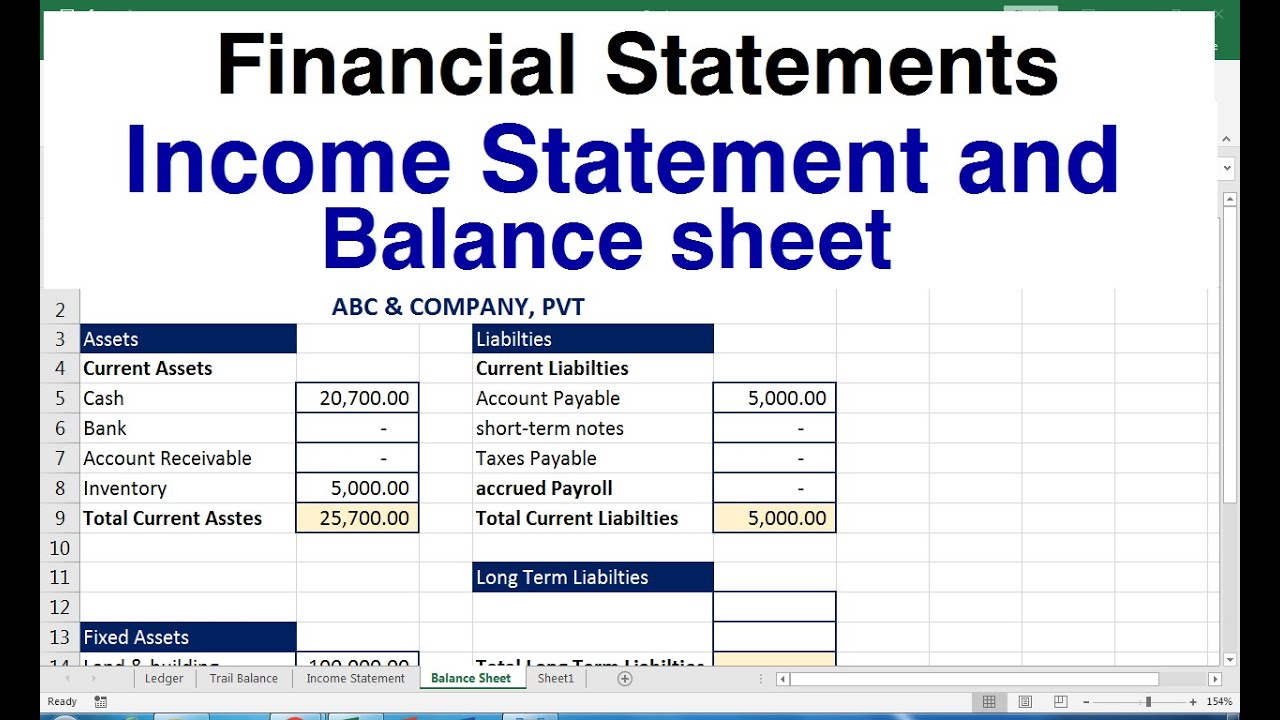

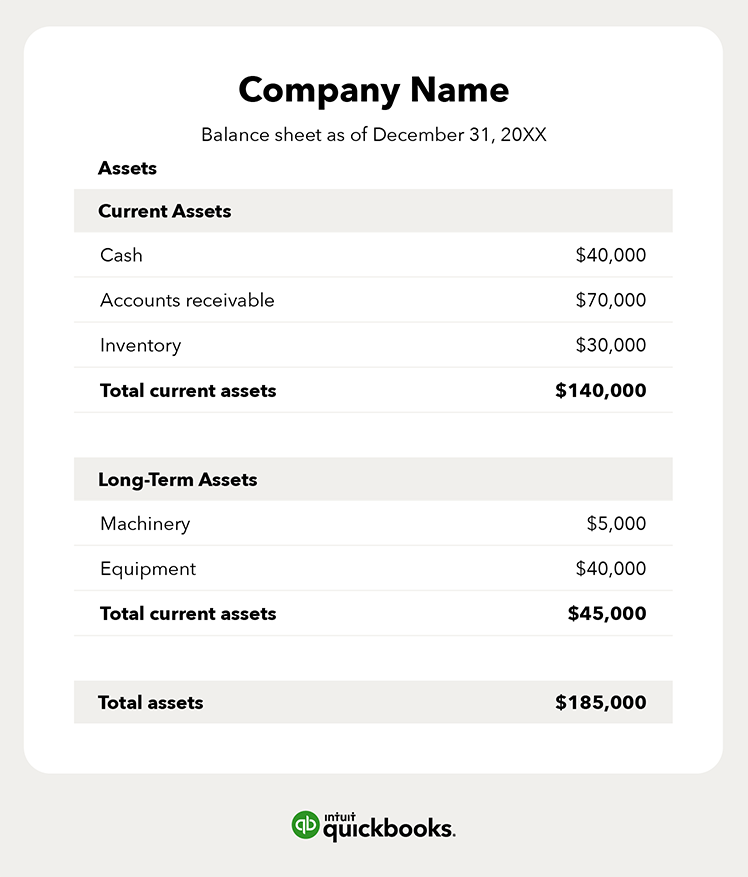

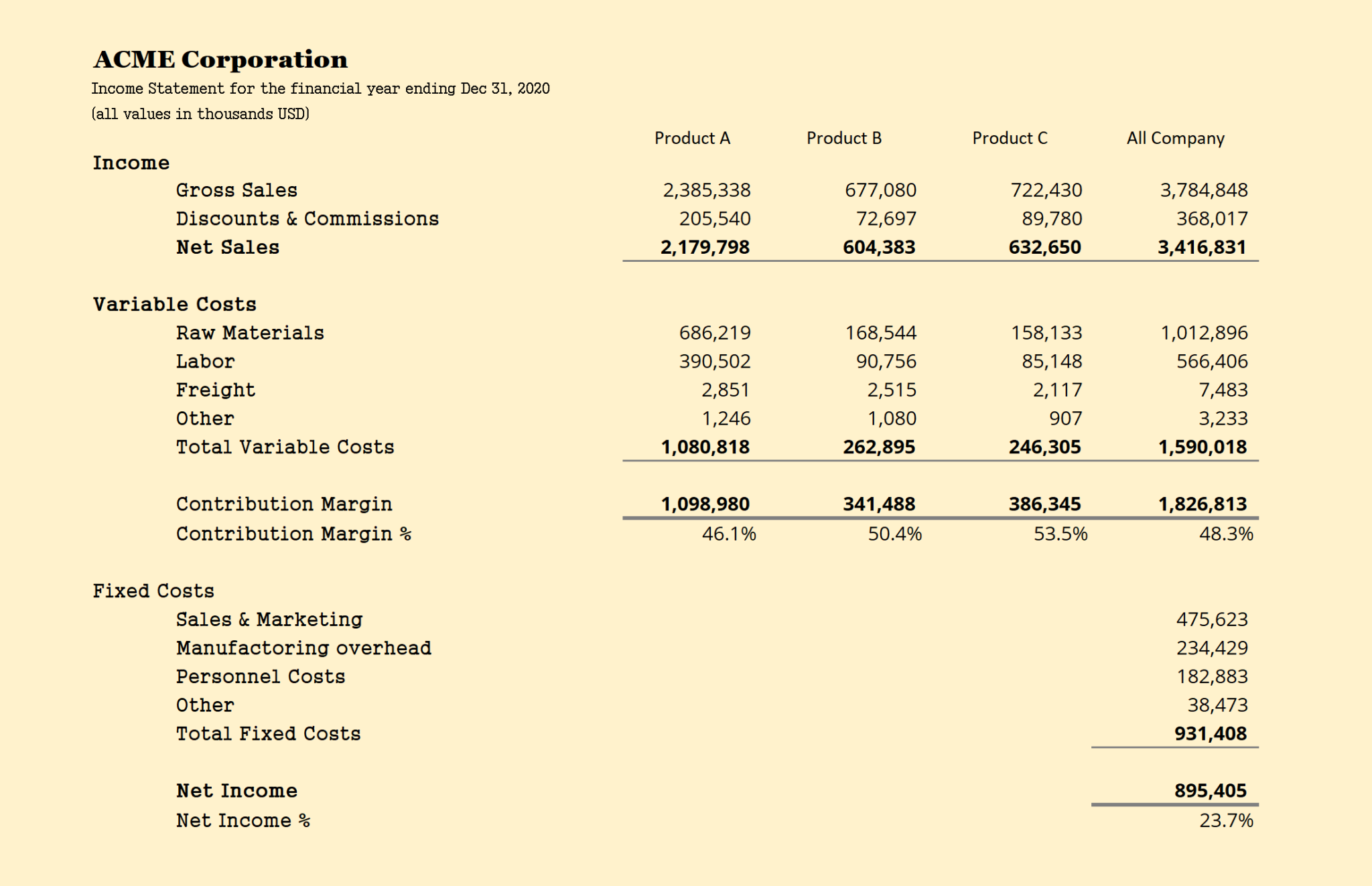

P&L Statement Vs Balance Sheet - Format versionsee your business grow Your balance sheet and p&l statement both provide key pieces of information that can be helpful in determining your long. The p&l statement, or income statement, details a company’s revenues and expenses over a specific period. Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or.

