnership that show its assets, liabilities, and. It is used to provide a more detailed balance sheet of the partnership's financial position when necessary.

It is used to provide a more detailed balance sheet of the partnership's financial position when necessary. The balance sheets are financial statements for a partnership that show its assets, liabilities, and. Form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a. Go to the input return tab. Form 1065, page 1, item f;

Form 1065 StepbyStep Instructions (+Free Checklist)

Form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a. It is used to provide a more detailed balance sheet of the partnership's financial position when necessary. Go to the input return tab. Form 1065, page 1, item f; The balance sheets are financial statements for a.

Form 1065 StepByStep Instructions [+Free Checklist]

It is used to provide a more detailed balance sheet of the partnership's financial position when necessary. Form 1065, page 1, item f; Go to the input return tab. The balance sheets are financial statements for a partnership that show its assets, liabilities, and. Form 1065 is an information return used to report the income, gains, losses, deductions, credits, and.

Form 1065 StepbyStep Instructions (+Free Checklist)

It is used to provide a more detailed balance sheet of the partnership's financial position when necessary. Form 1065, page 1, item f; Form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a. The balance sheets are financial statements for a partnership that show its assets, liabilities,.

Form 1065 Instructions in 8 Steps (+ Free Checklist)

Form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a. It is used to provide a more detailed balance sheet of the partnership's financial position when necessary. Form 1065, page 1, item f; Go to the input return tab. The balance sheets are financial statements for a.

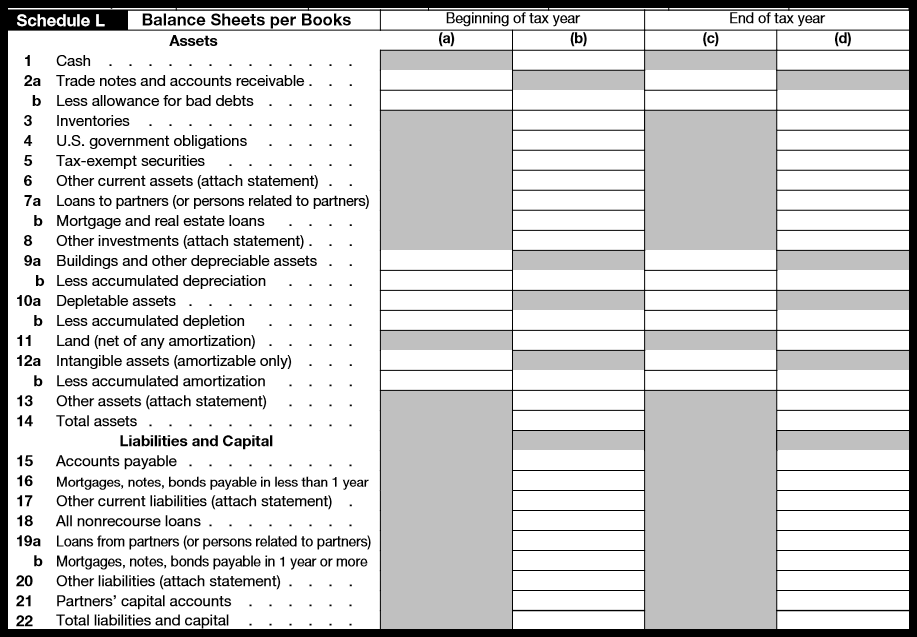

IRS Form 1065 Schedules L, M1, and M2 (2020) Balance Sheets (L

Go to the input return tab. It is used to provide a more detailed balance sheet of the partnership's financial position when necessary. Form 1065, page 1, item f; Form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a. The balance sheets are financial statements for a.

Form 1065 Instructions U.S. Return of Partnership

Form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a. Form 1065, page 1, item f; It is used to provide a more detailed balance sheet of the partnership's financial position when necessary. The balance sheets are financial statements for a partnership that show its assets, liabilities,.

Form 1065 StepbyStep Instructions (+Free Checklist)

The balance sheets are financial statements for a partnership that show its assets, liabilities, and. Form 1065, page 1, item f; It is used to provide a more detailed balance sheet of the partnership's financial position when necessary. Go to the input return tab. Form 1065 is an information return used to report the income, gains, losses, deductions, credits, and.

How to fill out an LLC 1065 IRS Tax form

Form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a. It is used to provide a more detailed balance sheet of the partnership's financial position when necessary. Form 1065, page 1, item f; The balance sheets are financial statements for a partnership that show its assets, liabilities,.