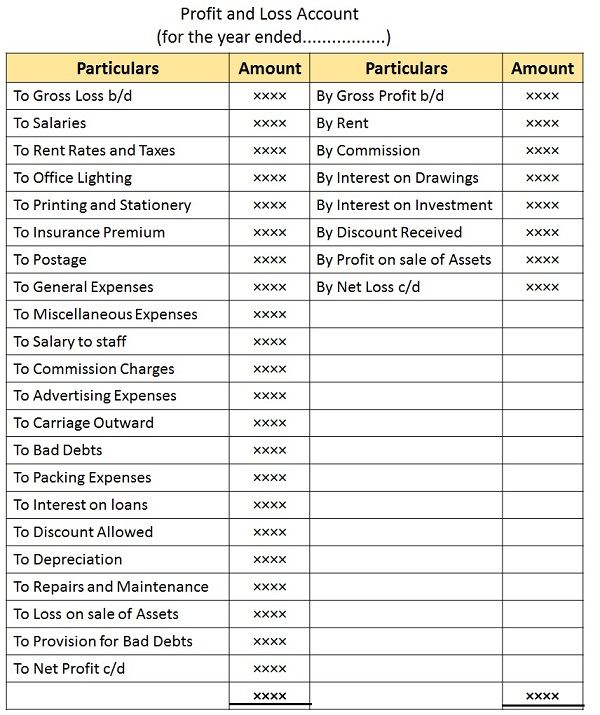

Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or. Format versionsee your business grow Your balance sheet and p&l statement both provide key pieces of information that can be helpful in determining your long. The p&l statement, or income statement, details a company’s revenues and expenses over a specific period.

The p&l statement, or income statement, details a company’s revenues and expenses over a specific period. Format versionsee your business grow Your balance sheet and p&l statement both provide key pieces of information that can be helpful in determining your long. Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or.

Difference Between Balance Sheet and Profit & Loss Account (with

Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or. Format versionsee your business grow Your balance sheet and p&l statement both provide key pieces of information that can be helpful in determining your long. The p&l statement, or income statement, details a company’s revenues and expenses over a specific period.

Great Tips About Sheet Balance And P&l Format Citysum

Format versionsee your business grow Your balance sheet and p&l statement both provide key pieces of information that can be helpful in determining your long. The p&l statement, or income statement, details a company’s revenues and expenses over a specific period. Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or.

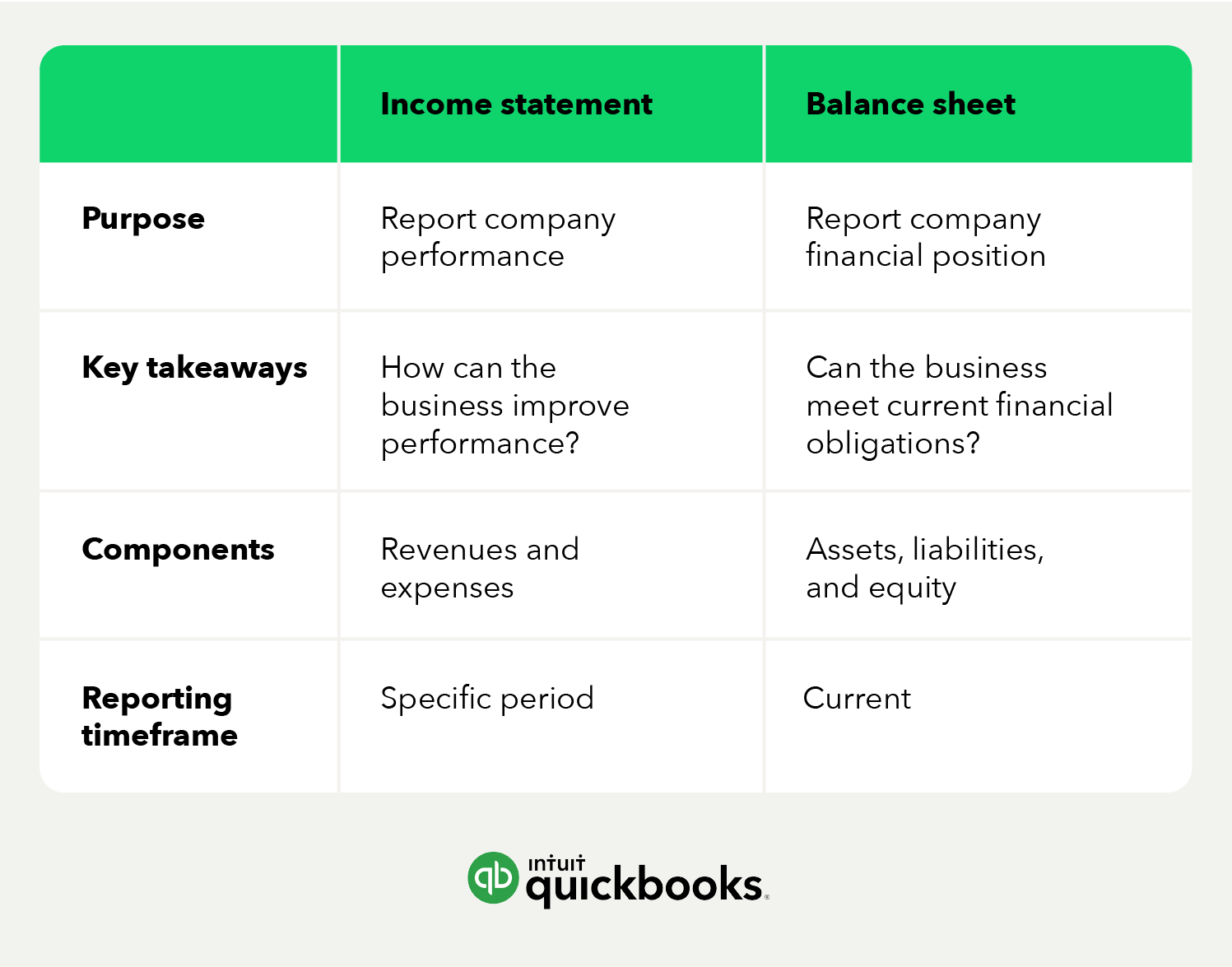

The Difference Between a Balance Sheet and P&L Infographic

Format versionsee your business grow Your balance sheet and p&l statement both provide key pieces of information that can be helpful in determining your long. The p&l statement, or income statement, details a company’s revenues and expenses over a specific period. Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or.

Difference Between Profit & Loss Account and Balance Sheet

Format versionsee your business grow Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or. Your balance sheet and p&l statement both provide key pieces of information that can be helpful in determining your long. The p&l statement, or income statement, details a company’s revenues and expenses over a specific period.

Balance sheet vs. profit and loss statement Understanding the

The p&l statement, or income statement, details a company’s revenues and expenses over a specific period. Format versionsee your business grow Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or. Your balance sheet and p&l statement both provide key pieces of information that can be helpful in determining your long.

Difference Between a Balance Sheet and a P&L Statement

Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or. The p&l statement, or income statement, details a company’s revenues and expenses over a specific period. Format versionsee your business grow Your balance sheet and p&l statement both provide key pieces of information that can be helpful in determining your long.

Difference between the Profit and Loss account and Balance Sheet

Your balance sheet and p&l statement both provide key pieces of information that can be helpful in determining your long. Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or. The p&l statement, or income statement, details a company’s revenues and expenses over a specific period. Format versionsee your business grow

Differences between Balance Sheet and ProfitLoss Account. YouTube

Your balance sheet and p&l statement both provide key pieces of information that can be helpful in determining your long. Format versionsee your business grow Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or. The p&l statement, or income statement, details a company’s revenues and expenses over a specific period.

8 Types of P&L (Profit & Loss) / Statements

Your balance sheet and p&l statement both provide key pieces of information that can be helpful in determining your long. Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or. The p&l statement, or income statement, details a company’s revenues and expenses over a specific period. Format versionsee your business grow

Difference Between Balance Sheet & Worksheet at Gregorio Davis blog

Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or. Format versionsee your business grow Your balance sheet and p&l statement both provide key pieces of information that can be helpful in determining your long. The p&l statement, or income statement, details a company’s revenues and expenses over a specific period.

The P&L Statement, Or Income Statement, Details A Company’s Revenues And Expenses Over A Specific Period.

Your balance sheet and p&l statement both provide key pieces of information that can be helpful in determining your long. Format versionsee your business grow Use a profit and loss statement when evaluating whether your business is profitable, where expenses can be trimmed, or.