IRS Form 1065 Schedules L, M1, and M2 (2019) Balance Sheets (L

Form 1065, page 1, item f; Form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a. Go to the input return tab. The balance sheets are financial statements for a partnership that show its assets, liabilities, and. It is used to provide a more detailed balance sheet.

Form 1065 StepbyStep Instructions (+Free Checklist)

Form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a. The balance sheets are financial statements for a partnership that show its assets, liabilities, and. Form 1065, page 1, item f; Go to the input return tab. It is used to provide a more detailed balance sheet.

It Is Used To Provide A More Detailed Balance Sheet Of The Partnership's Financial Position When Necessary.

Go to the input return tab. Form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a. Form 1065, page 1, item f; The balance sheets are financial statements for a partnership that show its assets, liabilities, and.

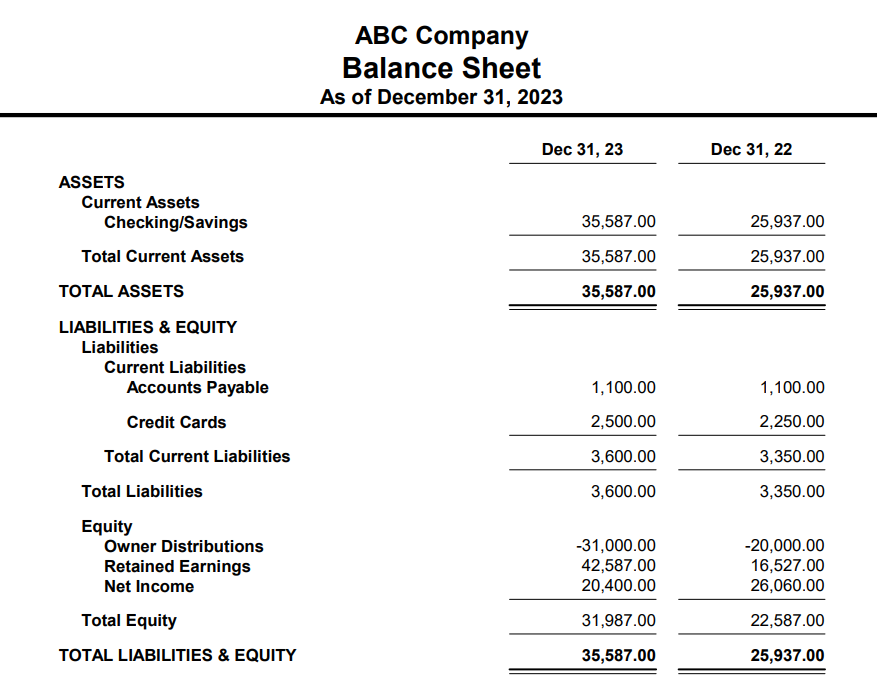

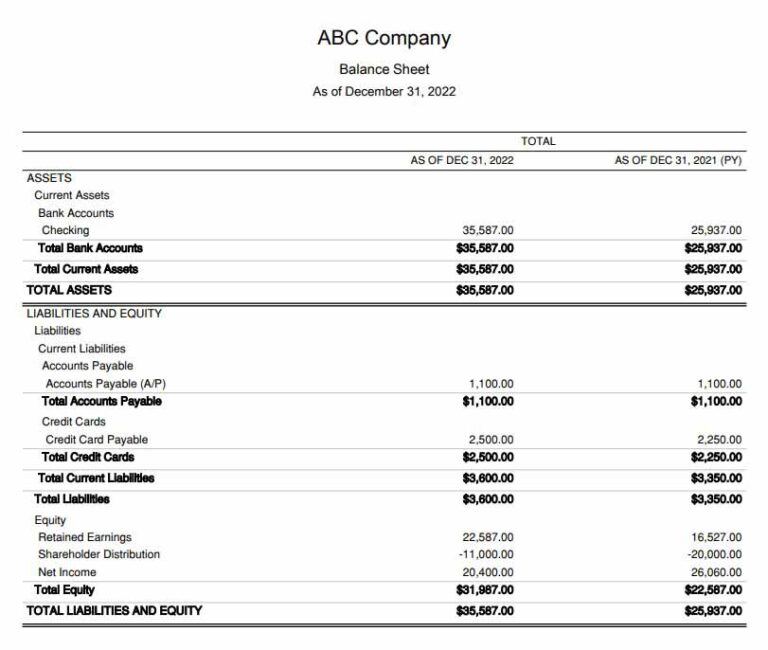

![Form 1065 StepByStep Instructions [+Free Checklist]](https://fitsmallbusiness.com/wp-content/uploads/2024/02/Screenshot_of_ABC_Company_Balance_Sheet.jpg)